Some highlights from this weekend’s Event Driven Monitor

Have a friend with an ED (“Event-Driven”) problem? Forward this newsletter to them and they can sign up for their own ED fix right to their inbox:

NEW USERS RECEIVE A FREE 4-WEEK TRIAL

The Event of the Week

…yet we expected Trump to choose them all.

Subscribe Now To Keep Reading…

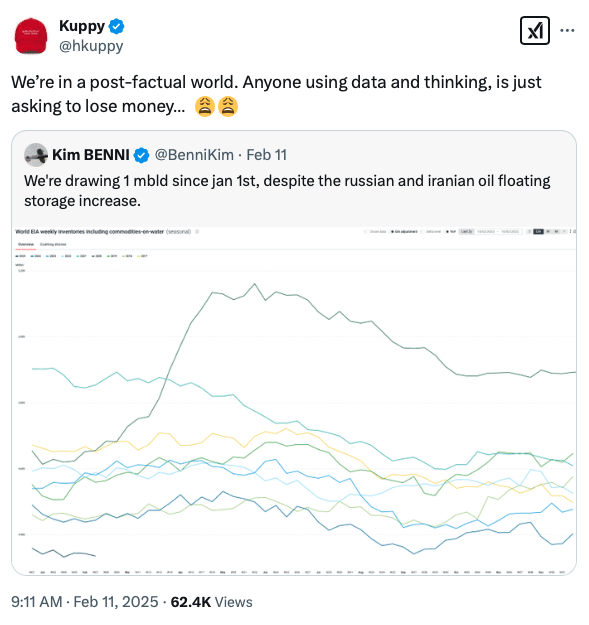

Kuppy’s Tweet of the Week

Chart and Kliff Note of the Week

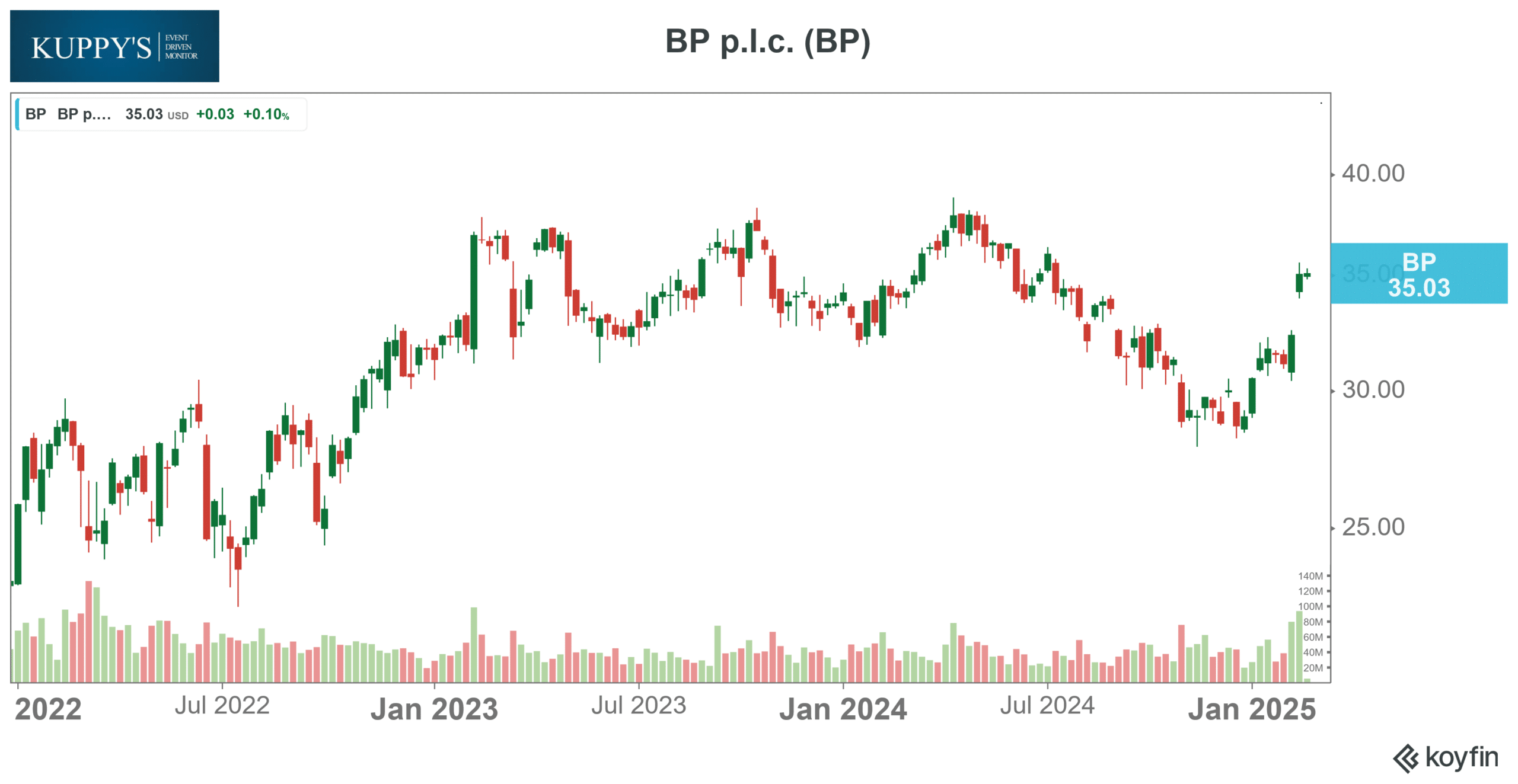

13D Monitor: BP & PSX- Start of the week we found out that Elliott Management built a stake in British oil major BP, nearing 5% ownership. WSJ reported that Elliott wants to trim the fat and cut spending on unprofitable renewable projects. Later during the week, Elliott disclosed a $2.5bn position at Phillips 66 and set up a website, find here. TLDR Elliott wants the company to conduct an operational review, consider divestments and add independent directors to the board.

