Offshore Is Getting Cheap…

A low frequency but juicy strategy where the edge is government incompetence.

Let’s dig in…

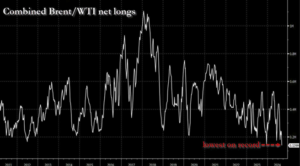

We’re in Zurich and then Geneva, after a week in Oslo at the Pareto Energy Conference. It was crowded, but we haven’t seen this much emotional pain outside of a funeral. A look at the below chart will give you a sense of why everyone is so dour. Then again, if your book even sort of looks like ours, you’re also feeling it…

Yes, they’re purging energy. Unfortunately, that’s one of the sectors we didn’t really ‘harvest’ in the spring. We’re still of the view that energy is in a bull market, and we’re mostly playing it through offshore service—as they’re trading at huge discounts to replacement value and the up-cycle is continuing as offshore is likely to be an increased percentage of global production as the decade moves on. After a week in Oslo, we’re even more convinced of this as offshore break-evens continue to decline as the tech evolves, whereas shale is hitting diminishing returns—particularly as it slams into Tier 2 rock.

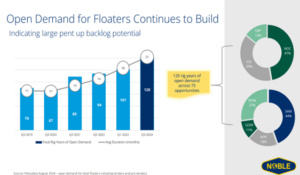

The theme of the week was resetting expectations for the timing of the inflection in offshore. Drillers saw 2024 as a busy contracting year, building off the contracting momentum of 2023 and setting up an inflection in pricing and term length of contracts starting in 2025. Instead, multiple factors stacked up and caused a sluggish 2024. Some majors (namely Shell) went pencils down on many projects as they shook up divisions and required employees to re-justify existing and future projects. Going into 2024, drillers expected Shell to have contracts for 3 additional drillships by this point in 2024.

E&P’s that initially intended to contract rigs in 2024 found delays and shortages in other important areas of offshore projects like subsea trees and FPSO’s. If E&P’s find that the dates for their subsea infrastructure and FPSO deliveries are pushed back, they are in no rush to start drilling the wells that meant to supply the infrastructure. Meanwhile, the increasing whitespace on drillers’ books starting in 2025 isn’t adding pressure on the E&P’s to secure rig capacity while they’re still uncertain about when they’ll need it.

Despite the somber mood of an underwhelming 2024, there was ample evidence that while the timing has been pushed back, the underlying demand has continued to grow. Open tenders for rigs increased in 3Q24 and the average duration being tendered is nearly 2 years. This increase is net of the tenders that have been turned into contracts over the past year.

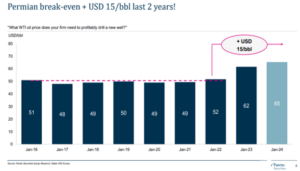

One reason for the sustained long-term demand is the increasing preference for offshore oil as E&P’s see costs increase and/or top tier opportunities decrease across the rest of the portfolio – most notably in their Permian portfolio.

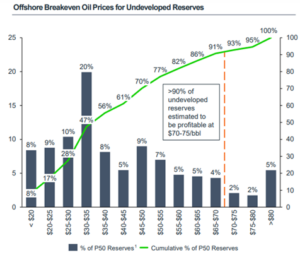

Meanwhile, ~85% of offshore resources have break-evens under $65, with a good chunk of it clustered in the $30s or lower. We increasingly are of the view that as longer drill campaigns are initiated with field-level production, and the tech keeps evolving, those break-evens will actually decline (net of inflation). Think of the world of 2008, the last peak in offshore, when compared to today. You used to have to tie in production to land using long and expensive pipelines, your drillships were mostly 6th Gen, with a single Blow Out Preventer (BOP) and no Managed Pressure Drilling (MPD). Your OSVs were smaller and less efficient. If you had an FPSO, you almost always used a shuttle-tanker, which added costs and complexity as well. It was slow and expensive to do stuff offshore and the seismic wasn’t very accurate either, hence there were a lot of dry holes. Now, look at what’s happening in Guyana. It’s starting to look like factory production, or how the Permian is worked over currently—except it’s better as there are no pipelines needed. Most importantly, the decline curves are a whole lot flatter than the Permian. This means your don’t have to keep putting capital back into your fields, you can actually invest, then harvest and return capital to shareholders (which is the new mantra in E&Ps).

