More on Stock Buybacks…

A low frequency but juicy strategy where the edge is government incompetence.

Let’s dig in…

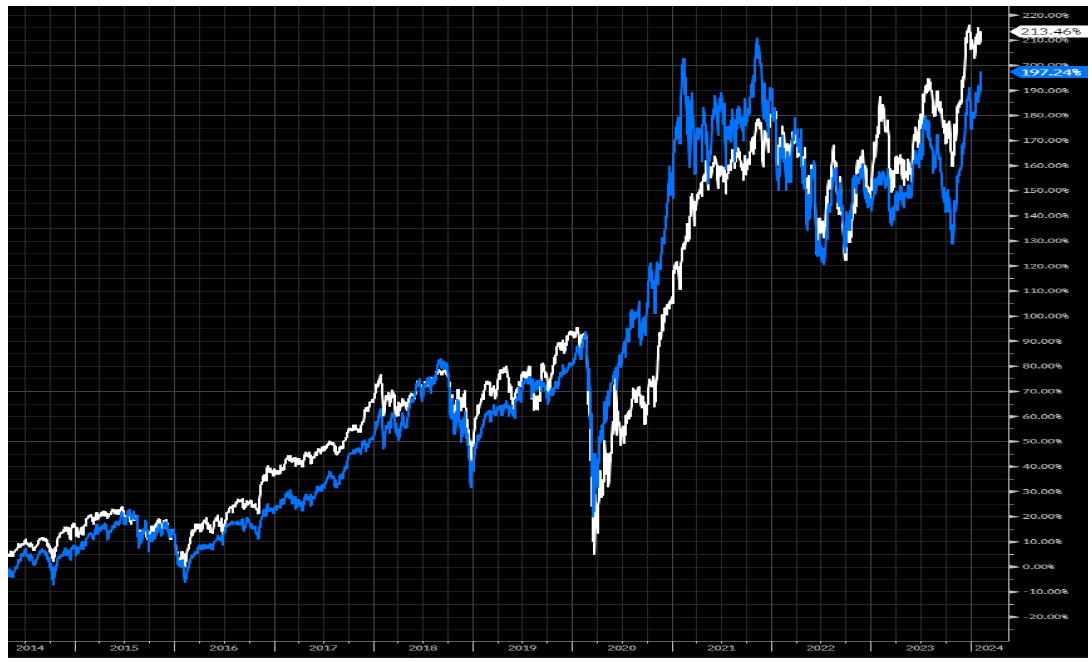

We are still digging out from earnings and prepping for another onslaught next week in some of our themes. But one theme that keeps pinging as we peruse the conference calls so far is the overall trend in buybacks (at least in our “old economy” themes and stocks). We noted a few weeks back that buybacks have been the key factor in outperformance over the past few years (read KEDM here)…even beating out the momentum factor (see buybacks in white and momo in blue below)

C-suites aren’t dumb and are leaning in (their comp depends on it…), realizing that active fund managers will no longer find their cheap stock and bid it too intrinsic. Market structure has shifted and cheap stocks will continue to get cheaper as active gets replaced with passive flows.

Even Einhorn was out this week complaining about how “markets were fundamentally broken…[with] passive investors having no opinion about value.” And he’s right (albeit a bit late to realize it and change tune, sorry Greenlight investors…). Market structure ebbs and flows, and while my hope is that value will once again has its moment, we are left to trade the markets in front of us, not the ones we wish for.

Turning back to buybacks, our friend Paulo (and fellow KEDM’er) noted it perfectly, “the point is this: 4x Ebitda will become 3x, 2x, 1x… The only solution to non-Mag7 and especially Value/Smallcap equity underperformance is for managements to introduce a price-insensitive buyer — the corporate buyback — to offset relentless price-insensitive Active redemption sales that weigh on their share price…”

Now combine a price-insensitive corporate buyer on the bid with another price-agnostic buyer, i.e. passive ETF flows, and you’ve got a powerful tail that squeezes the float. There is a reason why we focus so much of our energy on buybacks and index flows at KEDM. Not only are they catalysts to unlock value on single stocks, they are a theme in itself and highly reflexive. It is worth tracking these Monitors and watching for changes as we push through earnings season and we will continue to flag ones that seem interesting…

Start your 28-day free trial

Kuppy’s Event Driven Monitor (“KEDM”) is not a financial or investment advisor and the information contained in this publication is not intended to constitute legal, accounting, or text advice or individually-tailored investment advice and is not designed to meet your personal financial situation. The investments discussed in this publication may not be suitable for you. You are required to conduct your own due diligence, analyses, draw your own conclusions, and make your own investment decisions. Any areas concerning legal, accounting, or tax advice or individually-tailored investment advice should be referred to your lawyers, accountants, tax advisors, investment advisers, or other professionals registered or otherwise authorized to provide such advice. KEDM makes no recommendations whatsoever regarding buying, selling, or holding a specified security, a class of securities, or the securities of a class of issuers, and all commentary is for educational purposes only. The investment examples noted are intended to provide and example of the events and data KEDM flags each week and is not representative of typical returns generated by each event or any future returns.