Some highlights from this weekend’s Event Driven Monitor

Have a friend with an ED (“Event-Driven”) problem? Forward this newsletter to them and they can sign up for their own ED fix right to their inbox:

NEW USERS RECEIVE A FREE 4-WEEK TRIAL

The Event of the Week

We all know private marks are fake. What happens in real price discovery when a third of all endowment’s books start marking real marks on their privates? And who is the logical buyer when the IPO window is all but closed and firms are stuffed to the gills with PE deals. And what happens to these endowment’s risk models when a third of their book gets marked to the real market with no buyers?

Subscribe Now To Keep Reading…

Kuppy’s Tweet of the Week

Chart and Kliff Note of the Week

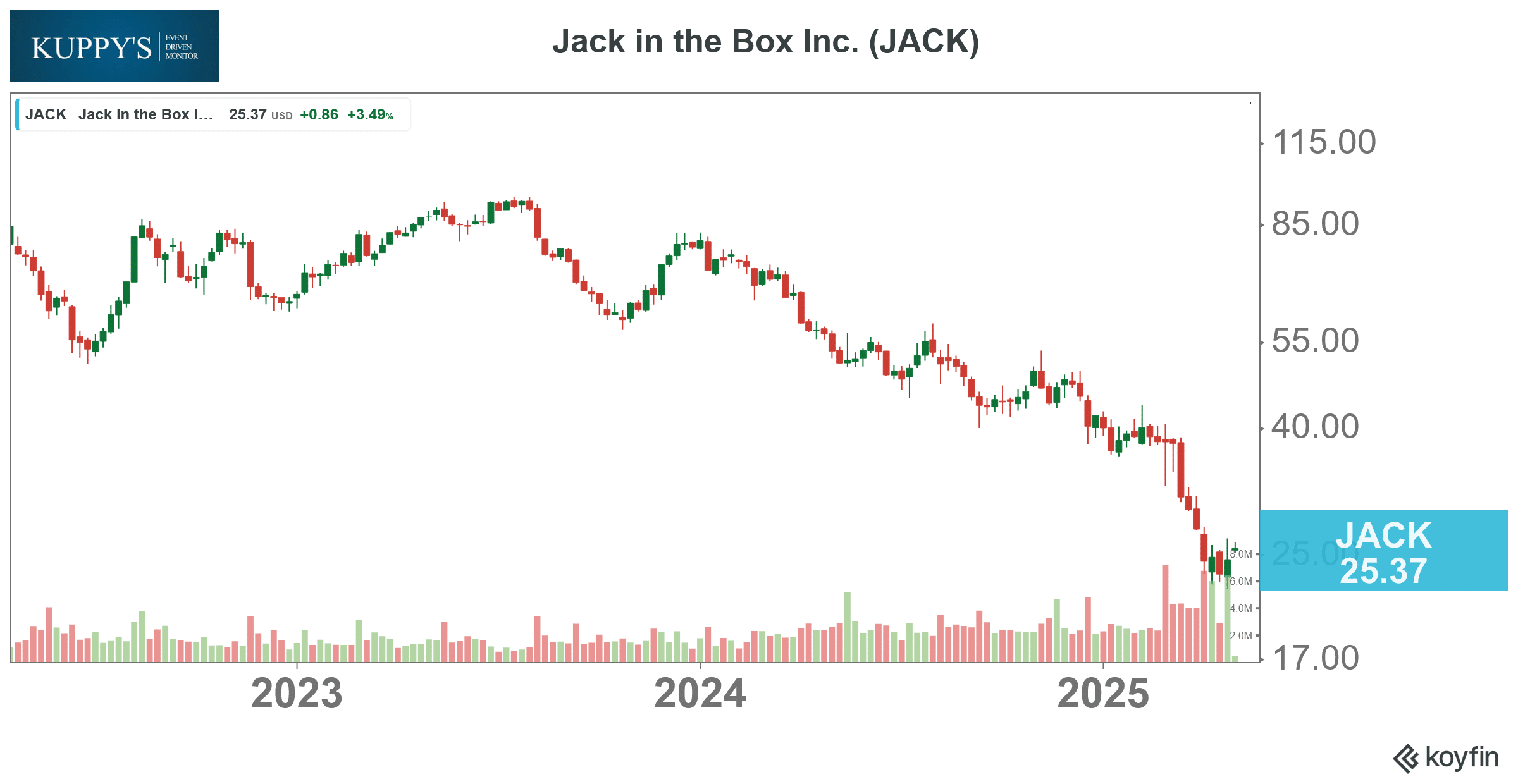

Strategic Alternatives Monitor: Jack in the Box announced earnings and unveiled the “Jack on Track” program. Company will be closing down 150 to 200 underperforming locations while also seeking strategic alternatives for Del Taco.