Think forward a bit at how this goes into the future. A handful of drillships target a field in proximity to an oversized FPSO, where they don’t even fully raise the BOP to save time on location moves. You have 2x BOP + MPD, which gets you much faster drilling (imagine going from 4 wells a year back in 2008, to a dozen today—maybe 20 in a few years??). The drillships are the most modern and over-engineered that are out there. Best PSI, best hook strength, just the best. You have your robotic vessels trail just behind your drillship for the tie-back to the FPSO. You use an FPSO to gather oil and partly process it. You no longer use shuttle tankers to bring oil onshore before re-transport. Now you can directly load a suezmax from the FPSO. Seismic has made every drill hole into a winner (or pretty damn close). Don’t tell anyone, but this is the actual AI play (not that anyone would give it a multiple). The tech just keeps going faster and better. It’s scary to say it, as we’re energy bulls, but we wonder if this is how it felt in 2012 in shale, right before productivity and then production really started to ramp.

While offshore is considered long-cycle when compared to shale as a short-cycle production method, we believe that’s changing too. Of course, everyone wants to ramp the Permian when oil prices surge. You can just drill and produce almost instantly—which is why large integrated E&Ps keep focusing on shale, even though the economics aren’t anywhere near as strong as in offshore. What if offshore acts more like short-cycle shale in a few years. Once you have your FPSO anchored on the field, it shouldn’t be too hard to float over some drillships, and increase production in a hurry. You don’t need to contract with shuttle tankers, you just call in a suezmax for export. You don’t need crazy and time-consuming set up. You just drill and take that FPSO from 50% utilization to 100% and do it in a hurry. I know, we’re not there yet, but we could be, and soon. If we get there in a few years, why would anyone bother with shale? The main advantages of shale are that you go fast to capture price surges. What if offshore was almost as fast, but with MUCH better economics…??

So, where’s the bottleneck as we ramp?? Right now, it’s FPSOs, production trees and tie-backs. Probably worth looking at the shipyards building those. What comes after FPSOs?? Well, we probably have a shortage of 7th and 8th Gen rigs. We are firmly of the opinion that they won’t build any more of those. Instead, they’ll upgrade them over and over again, to make them even more efficient, and dayrates on the best vessels will scream as you can do more with less. PSVs already took out the 2008 and 2014 highs. Why can’t drillships go for more than $1 million a day?? Maybe not today, but why not in a few years when you’re doing the work of 3-5 drillships of the prior decade. Those got contracted at $700k or more during the last cycle. That would be $2-3 million equivalent today. We think it’s coming…

Unfortunately, it’s not coming tomorrow. This is a process, a cycle if you will, and we’re firmly in the consolidation after the first surge. We think there’s more to come, but until then, investors can only think about their returns since the past month. Fortunately, the dejected attitude of most investors at the conference is reflected in oil service equities and we think they represent extreme values.

We’d argue that this chart dramatically understates the discount these assets are being priced at, as the “historical cost” denominator is significantly lower than the current cost of these newbuilds.

So, what can be the catalyst for contracting to ramp back up? We aren’t sure (and neither are the drillers), but one thing we’re watching is the current tender Petrobras has out for 9 rigs, expected to be announced in stages between now and 1H25. Most of the rigs that win contracts are expected to already be operating in the country, but in looking back to 2020-2023, Petrobras tenders has been a huge source of utilization for the industry and lit a fire under the other players to start contracting.

Basically, until contracting picks up again, the drillers seem stuck in a new higher plateau. Meanwhile, older vessels keep getting scrapped (are 6th Gen vessels even going to be part of this cycle??) and that tightens the market even further. At the same time, the industry keeps consolidating, which further tightens the market. We find it intriguing that many of the larger players are now trading at roughly the same EV as contractual backlog. With that backlog increasingly booked at better than 50% EBIT margins, not only is the EV covered by steel values, but increasingly it’s covered by deferred cash flow—or at least half the EV is. We remain quite optimistic on offshore drillers, but only those with modern tonnage, great balance sheets and large enough fleets, so that they can have economies of scale…

Start your 28-day free trial

Kuppy’s Event Driven Monitor (“KEDM”) is not a financial or investment advisor and the information contained in this publication is not intended to constitute legal, accounting, or text advice or individually-tailored investment advice and is not designed to meet your personal financial situation. The investments discussed in this publication may not be suitable for you. You are required to conduct your own due diligence, analyses, draw your own conclusions, and make your own investment decisions. Any areas concerning legal, accounting, or tax advice or individually-tailored investment advice should be referred to your lawyers, accountants, tax advisors, investment advisers, or other professionals registered or otherwise authorized to provide such advice. KEDM makes no recommendations whatsoever regarding buying, selling, or holding a specified security, a class of securities, or the securities of a class of issuers, and all commentary is for educational purposes only. The investment examples noted are intended to provide and example of the events and data KEDM flags each week and is not representative of typical returns generated by each event or any future returns.