Some highlights from this weekend’s Event Driven Monitor

Have a friend with an ED (“Event-Driven”) problem? Forward this newsletter to them and they can sign up for their own ED fix right to their inbox:

NEW USERS RECEIVE A FREE 4-WEEK TRIAL

The Event of the Week

We cannot think of a commodity in the history of our studies that has had such lopsided financial balances…

Let’s roll through some math while we’re on the topic of uranium as we recently looked at some research reports and had a good laugh at their expense.

So, everyone seems to be clustering somewhere around 185-190 million lbs. for 2024 consumption. Which is fine if you’re tracking annual usage of reactors. But, a bunch of reactors are having their initial loadings next year, including all the Japanese restarts.

Using VERY rough numbers, a reactor generally uses 500k lbs. a year, but an initial loading could use 1 to 2 million lbs. Factoring in those restarts, we tend to think that a number closer to 205 million is far more accurate for 2024 consumption and that number only increases in 2025 before levelling out a bit. However, the swing in underfeeding to overfeeding could use another 20 million lbs. in 2024, especially as it now seems that Russia has joined in the game.

Finally, if we were Western utilities and looking around at that map of Kazakhstan, we’d probably want to top off the inventory a bit. After years of drawdowns on inventory, we’d think it’s almost inevitable that we’re entering a re-stocking phase. Assuming 10% restocking, you have another 20 million lbs. of demand in 2024. So, call it 245 million of demand.

Now on the supply side…

Subscribe Now To Keep Reading…

Kuppy’s Tweet of the Week

If you haven’t yet heard our views on Argentina…

Chart and Kliff Note of the Week

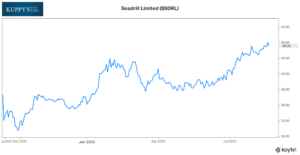

The 2022 BK Exit name, Seadrill, SDRL, announced a $250m program. Worth noting this popped up above in our 13F Tracker with Elliott and Greenlight both accumulating in the quarter.

So, we have this one popping up in the BK exit monitor (last year), Buyback Notes, and the 13-D/Activist Monitor…

Subscribe Now for More Event-Driven Opportunities

Friends of KEDM

- One of our new favorite podcasts is the Milkshakes Markets and Madness Podcast from Brent Johnson and Jon Kutsmeda. With how fast markets are moving we really appreciate the multi episode format with their Peek at The Week episodes coming out on Mondays, Midweek updates, and weekend full length episodes. You can listen to their most recent full length episode here.

- Two weeks ago Kuppy outlined his perspective on the best types of companies to own in an inflationary environment in a new blog for Kuppy’s Korner, “Playing Inflation Part 2”. Hint, it’s about more than just pricing power and cash flows.

Kuppy’s Event Driven Monitor scans over 20 corporate events for market moving information and distills them into our propietary “Kliff Notes.” One profitable trade should more than cover an annual subscription and access to the Event Driven chatroom!