Once you look at this chart, you simply cannot unsee it. Our good friend, Kevin “The Macro Tourist” Muir sent this to us during the Wednesday Fed smash. It accurately predicted the subsequent ripper on Friday. If it goes to analog, it likely continues for a few days, then death. Kevin has been harping on the size of the JPM Whale and all the year-end structured products for a while now. At first, we sorta ignored him, but we increasingly think he’s onto something here. As those sunset on Dec 31, we can get a major trend change. We suspect that it’s value over Ponzi in a GIANT sector rotation (remember 2022??). At the same time, this isn’t 2022. Back then, value names were humming along and putting up numbers. The economy feels like it’s rolling over now. Maybe everything simply goes down for the count??

If you aren’t into analogs, its worth listening to Vincent Deluard’s recent interview with Jack Farley who sees a perfect economic storm headed our way in Q1/Q2.

Bottomline, MAGA is eminently bearish for most equities. Positioning in growth is sloppy to the upside. We’ve been in harvest mode since the spring. And yes, we missed this rally, but now, we’re turning downright bearish on many sectors in the market.

But the first rule of “Project Zimbabwe” is you never short it, right?? Well, we’ve bought some pretty copious June/2025 put spreads, but now, we’re considering the chart above as an analogue to go outright short on some sectors. We’ve cut back as much as we dared to. Now, the only way to take our net down lower, is to play with dark magic and short a bit. We haven’t pulled the trigger yet, but tend to think we’ll be looking at spots with clearly defined risk levels. In particular, we think sectors like semiconductors are massively exposed to AI being a colossal bust, while global demand for them recedes, right as supply comes online in size…

Remember, we’re in a highly financialized economy. We’re going to run much larger deficits in the coming years. No one is going to want to fund our deficits. In many ways, TLT is the chart of truth (yes, we know that only retail punters trade this garbage). Look at it on the next page anyway…

This is an eminently bearish chart. It tried to bottom. We think it rolls and rolls hard. We think 10s go to 6% in the near future, so 20s go to 7.5%?? Ask Brazil how that’s working for equity multiples…

