In 2023, we introduced the silver tsunami to the KEDM crowd as a long-term trend. We pondered whether the right play was through medical devices or senior living facilities (SLF), or whether to fast forward and go straight to the publicly traded undertakers.

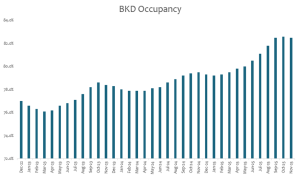

SLFs have done well since then, with WELL up 143%, VTR up 98%, and BKD up 183%. A recent acceleration in occupancy trends at BKD made us want to revisit the theme.

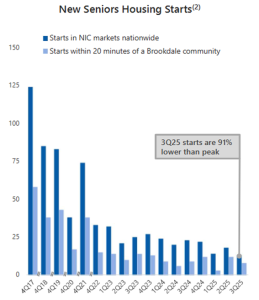

The fact that we are getting a silver tsunami is hardly a surprise. In anticipation of the aging baby boomer, developers poured money into new construction. New supply of SLFs peaked in 2017, which caused a temporary oversupply and a subsequent pullback in construction activity. SLF operators have struggled to operate profitably since.

But it got worse. Three years later, COVID hit, and people became reluctant to book grandpa a room in a crowded place with other geriatric germ carriers. Demand fell. To put the final nail in the coffin, a nursing shortage led to increased temporary staffing, resulting in enormous cost inflation.

In other words, SLFs have faced a triple downturn from which they are only just beginning to recover. With little new construction in the pipeline and 5-year lead times for new facilities, supply isn’t likely to spoil the party once this really gets going.

Source: Brookdale Investor Presentation Q3 2025

Meanwhile, grandpa keeps aging, and the target population (75+) is expected to grow rapidly in the 2nd half of this decade.

Source: Brookdale Investor Presentation Q3 2025

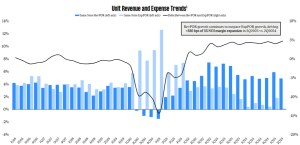

While nurses remain in short supply for many more years, SLF operators finally see a positive spread between Revenue Per Occupied Room and Expense Per Occupied Room.

Source: Welltower Business Update Q2 2025

Across senior living facilities, there are roughly two business models: owning SLFs and operating SLFs.

The REITs (WELL, VTR) own a broad portfolio of communities and sign long-term (10-20 years) triple-net leases with inflation escalators. This provides steady income and lower risk, but no immediate upside when the market tightens unless a contract comes up for renewal.

The operators include BKD and SNDA, although WELL and VTR also operate some of their own facilities. Operators either own their properties or lease them from the REITs. They rent the units to tenants on a monthly basis. Turnover is high, as their tenant base sadly passes away, especially in winter. The operators have been hit the hardest as occupancy levels disappointed, costs exploded, and rental rates were too high to turn a profit.

With many of the small, non-public operators in distress, the most profitable model has been to issue equity and buy distressed units in the $100-200k per unit range. This compares to replacement cost in the $200-300k range. Of course, this worked best for the REITs that trade at an implied valuation of well over $400k per unit, as was the case for WELL and VTR. The beauty of reflexivity.

So, over the last few years, the operators struggled with inflation, COVID-related demand shortages, and oversupply. Meanwhile, the REITs had access to capital and have been on a roll, buying up distressed peers.

But with supply tightening, occupancies creeping up, and some unprofitable leases being exited, maybe the way to play this theme is shifting in favor of the operator. And if you can enter those operators at a price below replacement value with improving supply / demand fundamentals, just before the FCF is about to take off, the sleepy operators can get exciting quite quickly.

BKD has been a recurring name in the KEDM monitors. We tend to like names that tick multiple boxes across various ED monitors. BKD has:

- A long-term tailwind in the original write-up on aging baby boomers

- A recent CEO change

- An activist shareholder, Ortelius, who fought (and lost) a proxy battle, but has been instrumental in a board and C-suite refresh

- A newly announced asset disposal program

- Occupancy data shows that the above is leading to real change

In short, BKD is a company with plenty of ED and a strong tailwind that should keep it up for the long haul.

For the last 3 years, BKD has been operating near break-even, suffering from unprofitable lease contracts and a heavy debt load. Most of those leases have now been terminated, and the last batch of 55 unprofitable communities will be returned to Ventas in late 2025. More importantly, there has been a change of the guard, and the new management team seems to be making real strides in driving occupancy.

It has long been unclear whether BKD’s industry lagging occupancy rates were a function of asset quality or management approach. New management has finally decided to prioritize occupancy, which, in the case of underperforming units (<70% occupancy), requires some cost cuts. While this comes at the expense of margins, it’s probably easier to raise prices in the future if a community isn’t 30% vacant. Occupancy rates since July are early indicators of an inflection going on at BKD. BKD tends to go up on strong vacancy data, then sell off on earnings when they disappoint on how much this actually adds to earnings. But 2026 could be the first time that earnings will actually look reasonable.

Source: BKD monthly occupancy data

Finally, BKD has decided it might not be the right operator for some of the communities that are still operating at a loss. 28 communities have been earmarked as sales candidates. It is hard to speculate on any proceeds, but shedding communities that are operating at negative EBITDA but still carry non-recourse debt will always be accretive and help BKD pay down its excessive debt load.

With Net Debt/EBITDA> 9x, BKD screens poorly and is certainly not without risk. In very rough numbers, you pay an EV of $200k / owned unit for BKD, of which $120k is debt and $80k is equity. Getting to a replacement value in the $250k range gets you a high double-digit return, which would assign no value to the operating business.

Will BKD finally be able to right the ship and start generating real cash? At some point, the valuation will shift towards an FCF multiple rather than an asset-based multiple. That’s how WELL and VTR end up with valuations of >$ 400k/unit.

The other operator we mentioned is Sonida. Sonida is a PE-backed operator who has been aggressively rolling up SLFs. Their lower liquidity made this more difficult to play, but in November, they announced the acquisition of CNL Healthcare Properties. Once this deal closes, the larger size might make this an investable play for institutional investors. The valuation on a per-unit basis is similar to BKD. You get a lower average rent per unit (location-based), partially offset by higher occupancies.

With no new material supply hitting the market until at least 2030, we have a couple of years to see how this industry unfolds. The shares have run since our first mention in 2023, but we believe the trend still has many years to go.