Our thinking on Gold

A low frequency but juicy strategy where the edge is government incompetence.

Let’s dig in…

Since many of us are involved in the metals markets, we thought a quick “awww shucks” was needed. Yes, we like to make fun of charts, but sometimes they really do work, even if they only work when you’re drawing your lines after the fact. Here’s gold. We’ve posted this a few times now, but are amazed ourselves.

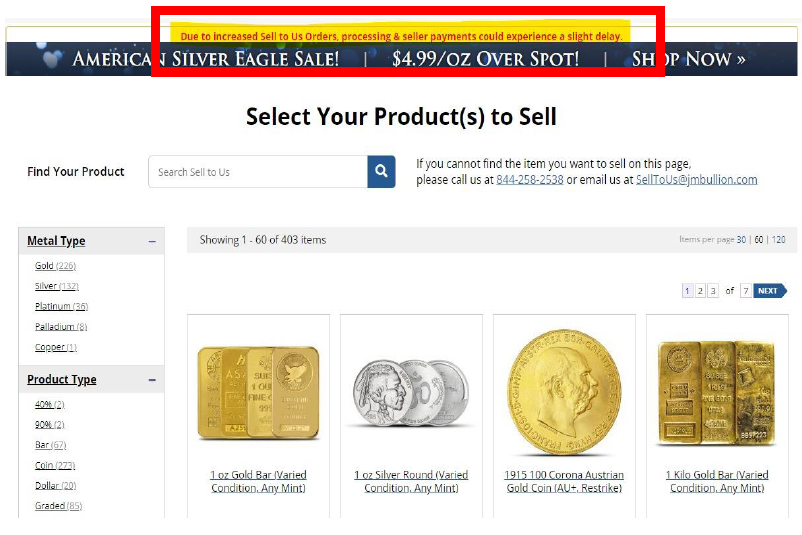

As sentiment traders, after flagging the low-risk entry, we are now focused on finding when to jump off what has become a freight train. Therefore, we found the following screenshot from JM Bullion quite fascinating.

Look on the top, which we’ve highlighted in yellow. They’re getting flooded with sellers. We remember back to when SVB blew up, when the banner notified buyers that they were overwhelmed with buy orders, and it would take time to process all of them. That created a local top that lasted almost a year. Now, flush with sellers, tells us what retail thinks of the metals market. Of course, you can simply look at the units outstanding at GLD if you want confirmation that retail is selling this rip—instead of buying. After a small pop in March, GLD is once again getting redemptions, despite gold absolutely screaming… For a nation of MOMO traders, this is bizarre…

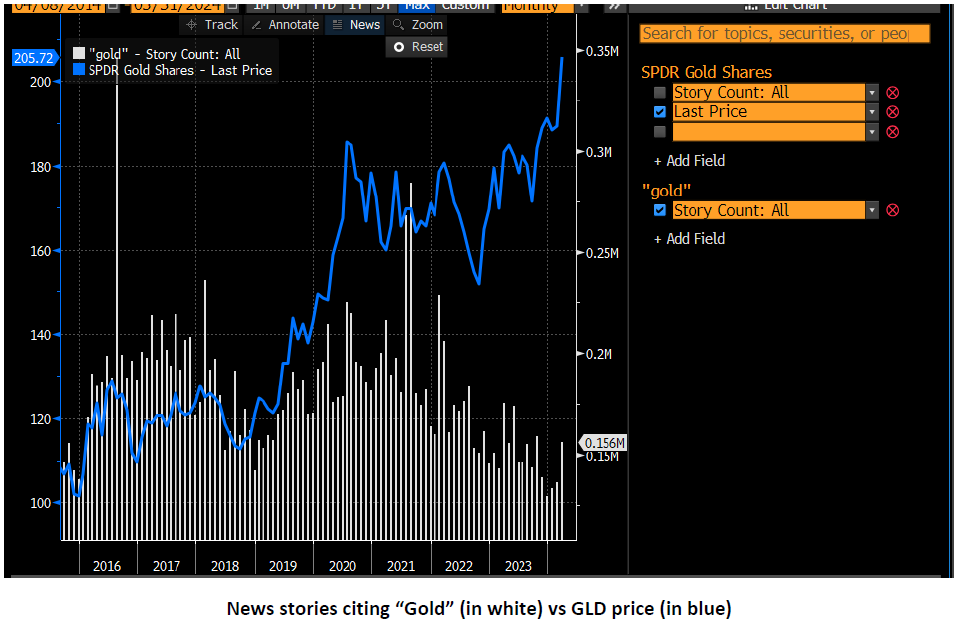

Meanwhile, MSM and bloggers still are’nt mentioning gold in their publications either…

Even surveying our close friends in this industry, friends who lean libertarian and goldbuggy, we’re amazed at how few have full positions. Finally, we’ve always been big believers in divergences. Early in the rally, we had this unnerving feeling that something was wrong, as GDX and GDXJ refused to catch a bid, despite gold absolutely ripping. In the past week, the miners have finally woken up, with a catch-up trade.

