Ongoing tailwind from people fleeing to

A low frequency but juicy strategy where the edge is government incompetence.

Let’s dig in…

Ever since we started paying taxes, we’ve been aware that many jurisdictions that offer reduced tax rates, or even zero tax rates. We know of places that offer attractive citizenship programs—we’ve even had Basil Elziki of Henley Partners on for a KEDM Happy Hour to share some insight on these places. However, we wonder what the long-term implications of this migration are, just like we wonder what trades we are missing.

Let’s take a step back in time. For as long as there were governments, there were taxes. At first, the taxes were applied to land, as that was the primary productive asset. Noble landowners paid up the food-chain and peasants paid their landlord with their labors. About two centuries ago, factories began to join land as a focus of taxation. Peasants would work for negligible salaries, and factory owners would then pay their taxes up the food-chain. Given how gradually the world industrialized, taxes simply evolved to incorporate factories as another form of land. This model worked until roughly a century ago when governments realized that if the peasants were allowed to earn more, they could also be heavily taxed. As a result, governments supported unions, who improved wages, creating a second tax base to pilfer. Unfortunately, factories are mobile and over the past few decades, they’ve been migrating overseas to places with much lower wages and often reduced taxes—leaving the peasants behind to still be heavily taxed, even if their wages aren’t as material as they used to be.

While this was happening, knowledge became the key asset of commerce—not factories or land. Knowledge is even more mobile than factories, and certainly more mobile than land. Knowledge goes where it’s treated best. In a world where multiple jurisdictions offer low tax rates, it takes more than just the rate to incentivize knowledge to settle. Regulations and incentives help (just look at Dubai!!), but quality of life has become an even bigger determinant of which places boom.

On the flip side, as more people flee high-tax jurisdictions, we genuinely fear what happens to the places that they leave behind. Parts of NYC, California and Chicago seem like Mad Max lately. Clearly there’s a tipping point where the tax base is so hollowed out, that government services get cut back, while the spending power that supports restaurants/shops/civic activities vaporizes, leading to a rapid cascade in quality of life for a city or region. Of course, it takes more than just taxes to make people flee, and much of this is self-inflicted by liberal policies that refuse to protect citizens from criminals, while importing migrants—which only accelerates the flight.

Thankfully, we aren’t long any of these places. We also don’t short much, so what’s the bull thesis in all of this??

As you’re well aware, we are big believers in Florida and particularly in the Florida Panhandle. Every time something insane happens in NYC or some other shit-hole, we always cheer for the inevitable wave of wealthy refugees to the Panhandle. As more of the tax base flees, what’s left crumbles faster, accelerating the flight of people and capital.

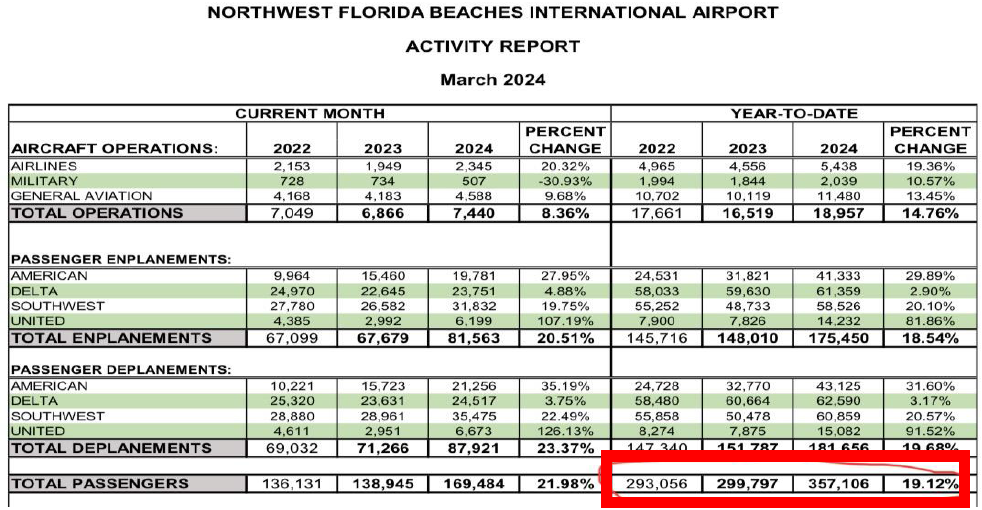

JOE seems to have been a huge beneficiary of this trend. Look at the comps for the primary airport serving the region. Think about how crazy it is that they’re comping +19% against peak WFH/Stimmy vacation/COVID Crazy Flight. The region is simply growing at an insane rate, and population migration is what drives property values.

So, what are the other trades like JOE?? Where else are people fleeing to?? Not just Americans—where are wealthy Europeans going?? We know that if you’re in LatAm, you’re going to Miami or Uruguay, but where else?? We were just in Grand Cayman for a compliance conference—no, really, we actually take compliance seriously— and the place was booming. We met with a few KEDM subscribers who explained about the influx of wealthy (mostly Canadians and Brits) who were escaping more than taxes and shitty weather. They wanted a better quality of life. As we look at the tsunami of migrants flooding into Western cities and notice that these cities no longer look as clean, or as safe—we wonder where everyone flees to. Last winter, we were in Malta, it’s positively booming, Andorra too.

There are dozens of these places that value personal safety, and want to attract residents who feel similarly—residents who will add and not detract from the place. They want residents who have capital, create jobs, bring skills. They understand that they cannot tax these people, as knowledge is mobile. But they’ll get their pound of flesh, through consumption taxes—don’t think there’s ever a free lunch. These places are working hard to attract this wave of refugees. These jurisdictions know that there’s a critical mass needed, that then accelerates the migration. The wealthy locals driving this process own the properties, they own the land and the local businesses that will service the taxpats. They want to get rich themselves, and they want their communities to thrive. There’s a lot of competition here—remember, it isn’t just about tax rate, it’s about quality of life. You need a lot of rich guys to support the restaurants/shops/groceries/health care/etc. to make the whole flywheel spin faster. They’re fighting for your attention every day.

Finishing this thought—knowledge is mobile, and as communities set up abroad, more people realize that they can also be mobile. There’s no stigma, and there’s no trading down in quality of life. In many cases, you’re moving somewhere that has more people that see the world as you do—you’re trading up.

So, in conclusion, we see a macro trend. A trend with huge tailwinds and a LOT of capital behind it. What are the trades?? What are the other trades like JOE?? We want a basket of JOEs. Who else is publicly traded and courting wealthy refugees??

Start your 28-day free trial

Kuppy’s Event Driven Monitor (“KEDM”) is not a financial or investment advisor and the information contained in this publication is not intended to constitute legal, accounting, or text advice or individually-tailored investment advice and is not designed to meet your personal financial situation. The investments discussed in this publication may not be suitable for you. You are required to conduct your own due diligence, analyses, draw your own conclusions, and make your own investment decisions. Any areas concerning legal, accounting, or tax advice or individually-tailored investment advice should be referred to your lawyers, accountants, tax advisors, investment advisers, or other professionals registered or otherwise authorized to provide such advice. KEDM makes no recommendations whatsoever regarding buying, selling, or holding a specified security, a class of securities, or the securities of a class of issuers, and all commentary is for educational purposes only. The investment examples noted are intended to provide and example of the events and data KEDM flags each week and is not representative of typical returns generated by each event or any future returns.