Some highlights from this weekend’s Event Driven Monitor

Have a friend with an ED (“Event-Driven”) problem? Forward this newsletter to them and they can sign up for their own ED fix right to their inbox:

NEW USERS RECEIVE A FREE 4-WEEK TRIAL

The Event of the Week

What the hell is going on over in China?? First, they detonated their real estate sector. Remember how homes are for living in, not speculating?? Then, they locked down for germs (you can’t be a superpower if you’re scared of the common cold). Finally, they crowned Xi as king, right after the party congress/purge. It’s been a strange couple of years over in China.

Even the so-called experts, mostly just seem to be guessing. So, we’ve tried to step into Xi’s shoes and think through what he wants…

Speaking of China, our next Happy Hour guest, Louis Vincent Gave, to chat all things China and macro. For those who are not familiar, Louis runs the legendary research and money management firm, GaveKal Group that he founded alongside his father. Subscribe for a free trial to join us at 5:15 on this coming Friday, October 25.

Subscribe Now To Keep Reading…

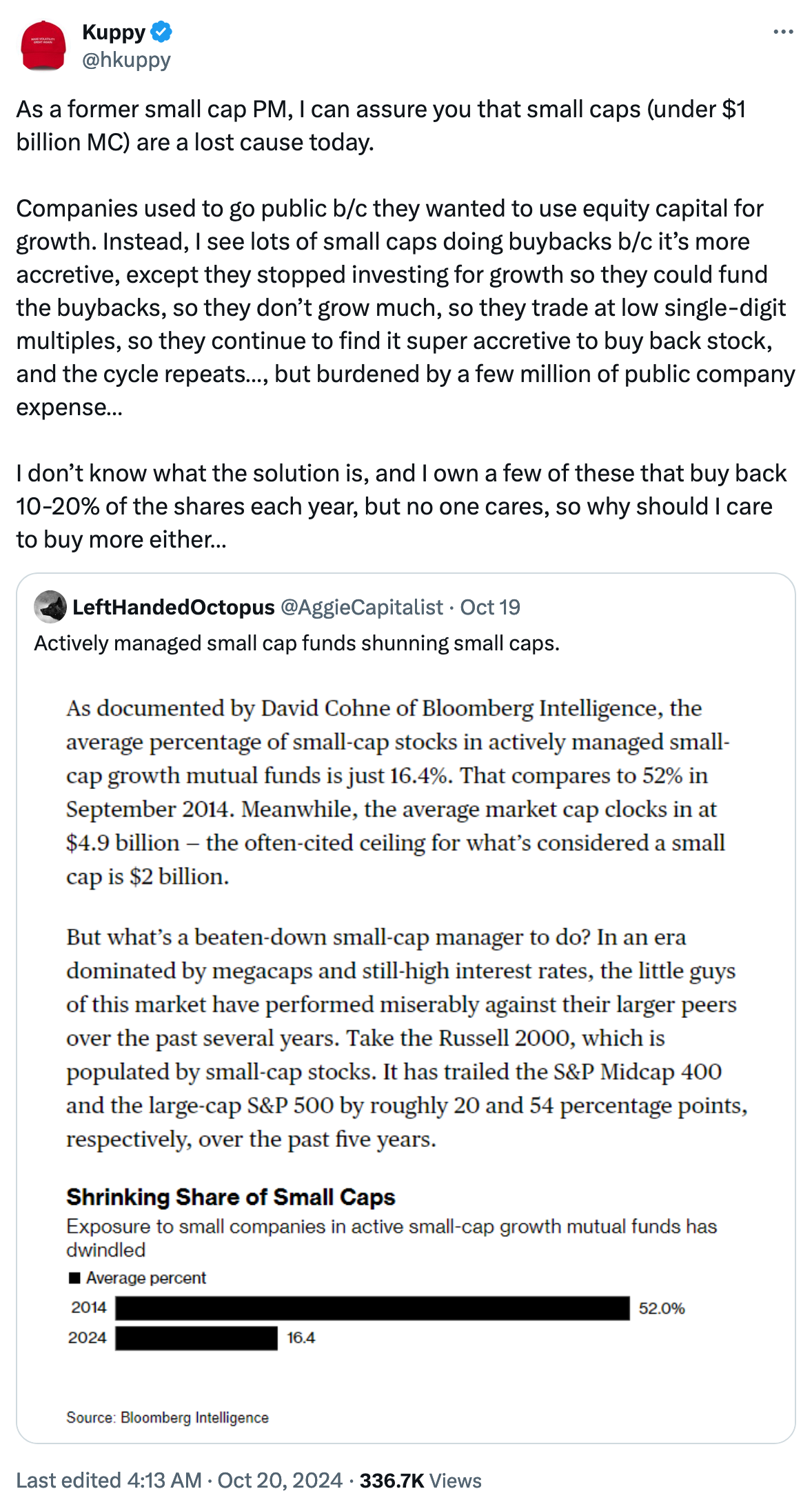

Kuppy’s Tweet of the Week

Chart and Kliff Note of the Week

Strategic Alternatives Monitor: Scilex Holdings, SCLX, board authorized management to explore options including a spin or a public listing of securities in order to better recognize the company’s value.

Secondaries Monitor: LCID popped another 262.4m shares @ $2.66 via BAML ($700mm deal) with Public Investment Fund’s purchasing another 374.7m shares to maintain its 58.8% holdings. You are never wrong if you just keep averaging in and don’t sell!

Subscribe Now for More Event-Driven Opportunities

Friends of KEDM

- It could not be more timely, as Jack Farley interviewed Jim Rogers on China prior to our “China” Happy Hour this week.

- Changing gears, Uranium Insider made an update on the Uranium Market.

- Our good friends at the Macro Voices Patrick Ceresna & Erik Townsendhosted Anas Alhajji discussing Oil, Middle-East tensions and China.

- Our Happy Hour guest Michael Kao interviewed MI2 Partners‘ Harry Melandri on Fed’s Reaction function and Geopolitics.

Kuppy’s Event Driven Monitor scans over 20 corporate events for market moving information and distills them into our propietary “Kliff Notes.” One profitable trade should more than cover an annual subscription and access to the Event Driven chatroom!