Many of us have this similar regret. After a lot of PTSD from going violently sideways for a decade, gold seems to be trending again. For those of us who stopped out multiple times, with nasty rug-burn along the way, it’s hard to get back in. I think that these sentiment metrics are saying exactly that.

At the same time, gold is one of the largest and most liquid global assets. We cannot think of an asset that is this hated, while making new highs almost daily. At some point, the news media will start talking about it, and then asset managers will need to have it on their year-end statements to clients. We know how this process works. There’s a reason that gold trends (1971-1981 and 2002-2012) as a commodity, punctuated by long periods of inactivity. We think this is the real deal. We’re excited for it. We like that no one else seems to notice. There will be many days in the future that scare us silly, but we think this is the break-out that Ron Paul foretold…

So, then how do we know when to exit?? This is a question we get asked a lot over the years. You have a win, but when do you take the chips off the table??

This starts with a basic question of timelines. Are you playing for a multi-year trade, a short-term momentum thrust, or something in-between. For us, we’re doing a bit of everything. We have some Krugerrands that we’ve owned for decades, and we’re never selling those. We also have some miners that we want to sell after the first real breadth thrust loses steam, ‘cause we absolutely hate miners—except during a true breadth thrust, when for a few weeks every few years, they tend to have true Beta to gold. Finally, we own some names that we want to play through a good chunk of the cycle itself.

So how do we know when the first breadth thrust is coming to a conclusion?? Well, we’re looking for a climax, and trust us, you can’t fake it…

What are the clues?? We want to see inflows into the metal ETFs. We want bubblevision to report nonstop about gold. We want to see junior miners that are finally able to raise capital. We want some negative divergence, where GDX and GDXJ to run out of steam while gold keeps going. We want silver to be outperforming gold. Will we sell too early?? Hopefully. We don’t want our miners, and we know there’s a long way down after the peak. But we’re gonna try and ride as long as possible.

How do we know when the intermediate top has come??

We want to see JM Bullion and Apmex get overrun with buy orders. We want to see this guy on the way home from work…

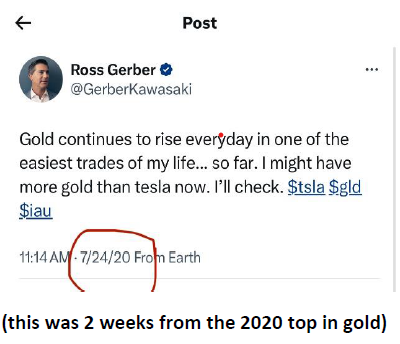

…and we want all the tech bros to become gold bros.

We’re not there yet. We don’t even think we’re close in terms of the intermediate top. Will there be some scary moments along the way?? Of course. Will we have some days where the bourbon starts flowing at 9am?? You know how we roll… But we’ve seen enough cycles to know where we stand. We want to let this one roll until it can go no further…

OK, enough of the pet rock. We’ll have more to say on our Happy Hour with Doug next week. For now, lets jump into the ED…

Start your 28-day free trial

Kuppy’s Event Driven Monitor (“KEDM”) is not a financial or investment advisor and the information contained in this publication is not intended to constitute legal, accounting, or text advice or individually-tailored investment advice and is not designed to meet your personal financial situation. The investments discussed in this publication may not be suitable for you. You are required to conduct your own due diligence, analyses, draw your own conclusions, and make your own investment decisions. Any areas concerning legal, accounting, or tax advice or individually-tailored investment advice should be referred to your lawyers, accountants, tax advisors, investment advisers, or other professionals registered or otherwise authorized to provide such advice. KEDM makes no recommendations whatsoever regarding buying, selling, or holding a specified security, a class of securities, or the securities of a class of issuers, and all commentary is for educational purposes only. The investment examples noted are intended to provide and example of the events and data KEDM flags each week and is not representative of typical returns generated by each event or any future returns.