The Year of the Snake…

A low frequency but juicy strategy where the edge is government incompetence.

Let’s dig in…

We are going to keep the commentary light this week as you have plenty of reading to do with the Happy Hour transcripts. However, last week we noted our increasing interest in the China theme when we wrote:

“After stopping out on a lot of our China exposure in Q4, we’re back at it. We think that China is actually doing fiscal now. They’re going to increase deficits. Monetary policy is stimulative, but fiscal is the real bazooka. Remember, Xi is telling his boys “I don’t wanna do too much and create a bubble, but it’s been 3 months and nothing is happening, so do some more.” We tend to think that economics works with unpredictable lags. Eventually, it will turn out that Xi did too much. We’re long and the charts look like a soft pullback into the David Tepper breakout range. Meanwhile, Western sentiment on China is as bearish as we can remember, but Trump has kept his mouth shut. Is a ‘deal’ brewing??”

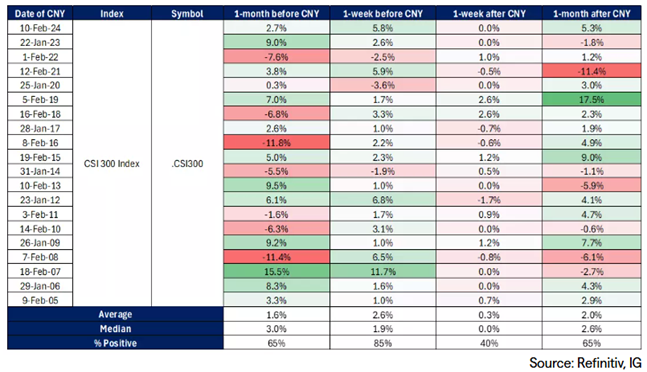

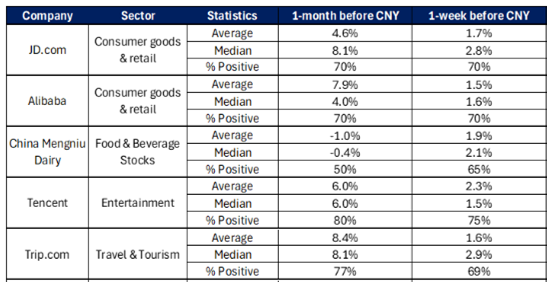

After writing that, a few of you sent across the data for the Chinese New Year’s trade, so we thought it worthy of passing along here. TLDR, Xi and Co. don’t want the Lunar New Year to go off on a down tick. Meanwhile every Zhang San (Chinese version of Joe Schmo) in China feels flush and lucky headed into the New Year (Jan 29). Consumption picks up, travel picks up, and overall optimism picks up. While antithesis to efficient markets, the period just before the Chinese new year tends to see the market rise, with a 85% hit ratio. We aren’t quant traders but a worthwhile data point nonetheless…

On top of that, this week we saw Trump and Xi’s bff call and the announcement that the Chinese VP is headed to the inauguration next week. The stars seem to be aligning. Is something brewing for the year of the snake??

Just remember, China is for trading, not owning…

Start your 28-day free trial

Kuppy’s Event Driven Monitor (“KEDM”) is not a financial or investment advisor and the information contained in this publication is not intended to constitute legal, accounting, or text advice or individually-tailored investment advice and is not designed to meet your personal financial situation. The investments discussed in this publication may not be suitable for you. You are required to conduct your own due diligence, analyses, draw your own conclusions, and make your own investment decisions. Any areas concerning legal, accounting, or tax advice or individually-tailored investment advice should be referred to your lawyers, accountants, tax advisors, investment advisers, or other professionals registered or otherwise authorized to provide such advice. KEDM makes no recommendations whatsoever regarding buying, selling, or holding a specified security, a class of securities, or the securities of a class of issuers, and all commentary is for educational purposes only. The investment examples noted are intended to provide and example of the events and data KEDM flags each week and is not representative of typical returns generated by each event or any future returns.