Some highlights from this weekend’s Event Driven Monitor

Have a friend with an ED (“Event-Driven”) problem? Forward this newsletter to them and they can sign up for their own ED fix right to their inbox:

NEW USERS RECEIVE A FREE 4-WEEK TRIAL

The Event of the Week

All we see is more ton miles…

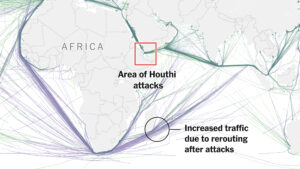

Things are literally exploding in the shipping sector so we hosted Charles Bonner from Marhelm for a special “Houthi Happy Hour” on all things shipping. Here are three of our biggest takeaways from the event…

- Russian sanctions were already making the market tight as more cargo was going from Russia through the Red Sea to Asia instead of through the Baltic to Western Europe. The Houthi disruption is just the cherry on top which has pushed rates from the Middle East to Europe from 50,000-60,000 a day to 150,000 a day.

- When there is a shorter- term crisis like this the companies with the biggest spot exposure have the most upside.

- There is uncertainty around ESG and new regulations for 2030. Nobody knows what type of engine to buy as none of the existing tech gets you to the goals being set. The technology simply doesn’t exist and that uncertainty is hurting order books across the board.

Subscribe Now To Keep Reading…

Kuppy’s Tweet of the Week

More explosions in the Middle East…

Chart and Kliff Note of the Week

Buyback window is closing (appx 1/29/24 re-open). Demand is about to enter some select names again. Once the dust settles we will be updating the Buyback Leaderboard for Q4 results. Stay tuned…

Pathward Financial, CASH, took in another appx. $30m in the trailing 15 weeks with their CEO bullish on buybacks – “There is not a better use of our capital than to buy the shares and if we get up into P/E 12 or something then will have a different conversation but right now I can’t get an ROE on capital that’s better than what I’ll get by buying back shares.”

Subscribe Now for More Event-Driven Opportunities

Friends of KEDM

- Kuppy joined Justin Huhn at Uranium Insider for a special podcast to discuss why he thinks this uranium cycle is going much higher…

- Our friends (and KEDM subscribers) at Blind Squirrel Macro recently wrote up the auto sector and some of their favorite plays should the sector be start to turn around with a special look at a name that kept getting flagged in KEDM’s Event-Driven Monitors. They also discussed the sector and that KEDM name with Erik Renander and Gray Oak Capital Management’s Steven Schlegel with on Erik’s podcast here.

Kuppy’s Event Driven Monitor scans over 20 corporate events for market moving information and distills them into our propietary “Kliff Notes.” One profitable trade should more than cover an annual subscription and access to the Event Driven chatroom!