Quick Update on Offshore…

A low frequency but juicy strategy where the edge is government incompetence.

Let’s dig in…

Let’s quickly turn over to offshore. We’ll have more to say in a future edition, as this has gotten long-winded already, but given the equity performance we’d be remiss to not mention it. Much like Naz is peaking in the final days of December, we think offshore is bottoming. We’ve basically tossed a lot of our favorite names to secure the funds to keep averaging down on offshore. It’s been frustrating and depressing, but it’s often darkest before dawn in terms of finding bottoms. Fortunately, the fundamentals look great, and there’s been a wave of recent contract signings, along with sizable FIDs.

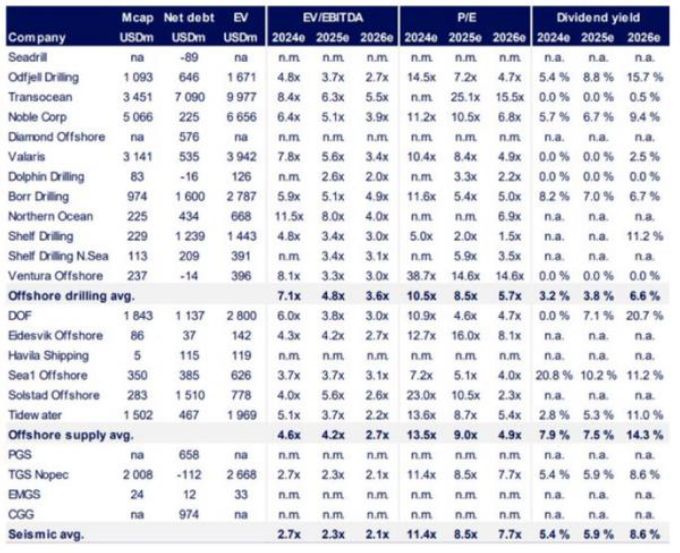

Look at a chart from Pareto. It’s simply too cheap. This is by far our favorite sector. We think oil is actually bottoming (look, we’re actually drawing in shoulder season with a global recession) and Trump is the first leader to want to “run it hot!!” Even China is sorta stimulating (finally).

We think that investors got over their skis in terms of expectations. If we have two solid years of consolidation, instead of new highs in charters, you’re going to see a lot of cash flow and share repurchases. You’ll continue to see older equipment cycle out. It’s all bullish for the next leg up. And yes, when analysts are too high, and need to take their estimates down, the pods sell, then short. That’s why the past 3 months have been miserable. One day, the analysts will have their numbers low enough and the pods will cover and then go long. As we wait, some VERY discounted buybacks are happening, while insiders keep buying to tighten the float. We think it’s going to work out just fine…

Start your 28-day free trial

Kuppy’s Event Driven Monitor (“KEDM”) is not a financial or investment advisor and the information contained in this publication is not intended to constitute legal, accounting, or text advice or individually-tailored investment advice and is not designed to meet your personal financial situation. The investments discussed in this publication may not be suitable for you. You are required to conduct your own due diligence, analyses, draw your own conclusions, and make your own investment decisions. Any areas concerning legal, accounting, or tax advice or individually-tailored investment advice should be referred to your lawyers, accountants, tax advisors, investment advisers, or other professionals registered or otherwise authorized to provide such advice. KEDM makes no recommendations whatsoever regarding buying, selling, or holding a specified security, a class of securities, or the securities of a class of issuers, and all commentary is for educational purposes only. The investment examples noted are intended to provide and example of the events and data KEDM flags each week and is not representative of typical returns generated by each event or any future returns.