Some highlights from this weekend’s Event Driven Monitor

Have a friend with an ED (“Event-Driven”) problem? Forward this newsletter to them and they can sign up for their own ED fix right to their inbox:

NEW USERS RECEIVE A FREE 4-WEEK TRIAL

The Event of the Week

Almost three months ago, we noted KEDM was in full harvest mode, as we culled the herd and moved to center-book. We even pruned some center-book names—though, our focus was on purging anything illiquid, stuff we’d be hard-pressed to sell in a real correlation-1 scenario. We wanted to de-gross in a major way.

Anyway, it seems that just about every risk-seeking strategy had some version of Yen funding and the Yen suddenly went bid—hard. This weekend, there’s going to be a lot of soul searching as the quant teams travel to Sagaponack and brief their PMs on what just happened. We assume that the preparation for the conversations start something like this…

Subscribe Now To Keep Reading…

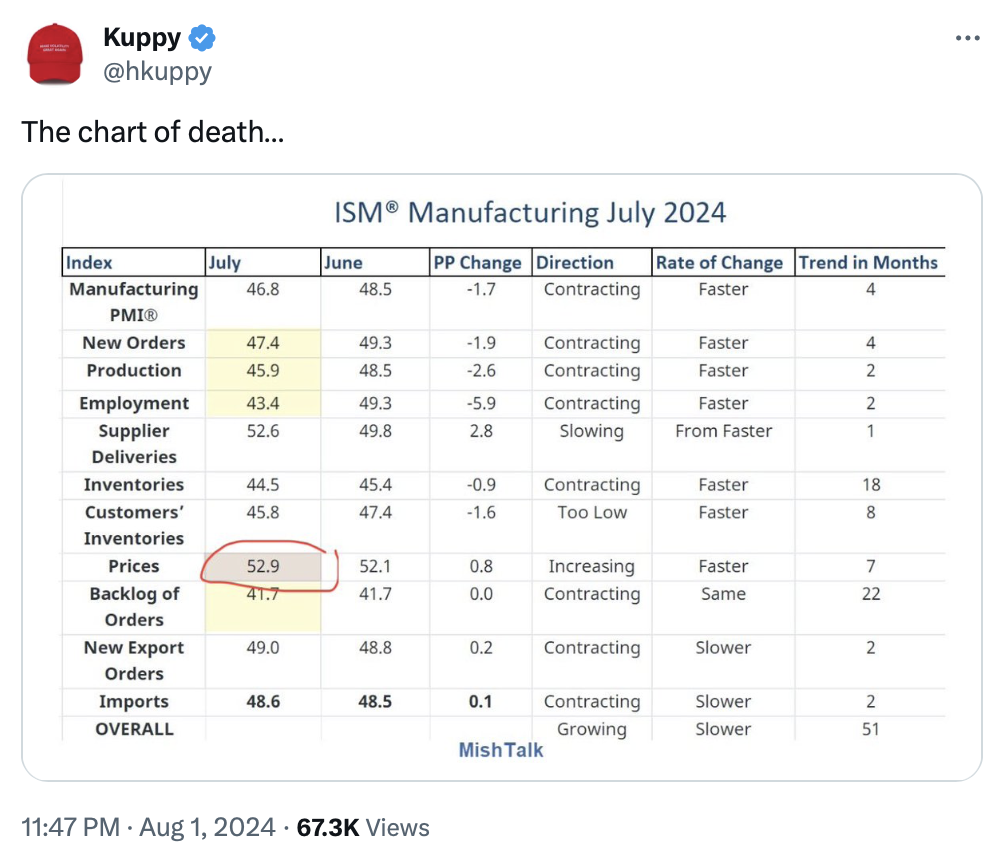

Kuppy’s Tweet of the Week

Chart and Kliff Note of the Week

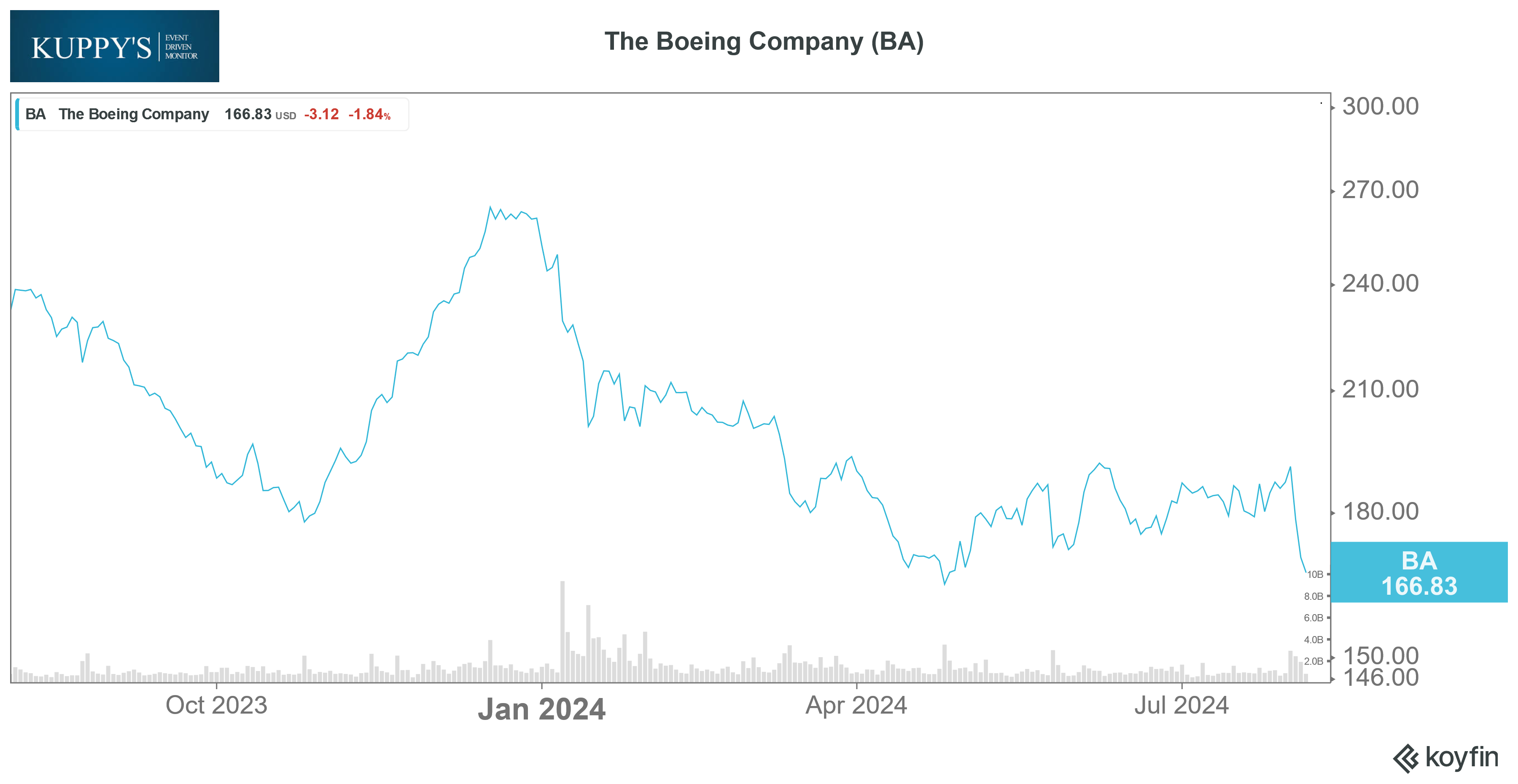

BA announces Calhoun’s replacement – an industry vet with a prior stint at Rockwell Collins.Maybe he’s got what it takes to turn this thing around… or at least not kill anybody

Subscribe Now for More Event-Driven Opportunities

Friends of KEDM

- Mike Green, one of our Happy Hour guests, was recently interviewedwith Jack Farley, echoing near certainty recession and prolonged, panic-inducing sell-off.

- Goehring & Rozencwajg published a note, “Remembering the Massive Crude Bull Markets of the 1970s and 2000s“.

- Another Happy Hour guest of KEDM, Michael Kao released its Episode 3 of Kaos Theory.

Kuppy’s Event Driven Monitor scans over 20 corporate events for market moving information and distills them into our propietary “Kliff Notes.” One profitable trade should more than cover an annual subscription and access to the Event Driven chatroom!