,It feels like every week in KEDM we are mentioning a new crypto treasury stock – this week, its American Bitcoin, last week was Trump & Co. trying to corner CRO. In many ways, these stocks capture some of the market’s greatest hits over the past few years: they pop up at the speed of SPACs, the capture the buzz of crypto, and they ride the meme wave to crazy prices. In other ways, they feel kinda… old? You’ve likely heard the analogy but today’s crypto treasury stocks seem to echo the infamous Investment Trusts of the 1920s.

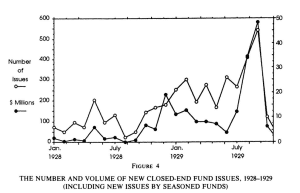

These Trusts became the hottest product during the roaring 20s, growing from a small handful at the beginning of the decade to around 300 in 1927. By 1929, new Trusts were hitting the market at a rate of nearly one per day. During that year, Trusts accounted for 30% of all new issues.

The idea behind Investment Trusts is pretty simple: they sold shares to investors and used that money to buy securities. Often, these Trusts traded at a big premium to NAV, so selling new shares is accretive to existing shareholders. Sell new shares at a premium, buy more securities causing those securities to rise, causing the Trust to rise and so on. Let the perpetual motion machine ride on. Sound familiar???

Then these Trusts took on leverage to fund their securities purchases. In the 1920s, it was common for stocks to have high dividend yields and, on average, dividend yields were often higher than bond yields. So Trusts could take on some leverage, buy some dividend stocks to cover the interest payment, and juice its returns.

For most of the decade, these trusts were hitting on every trend in a rising market. The demand for stocks kept growing, and Trusts provided the easiest way for most people to get exposure. They’ll pay a premium, but that’s fine since it’s the easiest way to own stocks and it’ll just continue to grow into the future. Debt was cheap and while leverage might be high, these Trusts could cover their interest with the dividend payments they receive, and they can grow their NAV to manage the leverage levels.

So what changed? Well, the rapid issuance of new Trusts towards the end of the decade outgrew investor demand and created cracks in these trends. New Trusts faced stiff competition for capital and had to come up with more creative ways to attract investors, with many turning to preferred equities and other derivatives. As these Trusts layered on more leverage, their obligations grew faster than the dividends from the stocks they held and Trusts were forced to pay these cash outflows with continued equity issuances. Death spiral was engaged and this proved to be the death knell for the industry.

Leverage and share price premium were the stilts holding up the Investment Trust industry, and the market crash in October 1929 only accelerated the inevitable downfall. Leverage and aggressive cash obligations drove constant equity issuance and harmed stock price premiums, and Trusts became forced sellers into a declining market.

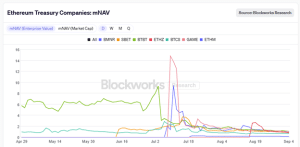

Look, we aren’t calling for a 1929 crash in equity, we are simply saying that this existential focus on the multiple of NAV (the new term for share price premium) reminds us of crypto treasury companies, like the movement’s poster child Strategy, MSTR… MSTR even makes it easy for you to track its mNAV via its own website!

Honestly, the financial alchemy of MSTR and the other crypto treasury companies is impressive! Saylor is a master financial engineer and even better at painting a narrative. Selling billions of dollars of stock for a multiple of its stated worth is always impressive, and these companies are on one of the greatest sustained streaks of alchemy we’ve ever seen. Calling the exact moment this streak ends is a fools errand, but we’re starting to wonder if some of the tailwinds powering this trend are FINALLY shifting to headwinds?

Last week, MSTR raised just $47m in its new preferred stock offering and had to hit their common stock ATM to raise an additional $425m. The problem is, MSTR previously guided that it would not issue common shares when mNAV was under 2.5x, and had to walk that back when they issued common stock at ~1.5x mNAV.

