Some highlights from this weekend’s Event Driven Monitor

Have a friend with an ED (“Event-Driven”) problem? Forward this newsletter to them and they can sign up for their own ED fix right to their inbox:

NEW USERS RECEIVE A FREE 4-WEEK TRIAL

The Event of the Week

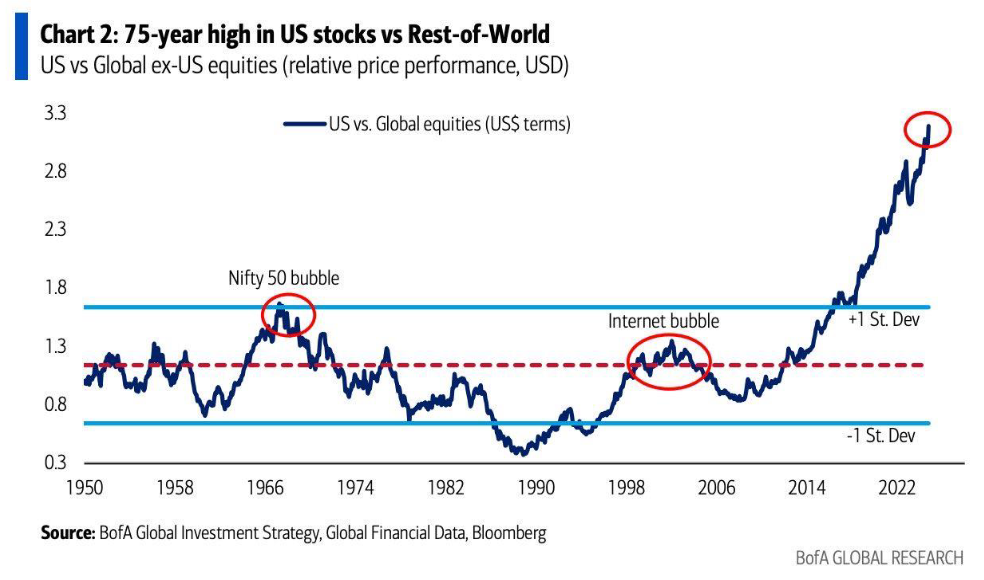

Regular KEDM readers have likely picked up on our growing bullishness for some specific EMs. We all know the chart by now but the US is stretched as NVDA and MSTR prop up the whole market. And as DMs become EMs, emerging markets should see a flip in fund flows with EMs finally “emerging.”

Since starting to note EMs in KEDM we have touched on LatAm/Brazil, China and Turkey. Our last Turkish update was rightfully neutral, but that was back on election uncertainty, so we figured it was time for an update on the eve of Turkey Day. Let’s jump in…

Subscribe Now To Keep Reading…

Kuppy’s Tweet of the Week

Chart and Kliff Note of the Week

Cluster Insider Buy Monitor: Not a cluster, but a director bought ~$102K worth at Advance Auto Parts (AAP). AAP recently entered into a cooperation agreement with ThirdPoint and Saddle Point Management (appointed three new directors) and entered into a definitive agreement to sell Worldpac to Carlyle for $1.5 billion in cash. Burry’s firm owned some AAP in late 2023 and early 2024, per Scion’s 13-Fs.

CEO Change Monitor: CTRN announces that its interim CEO will become permanent. Notable that the press release makes sure to mention the three turnarounds and exits he has had previously given that there is an activist with 30% ownership pulling the strings. With the M&A environment looking brighter a sale could be around the corner.

Subscribe Now for More Event-Driven Opportunities

Kuppy’s Event Driven Monitor scans over 20 corporate events for market moving information and distills them into our propietary “Kliff Notes.” One profitable trade should more than cover an annual subscription and access to the Event Driven chatroom!