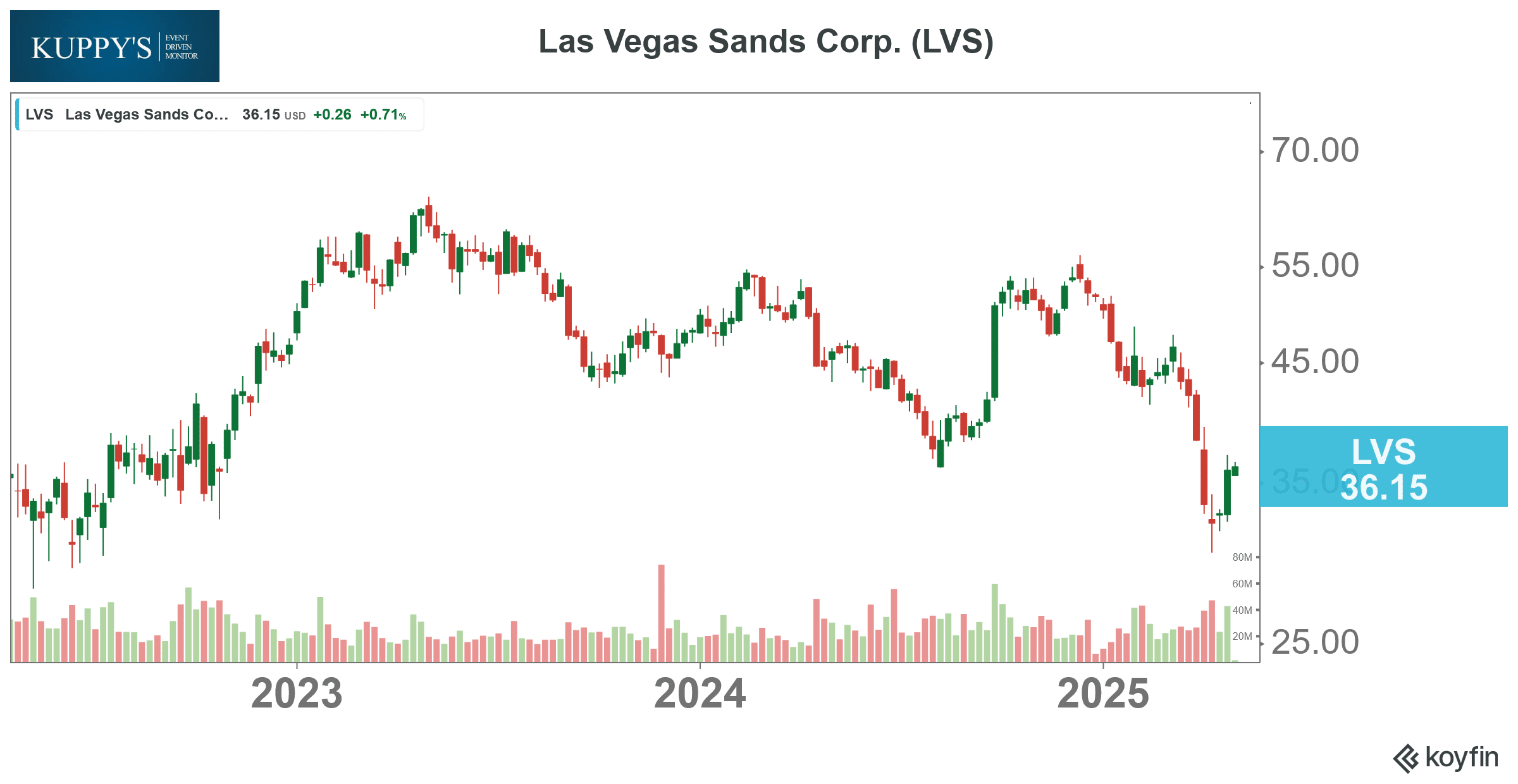

Announced Buyback Monitor: Las Vegas Sands, LVS, continues to hammer the buy button (as they have since Q4 2023), with another $450m bought in this Q (well over $2b since their program began). They reupped to $2B and are re-focusing on buybacks as the HBU and most accretive lever to pull and dropping their bid for a casino license in NYC.

Subscribe Now for More Event-Driven Opportunities

Kuppy’s Event Driven Monitor scans over 20 corporate events for market moving information and distills them into our propietary “Kliff Notes.” One profitable trade should more than cover an annual subscription and access to the Event Driven chatroom!