A crypto treasury’s mNAV is valuable if it can raise money, and raising money is valuable if it trades at a high mNAV. A hiccup in this recursive process can be an early warning sign of a higher cost of capital or ultimately, funding troubles. And mNAVs are trending down (see SBET’s new 1.5B buyback as its mNAV dips below .9x)…

The steady rise in cost of capital can already be seen in MSTR’s security offerings. In 2024 and early 2025, MSTR went all in on convertible debt issuance at great prices. They raised $8.2bn at a ~0.4% weighted coupon, including its last two issues in November 2024 and February 2025 raising a combined $5bn at a 0% coupon. This year, MSTR has relied on issuing perpetual preferred stock. Its first round, with the exchange ticker STRK, came with an 8% dividend rate. Its next two, STRF and STRD, had a 10% dividend. Its latest preferred offering, STRC, has a variable dividend that starts at 10% but with a potential increase if STRC trades below $99 and decrease if STRC is above $101.

This higher cost of funding points to another potential headwind. While their leverage is still pretty low compared to their BTC holdings, the cost of servicing this new capital structure has gotten considerably more expensive. As it stands currently, MSTR will have to pay ~$580m of dividends to their preferred shareholders, and pay that in US dollars. MSTR can raise more money to fund these dividends, but that likely comes with additional cash payments. They could defer these dividends, but that will likely crater confidence and send mNAV below 1 – not to mention the mountain of equity they’d need to issue to pay the cumulative dividend down the road. MSTR still has over $16bn available under its common stock ATM, but these sales would be around 1.5x mNAV and cause another backlash in the common equity that drives mNAV lower.

The last headwind for MSTR and the crypto treasury industry as a whole is the success of the industry itself. The share premium enjoyed by these crypto treasuries comes partly from the fact that they’re often the only or easiest way for investors and institutions to gain crypto exposure. For pools of money that can’t or don’t want to hold actual crypto, these stocks offer exposure without some of the difficulty or regulator issues of holding crypto assets. The success of these companies brought in new players, whether that’s American Bitcoin via an IPO or The Ether Machine, Twenty-One Capital and ProCap via SPACs (presumably, since these are still awaiting de-SPAC status). These new competitors bring on more supply of crypto-exposure vehicles to meet the current demand of investors looking for crypto exposure. The current incumbents are no longer the other game in town, and demand that previously contributed to inflated mNAVs will have the chance to invest in other crypto vehicles, ala Trusts in the 1920s.

Timing, like always, remains the trickiest part. MSTR has been able to feed the machine by opportunistically issuing equity and convertible bonds at basically 0%, providing a long runway to build its BTC holdings and mNAV. But MSTR may have finally crossed the Rubicon when it levered up its cash flow statement instead of just its balance sheet. The $580m in dividends from preferred shares means they have traded in their long runway for short term liquidity. They are now on the clock to fund these payments with equity raises every quarter instead of only raising capital when advantageous. At the same time, they’re going to be forced to raise capital in a market with increasing competition for the same pool of capital, resulting in a rising cost of capital. These circumstances were deadly for Investment Trusts 100 years back and may be Saylor’s kryptonite.

If MSTR’s days are numbered, what’s next?? What happens if the capital markets close for MSTR, forcing them to sell BTC to cover obligations? These inventions are some of the most reflexive things we have seen in a loooong time. MSTR/SBET/et.at. no longer using shareholder funds to buy more BTC/ETH and grow NAV – it would be selling BTC and shrinking NAV to pay out other shareholders driving the underlying down, forcing them to sell more…around and around we go… If the face of the crypto treasury industry reverses course, the rest of the industry won’t be able to escape the fallout. These guys hold 3.7m BTC, around 18% of all BTCs ever mined, so BTC will feel the effect of forced selling. Over $500bn of assets are now at risk, between the $400bn of BTC and +$100bn of crypto treasury company equity. Remember, on the way down, the borders aren’t drawn on whether an asset is crypto; the borders are determined by if the asset trades with risk and excess liquidity. The market’s favorite trading sardines, the momo trades, the 0dte bros… are all in Camp Crypto. It’s all one correlated trade with reflexivity quickly flipping from a multiplier to a divider…buyer beware…