Some highlights from this weekend’s Event Driven Monitor

Have a friend with an ED (“Event-Driven”) problem? Forward this newsletter to them and they can sign up for their own ED fix right to their inbox:

NEW USERS RECEIVE A FREE 4-WEEK TRIAL

The Event of the Week

Jumping to the markets, JPOW pulled the trigger on re-engaging Project Zimbabwe. We’ve been banging the table on the peasants getting carved up, hence our de-grossing, but we were a bit surprised on how trigger happy he was with equity markets clipping highs. Just goes to show how bad the FED is fuct.

KEDM readers are already well aware of our core themes, which just so happen to be pro-inflation with a heavy dose of commodities (shocker). But beyond that, if US/DMs are going full scale EM/Zimbabwe, there is about to be a massive flip of fund flows out of all US risk assets.

Click below to see where those Funds will flow to next and were KEDM will be kicking tires…

Subscribe Now To Keep Reading…

Kuppy’s Tweet of the Week

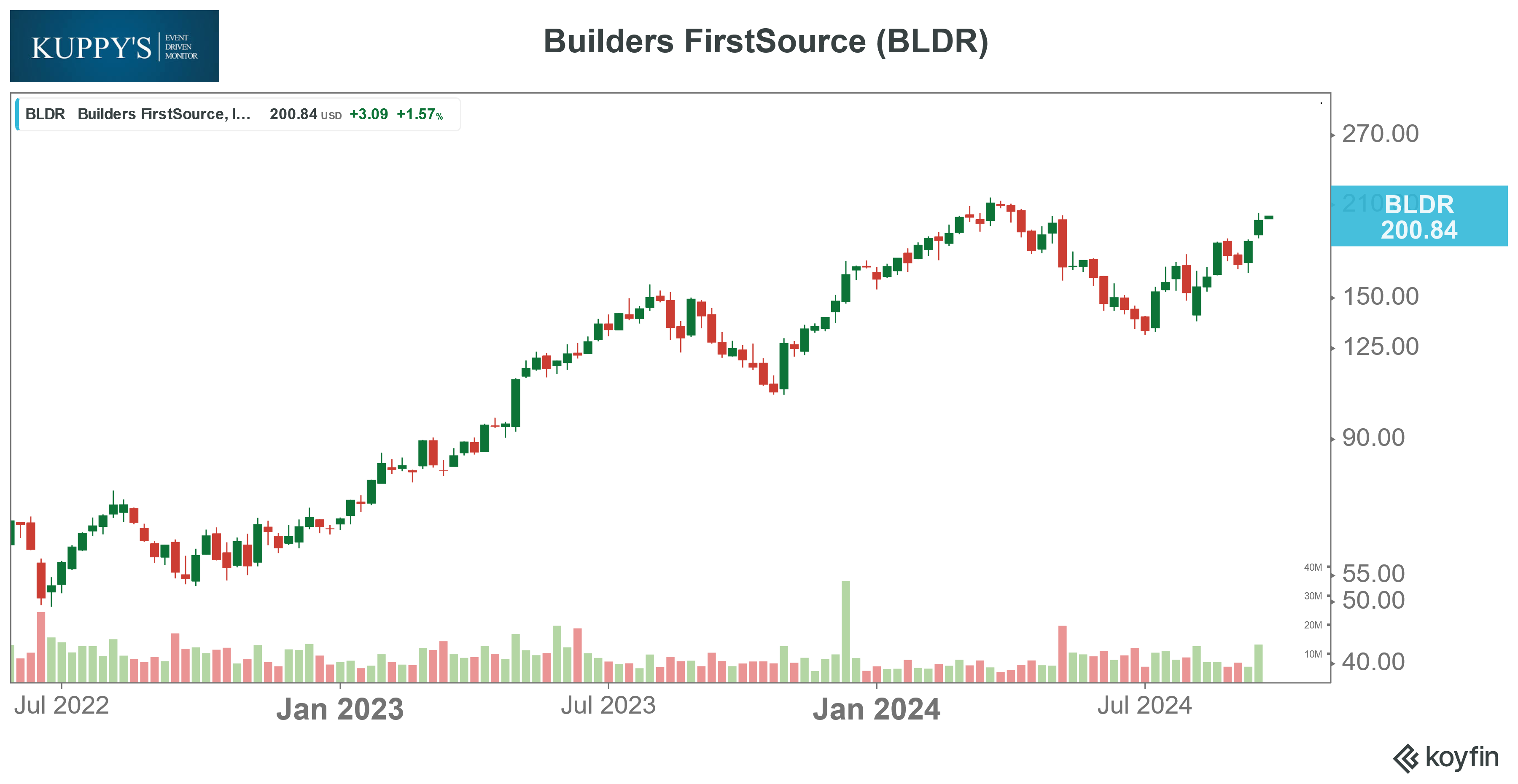

Chart and Kliff Note of the Week

Peter Jackson, current CFO, will replace CEO Dave Rush at long-time KEDM favorite BLDR. This is an interesting event for the stock as Jackson has historically been the capital deployer while Rush, and Flitman before him, were more operationally focused. The news probably signals the maturation of this business into a pure platform-like consolidator of the building products distribution space and likely precedes a step-up in M&A activity.

Subscribe Now for More Event-Driven Opportunities

Friends of KEDM

- Our friend Michael Kao interviewed with Andrew Brill from Wealthion on “FED Pivot Too Soon?“

Kuppy’s Event Driven Monitor scans over 20 corporate events for market moving information and distills them into our propietary “Kliff Notes.” One profitable trade should more than cover an annual subscription and access to the Event Driven chatroom!