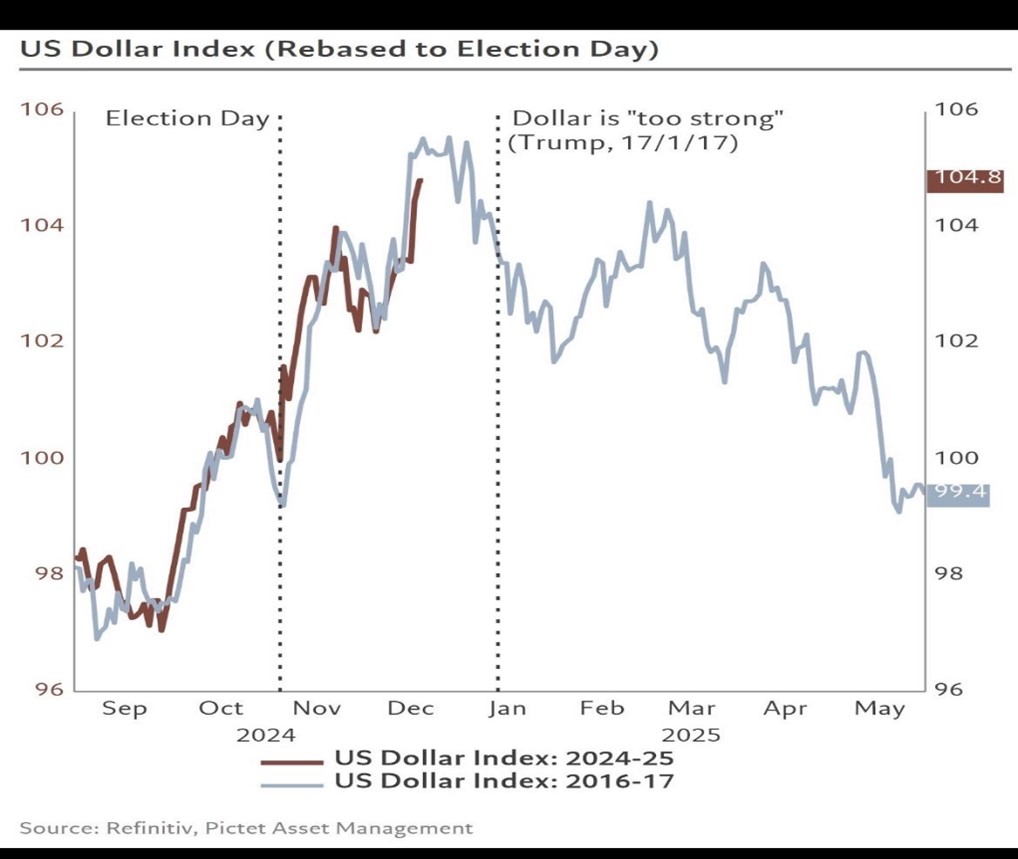

Now, there is a release valve here. We need the Dollar down, and down a lot. Sorry to hit you with a second analog. However, we cannot help ourselves. We need a forced devaluation. We need a Mar-A-Lago accord. If Trump plans it, it will be in the first few weeks. If not, this can get nasty fast…

We don’t know if Trump can pull it off, because we really don’t know what the actual plan is right now. However, we can’t help but look at all the charts that are breaking down.

CZR is about to break below a 3-year consolidation. Gambling is tied to disposable income. You’d think that with all the FartCoin winning, you’d have more gambling, but no. The data is going soft. We’re seeing this all over the place. We’re based in Rincon, Puerto Rico. This is where you go when you want a week of warmth and some surf. It’s a week before Xmas. The place should be jammed up. It’s empty. We hear from our friends that Whistler is empty on the other coast. Maybe, just maybe, the consumers are feeling tight—even while their MAG7 + Bitcoin are making highs. If so, it only gets worse if they roll.

As noted above, we think they roll in Jan. It’s a trend change.

Now, we admit we’ve been too bearish all year. It’s kept us out of good trades. Thankfully, we didn’t short, we simply cleaved off the chaff and moved to center book. And we have zero regrets. Now we think things are genuinely rolling over, and that’s before RRP hits zero…

We haven’t talked about the Overnight Reverse Repo facility in a while. It was top of mind when it was really draining in 2023, but the pace slowed in 2024. Now, it’s about to hit zero and will get zeroed with about six weeks of QT. Remember how equities are basically a mirror of RRP liquidity?? Now you see the catalyst. As liquidity finally drains, we expect equities to drain.

Maybe we’re just sour because we’re having a pretty frustrating year, but the bearish signs keep lining up. We think it’s time to hide—especially as everyone is now in the pool…

And we’ve shown this chart a few times now, but imagine what happens when JPOW is forced to raise rates, right as a bunch of corporates are facing the 2025 refinancing wall…

Look at how silly the C spread looks??

More Bear Porn…

A low frequency but juicy strategy where the edge is government incompetence.

Let’s dig in…

Once you look at this chart, you simply cannot unsee it. Our good friend, Kevin “The Macro Tourist” Muir sent this to us during the Wednesday Fed smash. It accurately predicted the subsequent ripper on Friday. If it goes to analog, it likely continues for a few days, then death. Kevin has been harping on the size of the JPM Whale and all the year-end structured products for a while now. At first, we sorta ignored him, but we increasingly think he’s onto something here. As those sunset on Dec 31, we can get a major trend change. We suspect that it’s value over Ponzi in a GIANT sector rotation (remember 2022??). At the same time, this isn’t 2022. Back then, value names were humming along and putting up numbers. The economy feels like it’s rolling over now. Maybe everything simply goes down for the count??

If you aren’t into analogs, its worth listening to Vincent Deluard’s recent interview with Jack Farley who sees a perfect economic storm headed our way in Q1/Q2.

