Some highlights from this weekend’s Event Driven Monitor

Have a friend with an ED (“Event-Driven”) problem? Forward this newsletter to them and they can sign up for their own ED fix right to their inbox:

NEW USERS RECEIVE A FREE 4-WEEK TRIAL

The Event of the Week

Look out below…

We have beat a dead horse re: rates and the FED’s intent to break something, so as rates surge, we think it’s time to step back into the trading turret, for what looks like a rather volatile Q4. As we warned last week, TLT looked like it was going to break support again (spoiler alert: it did), and it was time to “de-gross (or find the bull market theme) and strap in…

Hopefully you took notice…

Its going to be a fun Q4 and we are looking forward to vol picking up so we can get back to some shorter term ED trades we find in KEDM…

Subscribe Now To Keep Reading…

Kuppy’s Tweet of the Week

Seek out bull market themes…

Chart and Kliff Note of the Week

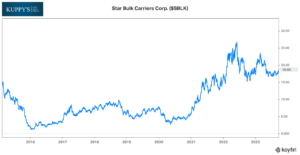

Worth noting that Oaktree is selling 10m SBLK shares (of their 26m owned) back to the drybulk shipping company. Kinda tells you where their heads are at in bulk cycle after holding for a decade…

Subscribe Now for More Event-Driven Opportunities

Friends of KEDM

- Our friend Brandon Beylo did a fantastic breakdown of an interview from Bloor Street Capital that took place at the 2023 World Nuclear Symposium. Great primer on the ins and outs of the physical uranium market.

- Louis Vincent Gave and Kuppy got together on Real Vision as part of a series they put together called “Boom or Bust”. You can watch the interview here if you are a subscriber or read their breakdown on Twitter. Look for a Make Volatility Great Again cameo from Louis.

- Reminder to all readers that we are doing a special “uranium breakout” offer for KEDM right now. Sign up for your annual subscription with coupon code U308 here and save $1308 on your first year back at KEDM

Kuppy’s Event Driven Monitor scans over 20 corporate events for market moving information and distills them into our propietary “Kliff Notes.” One profitable trade should more than cover an annual subscription and access to the Event Driven chatroom!