Our newest inflecting theme – RoRo

A low frequency but juicy strategy where the edge is government incompetence.

Let’s dig in…

Turning to our newest theme, RoRos, earnings got rolling with a focus on the current progress of contract renewals, mitigating Red Sea disruptions and meaningful changes in capital allocation strategies.

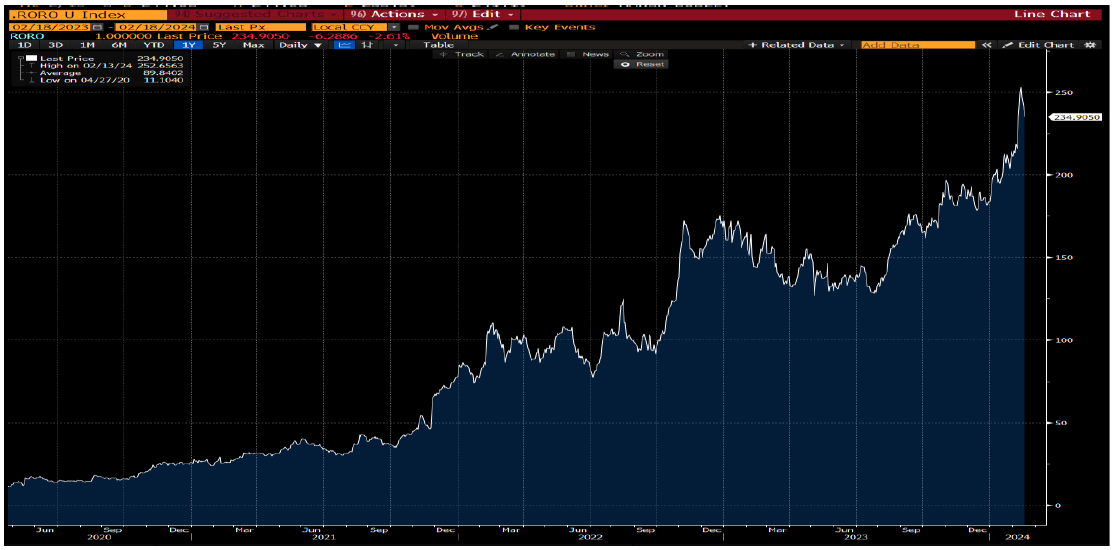

RORO Index…No, this isn’t SMCI.

Current market rates hit a new record-high in January, with HAUTO reporting net rates of $85.40/cbm. Both HAUTO and WAWI have spent FY23 taking advantage of strong rates to roll contracts. RoRo operators tend to be cagey when discussing exactly where their contracts are marked, but WAWI reported rate increases on new contracts coming in at 20% to +100% depending on trade lane, and HAUTO states that the average net rate for new contracts is over $100/cbm.

FY24 will be the year of contract renewals for the RoRo industry, followed by FY25 and FY26 being the years of digesting newbuild supply. HAUTO is set to renew ~28% of their annual volumes in FY24 and WAWI is looking to renew a whopping ~46% of annual volumes this year. Both operators appear committed to bringing these contracts up to market rates, and claim to be securing more firm volume commitments from its customers – though, like with rates, they continue to be vague about exact commitment levels or terms.

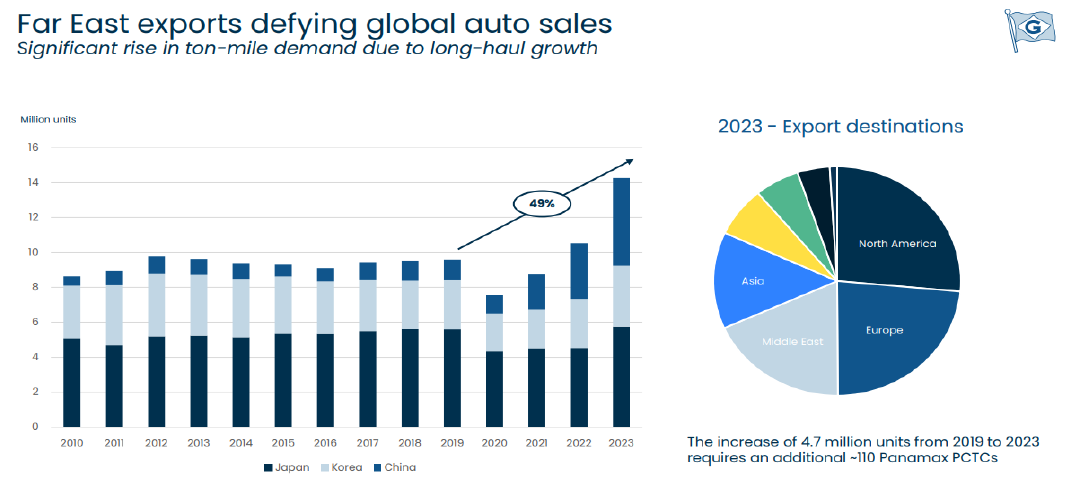

As the industry looks past FY24, it remains cautiously optimistic about absorbing the expected newbuilds with the orderbook standing at 37% of the current fleet as of December 2023. Gram Car Carriers, GCC NO, points out that while the orderbook is large, this will be the first net fleet growth since ~2017, while east auto exports have expanded 49% since then.

While a 37% orderbook is daunting in any floating industry, the demand and ton-miles are continuing to increase (WAWI estimates Chinese exports in FY24 will increase 26% YoY) and port congestion for RoRos has been a recurring issue that absorbs capacity, even at the reduced size of the industry fleet.

Over the near term, RoRo operators will be trying to navigate the Red Sea disruptions with both HAUTO and WAWI avoiding the Red Sea since the end of FY23. Rerouting around the Cape of Good Hope will decrease volumes and increase voyage expenses, but operators are trying to offset increased costs through surcharges and some cargo repricing for these voyages. Many operators already have surcharge mechanisms in place for their contracts used to offset bunker costs. These surcharges are usually set at the start of a voyage and therefore lag when costs are increasing, but eventually even out over the year when higher surcharges lag decreasing costs.

Lastly, most operators and tonnage providers are finding themselves with significant cash flow due to higher rates but limited ways to deploy the cash if they’ve already set up financing for their newbuilds. Operators have been willing to set and increase generous dividend policies with GCC paying out 75% of net income in dividends and HAUTO moving to pay out “100% of cash generation after amortization of debt facilities, capital expenditures and payable taxes.”

RoRos are ignored, and seem to be inflecting…

Start your 28-day free trial

Kuppy’s Event Driven Monitor (“KEDM”) is not a financial or investment advisor and the information contained in this publication is not intended to constitute legal, accounting, or text advice or individually-tailored investment advice and is not designed to meet your personal financial situation. The investments discussed in this publication may not be suitable for you. You are required to conduct your own due diligence, analyses, draw your own conclusions, and make your own investment decisions. Any areas concerning legal, accounting, or tax advice or individually-tailored investment advice should be referred to your lawyers, accountants, tax advisors, investment advisers, or other professionals registered or otherwise authorized to provide such advice. KEDM makes no recommendations whatsoever regarding buying, selling, or holding a specified security, a class of securities, or the securities of a class of issuers, and all commentary is for educational purposes only. The investment examples noted are intended to provide and example of the events and data KEDM flags each week and is not representative of typical returns generated by each event or any future returns.