Some highlights from this weekend’s Event Driven Monitor

Have a friend with an ED (“Event-Driven”) problem? Forward this newsletter to them and they can sign up for their own ED fix right to their inbox:

NEW USERS RECEIVE A FREE 4-WEEK TRIAL

The Event of the Week

News stories citing “Gold” (in white) vs GLD price (in blue)

How do we know when to exit gold?? This is a question we’ve gotten asked a lot over the years. You have a win, but when do you take the chips off the table?? This starts with a basic question of timelines. Are you playing for a multi-year trade, a short-term momentum thrust, or something in-between? For now let’s think about the short-term…

So, how do we know when the first breadth thrust is coming to a conclusion?? Well, we’re looking for a climax, and trust us, you can’t fake it…

What are the clues?? We want to see inflows into the metal ETFs. We want bubblevision to report nonstop about gold. We want to see junior miners that are finally able to raise capital. We want some negative divergence, where GDX and GDXJ run out of steam while gold keeps going. We want silver to be outperforming gold. We want to see JM Bullion and Apmex get overrun with buy orders …and we want all the tech bros to become gold bros.

Subscribe Now To Keep Reading…

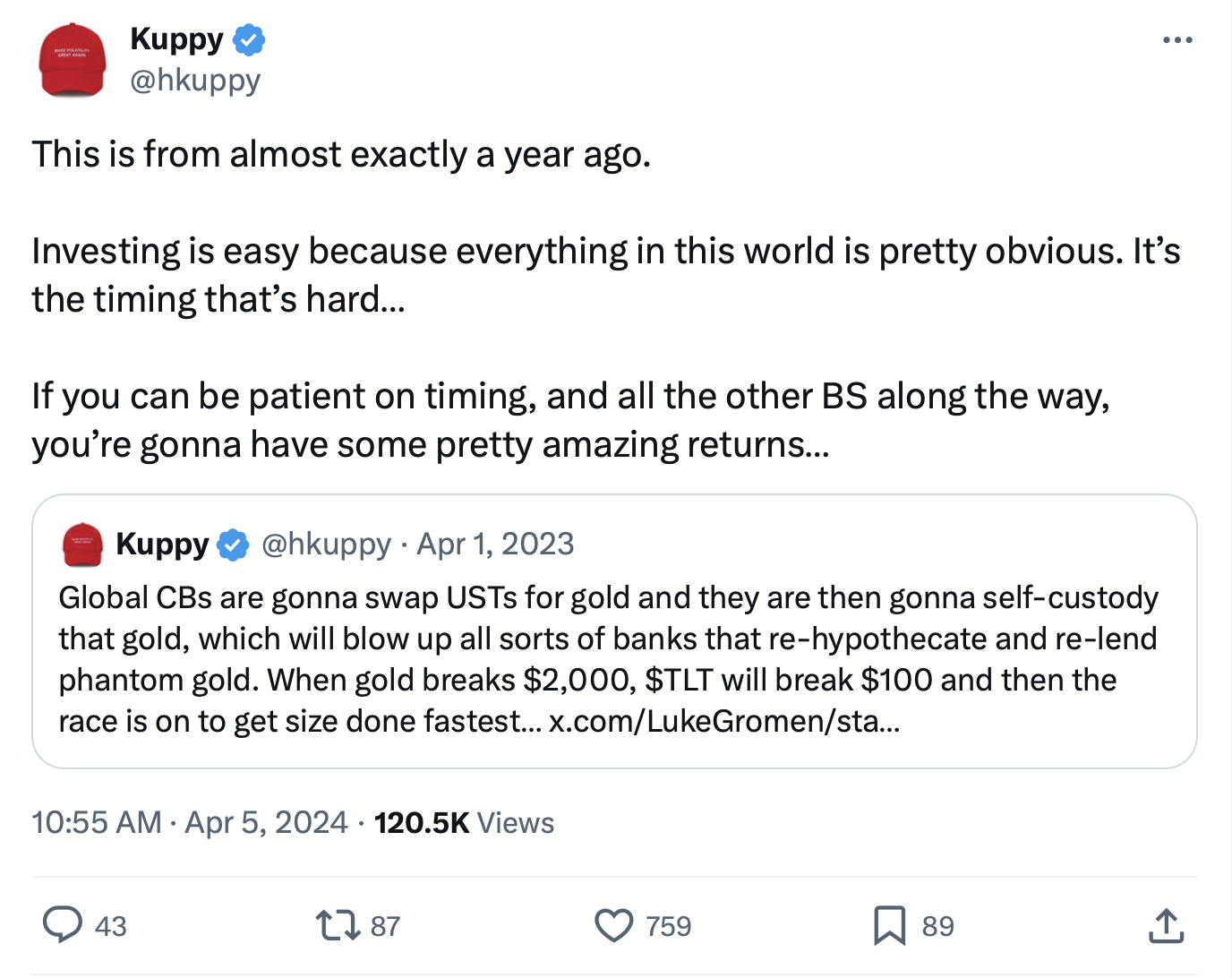

Kuppy’s Tweet of the Week

A little throwback to one of Kuppy’s most prescient calls…

Chart and Kliff Note of the Week

LATAM Airlines will start the process of re-listing shares on NYSE upon consent from creditors that supported their Chapter 11 reorganization. Estimated timeline for the relisting is approximately 6 months.

Bankruptcies are one of our favorite events to track. Sign up for a trial to see who else is emerging from bankruptcy…

Subscribe Now for More Event-Driven Opportunities

Friends of KEDM

- Our good friend and KEDM subscriber Blind Squirrel Macro went on Forward Guidance this week to discuss one of our favorite themes, Chinese Auto Exports. This is a must watch if you are following this trend with huge implications for shipping as well as autos.

- Quant legend and hedge fund billionaire Cliff Asness went on our friend Meb Faber’s podcast this past weekend. Cliff is not a regular on the podcast circuit so this a rare interview. He does not pull any punches here.

Kuppy’s Event Driven Monitor scans over 20 corporate events for market moving information and distills them into our propietary “Kliff Notes.” One profitable trade should more than cover an annual subscription and access to the Event Driven chatroom!