Some highlights from this weekend’s Event Driven Monitor

Have a friend with an ED (“Event-Driven”) problem? Forward this newsletter to them and they can sign up for their own ED fix right to their inbox:

NEW USERS RECEIVE A FREE 4-WEEK TRIAL

The Event of the Week

We haven’t been exactly bullish in recent months. We aren’t doom and gloomers either, but regime changes tend to create markets where macro Trumps the micro. Are the past 10 days, just a precursor to the coming wackiness and onslaught of “100-year, one-in-a-lifetime moves” that will likely come weekly??

So, turning to our beloved offshore theme, we figured it was time for an update from our analyst as drillers released earnings on the eve of the market Klusterfuk. They weren’t immune to the macro but collectively, the drillers had a great Q2. Let’s dive in…

Subscribe Now To Keep Reading…

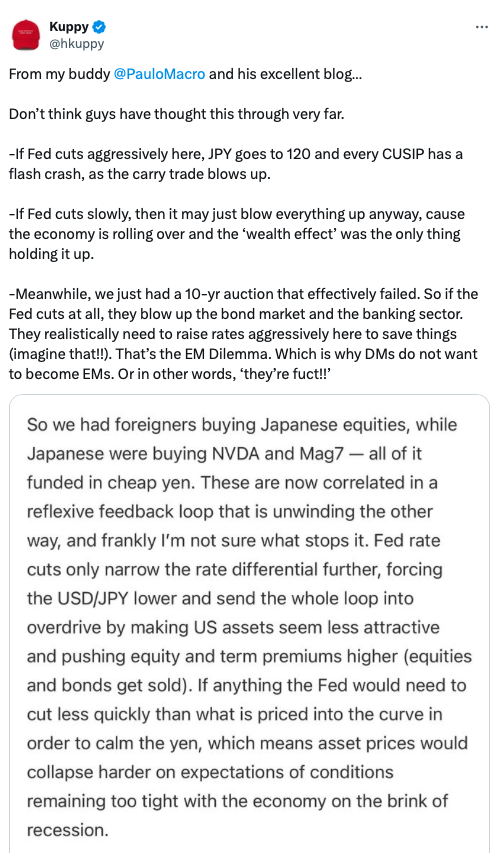

Kuppy’s Tweet of the Week

Chart and Kliff Note of the Week

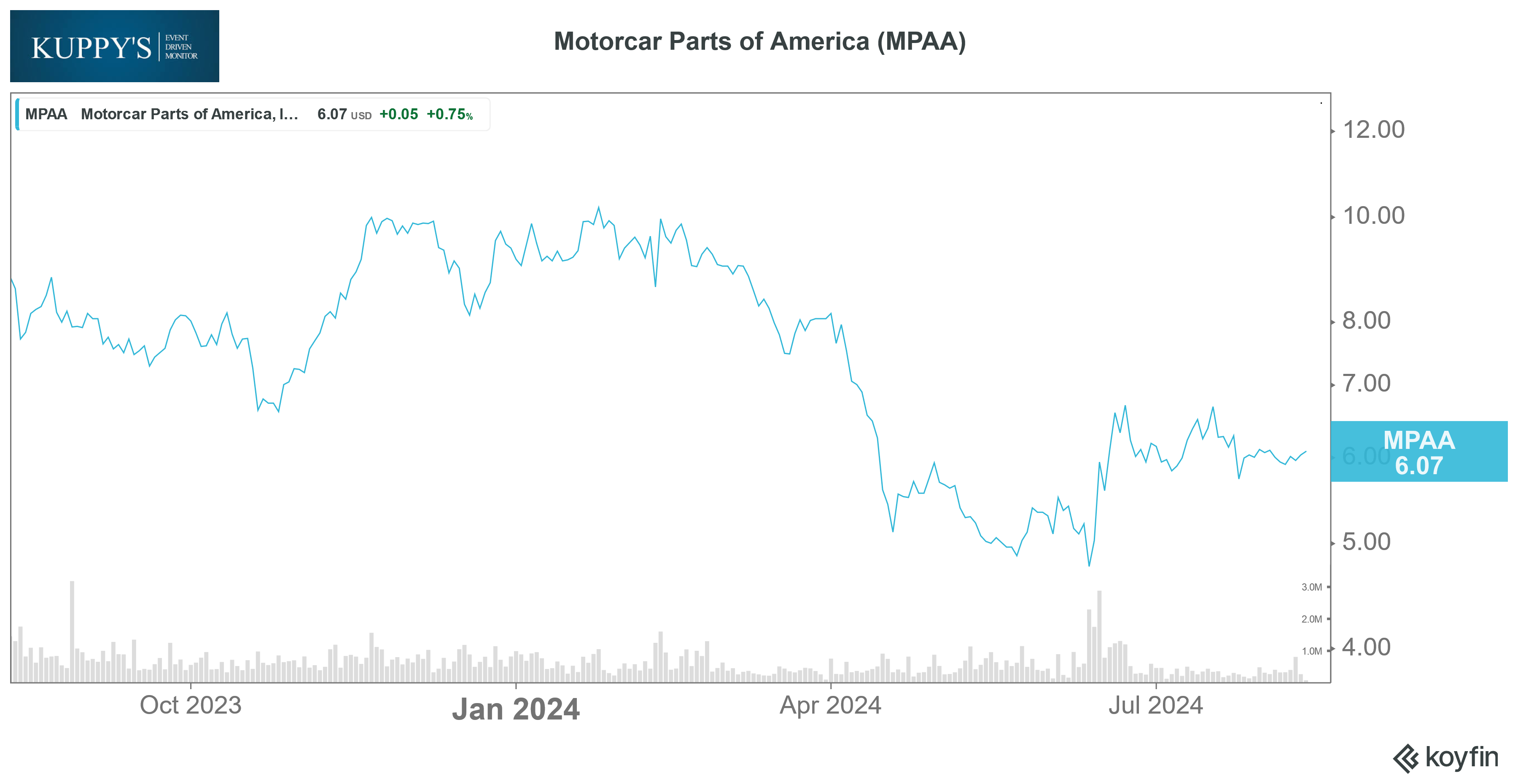

Cove Street Capital (4% owner) sent a rather dramatic letter to Motoparts of America, titled “For Whom The Bell Tolls” While Cove Street is not the lone victim of this perpetual value trap, Cove Street and another fund- Bison Capital seems serious about changing the management, we’ll keep an eye on this one.

Subscribe Now for More Event-Driven Opportunities

Friends of KEDM

- Our good friends, Tony Greer of TG Macro and Jared Dillian of The Daily Dirtnap, invited Kuppy to their recently started The Macro Dirt Podcast. We highly recommend subscribing to their podcast.

- Value investor and our Happy Hour Guest – Josh Young had a good conversation with Bill Hamlen, an ex-oil trader, who is running for Congress in New Hampshire.

Kuppy’s Event Driven Monitor scans over 20 corporate events for market moving information and distills them into our propietary “Kliff Notes.” One profitable trade should more than cover an annual subscription and access to the Event Driven chatroom!