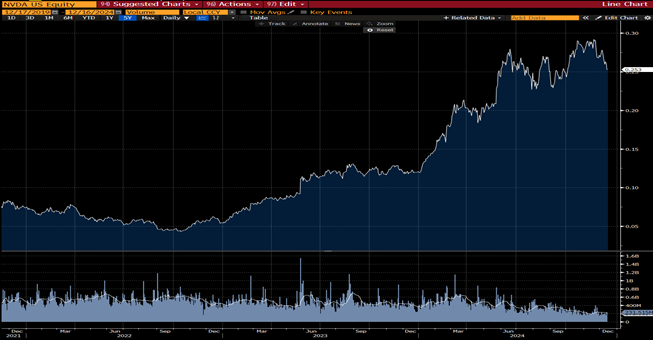

The commentary will be quite light this week (i.e. non-existent) as our entire team is nursing hangovers from our annual holiday party last night. Needless to say, our thinking hasn’t changed much since our piece last week. If anything we kept hearing even more bells ringing the top this week, as Mike Saylor and Palantir got added to the Naz (seriously can anyone explain wtf PLTR does???). Meanwhile Thomas Peterffy was making the media rounds, warning the world that Mag7 was 70% of their trading volumes and margin loans are mooning; he seemed quite worried about the plumbing if we see a 50% pullback in the meme assets. Staring at the relative strength of the General (i.e. NVDA) as QQQs make highs, it seems like the new year is going to get rocky…

NVDA/QQQ

As we mentioned last week, we retreated over summer and are becoming outright bearish on the broad US markets. We still love our idiosyncratic themes (EMs, and even offshore, which we will dive into next week with an update), but all we see is a chop fest ahead, at best, and a lengthy risk-off period, at worst. Meanwhile, vol is cheap across the board and we prefer not to go insurance shopping when the house is already on fire…

The Bell is Ringing…

A low frequency but juicy strategy where the edge is government incompetence.

Let’s dig in…

The commentary will be quite light this week (i.e. non-existent) as our entire team is nursing hangovers from our annual holiday party last night. Needless to say, our thinking hasn’t changed much since our piece last week. If anything we kept hearing even more bells ringing the top this week, as Mike Saylor and Palantir got added to the Naz (seriously can anyone explain wtf PLTR does???). Meanwhile Thomas Peterffy was making the media rounds, warning the world that Mag7 was 70% of their trading volumes and margin loans are mooning; he seemed quite worried about the plumbing if we see a 50% pullback in the meme assets. Staring at the relative strength of the General (i.e. NVDA) as QQQs make highs, it seems like the new year is going to get rocky…

NVDA/QQQ

As we mentioned last week, we retreated over summer and are becoming outright bearish on the broad US markets. We still love our idiosyncratic themes (EMs, and even offshore, which we will dive into next week with an update), but all we see is a chop fest ahead, at best, and a lengthy risk-off period, at worst. Meanwhile, vol is cheap across the board and we prefer not to go insurance shopping when the house is already on fire…

Start your 28-day free trial

Kuppy’s Event Driven Monitor (“KEDM”) is not a financial or investment advisor and the information contained in this publication is not intended to constitute legal, accounting, or text advice or individually-tailored investment advice and is not designed to meet your personal financial situation. The investments discussed in this publication may not be suitable for you. You are required to conduct your own due diligence, analyses, draw your own conclusions, and make your own investment decisions. Any areas concerning legal, accounting, or tax advice or individually-tailored investment advice should be referred to your lawyers, accountants, tax advisors, investment advisers, or other professionals registered or otherwise authorized to provide such advice. KEDM makes no recommendations whatsoever regarding buying, selling, or holding a specified security, a class of securities, or the securities of a class of issuers, and all commentary is for educational purposes only. The investment examples noted are intended to provide and example of the events and data KEDM flags each week and is not representative of typical returns generated by each event or any future returns.