Bottomline, MAGA is eminently bearish for most equities. Positioning in growth is sloppy to the upside. We’ve been in harvest mode since the spring. And yes, we missed this rally, but now, we’re turning downright bearish on many sectors in the market.

But the first rule of “Project Zimbabwe” is you never short it, right?? Well, we’ve bought some pretty copious June/2025 put spreads, but now, we’re considering the chart above as an analogue to go outright short on some sectors. We’ve cut back as much as we dared to. Now, the only way to take our net down lower, is to play with dark magic and short a bit. We haven’t pulled the trigger yet, but tend to think we’ll be looking at spots with clearly defined risk levels. In particular, we think sectors like semiconductors are massively exposed to AI being a colossal bust, while global demand for them recedes, right as supply comes online in size…

Remember, we’re in a highly financialized economy. We’re going to run much larger deficits in the coming years. No one is going to want to fund our deficits. In many ways, TLT is the chart of truth (yes, we know that only retail punters trade this garbage). Look at it on the next page anyway…

This is an eminently bearish chart. It tried to bottom. We think it rolls and rolls hard. We think 10s go to 6% in the near future, so 20s go to 7.5%?? Ask Brazil how that’s working for equity multiples…

Now, there is a release valve here. We need the Dollar down, and down a lot. Sorry to hit you with a second analog. However, we cannot help ourselves. We need a forced devaluation. We need a Mar-A-Lago accord. If Trump plans it, it will be in the first few weeks. If not, this can get nasty fast…

We don’t know if Trump can pull it off, because we really don’t know what the actual plan is right now. However, we can’t help but look at all the charts that are breaking down.

CZR is about to break below a 3-year consolidation. Gambling is tied to disposable income. You’d think that with all the FartCoin winning, you’d have more gambling, but no. The data is going soft. We’re seeing this all over the place. We’re based in Rincon, Puerto Rico. This is where you go when you want a week of warmth and some surf. It’s a week before Xmas. The place should be jammed up. It’s empty. We hear from our friends that Whistler is empty on the other coast. Maybe, just maybe, the consumers are feeling tight—even while their MAG7 + Bitcoin are making highs. If so, it only gets worse if they roll.

As noted above, we think they roll in Jan. It’s a trend change.

Now, we admit we’ve been too bearish all year. It’s kept us out of good trades. Thankfully, we didn’t short, we simply cleaved off the chaff and moved to center book. And we have zero regrets. Now we think things are genuinely rolling over, and that’s before RRP hits zero…

We haven’t talked about the Overnight Reverse Repo facility in a while. It was top of mind when it was really draining in 2023, but the pace slowed in 2024. Now, it’s about to hit zero and will get zeroed with about six weeks of QT. Remember how equities are basically a mirror of RRP liquidity?? Now you see the catalyst. As liquidity finally drains, we expect equities to drain.

Maybe we’re just sour because we’re having a pretty frustrating year, but the bearish signs keep lining up. We think it’s time to hide—especially as everyone is now in the pool…

And we’ve shown this chart a few times now, but imagine what happens when JPOW is forced to raise rates, right as a bunch of corporates are facing the 2025 refinancing wall…

Look at how silly the C spread looks??

Start your 28-day free trial

Kuppy’s Event Driven Monitor (“KEDM”) is not a financial or investment advisor and the information contained in this publication is not intended to constitute legal, accounting, or text advice or individually-tailored investment advice and is not designed to meet your personal financial situation. The investments discussed in this publication may not be suitable for you. You are required to conduct your own due diligence, analyses, draw your own conclusions, and make your own investment decisions. Any areas concerning legal, accounting, or tax advice or individually-tailored investment advice should be referred to your lawyers, accountants, tax advisors, investment advisers, or other professionals registered or otherwise authorized to provide such advice. KEDM makes no recommendations whatsoever regarding buying, selling, or holding a specified security, a class of securities, or the securities of a class of issuers, and all commentary is for educational purposes only. The investment examples noted are intended to provide and example of the events and data KEDM flags each week and is not representative of typical returns generated by each event or any future returns.