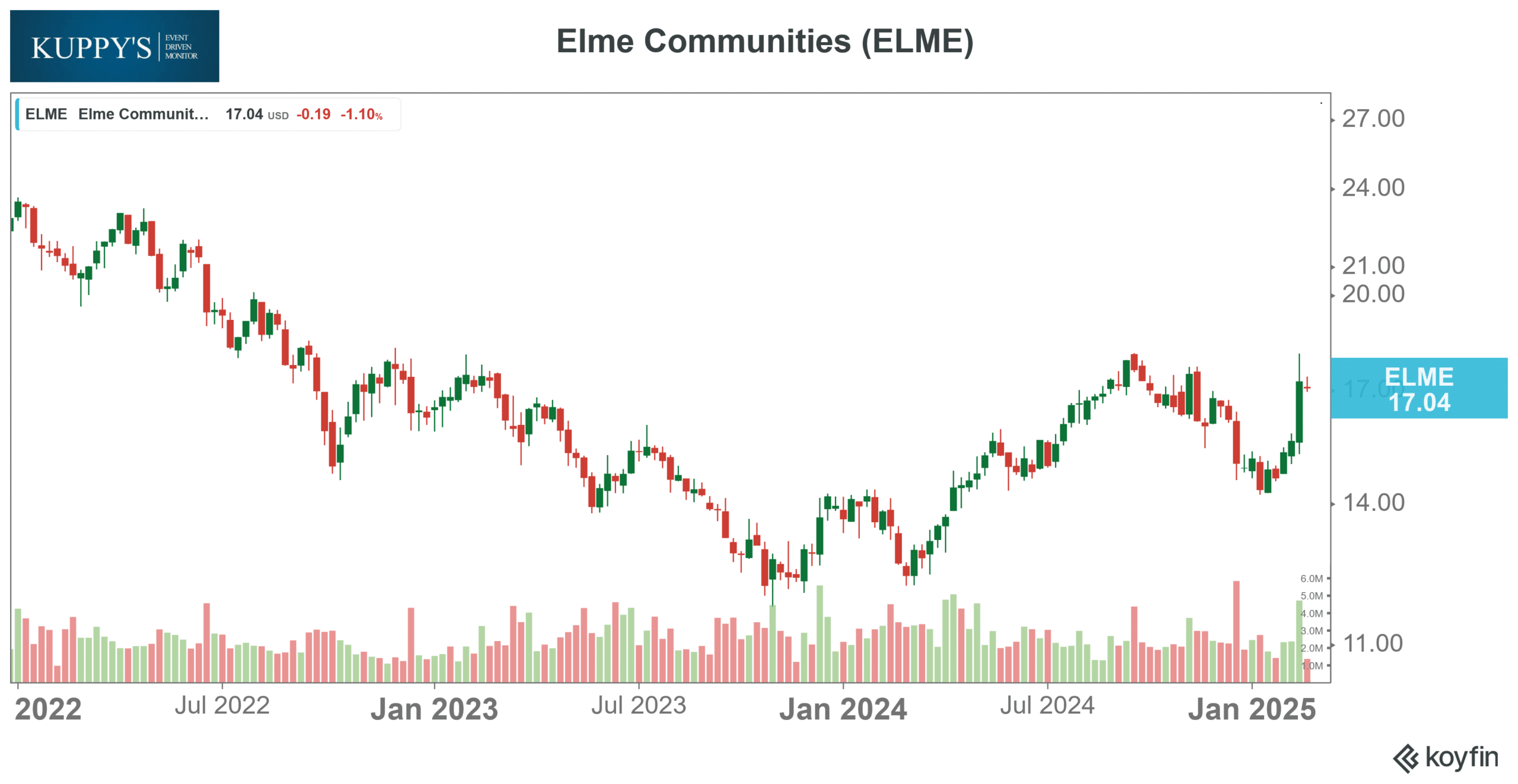

Strategic Alternatives Monitor: Elme communities announced results and mentioned they “initiated a formal evaluation of strategic alternatives in an effort to maximize shareholder value”. ELME did FY24 Core FFO of $82m and guiding for 1.5%-3.5% NOI growth (same store) and we like that they are looking at strat. alts, but they have large exposure to Washington DC metro, buyer beware…

Subscribe Now for More Event-Driven Opportunities

Kuppy’s Event Driven Monitor scans over 20 corporate events for market moving information and distills them into our propietary “Kliff Notes.” One profitable trade should more than cover an annual subscription and access to the Event Driven chatroom!