RRP + TGA

OK, let’s get into it. Sometimes someone says something that jars our memory and reminds us to check some charts. Our buddy Paulo Macro has done just that and as a result, we’re going to shamelessly steal from his recent piece. Please subscribe to see his other writings. We’re of the view that the global…

It’s All A Sideshow…

Just signed on, did anything happen this weekend???? Remember how the market was hyper focused on tarriffs 2 months ago as correlations hit 1. Did we solve that one yet? Asking for a friend. Now, fintwitters are all experts on Fordow and the Stait of Hormuz. Tarrifs are a sideshow. Funny how that works. But…

We Are Rather Dour…

We told ourselves that we’d come back from vacation when something happens. What’s going on in the Middle-East certainly qualifies as a “something happening.” We’ll leave it to Twitter experts to speculate on what exactly will happen. We watch the same videos that you do, with the proviso that “the first casualty of war is…

You are all going to panic…

Currently writing from Croatia and on my final leg before returning to PR late next week. Looking forward to getting back to the island, but hyper focused on not getting sucked back into the markets. Having been gone for a few weeks and clearing my head, the end result is that nothing has changed my…

Dead Cat Bounce

Once you see a chart, you sometimes struggle to un-see it… This is the Naz during the 2000 tech bubble. Now let’s look at the GFC. Note a pattern? A smash, then consolidate, then leak lower until the real selling starts. It’s almost a chart crime to then pull up 1929, but we can’t help…

An Important Gloom and Doom PSA….

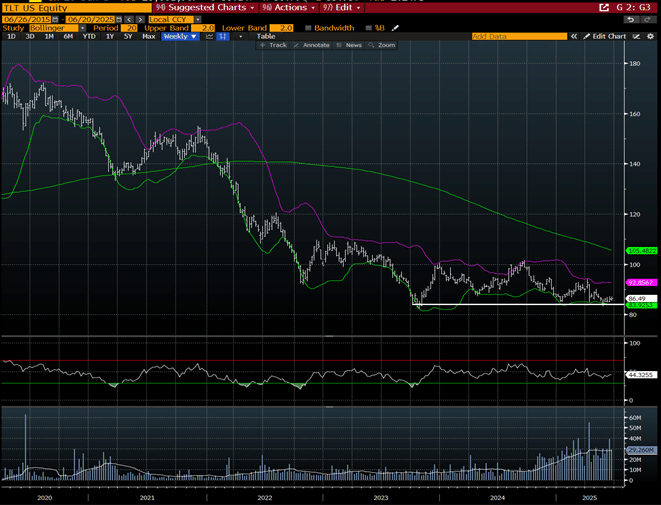

It’s said that there’s no such thing as a quadruple bottom in finance. That’s terrifying as TLT (yeah, we know only retail track it…) looks to be teasing a 4th bottom. We’re increasingly of the view that TLT fails. When that happens, we really don’t know WTF happens. Just think about all the things that…

Tina died in 2025…

Speaking of tops, on January 12, we posted an eerie chart of CSCO against the last remaining generals left in the markets using SMH as the proxy (we urge you to re-read here). Let’s revisit: “In summary, we’re bears. Now raging Kodiak Bears… We were just starting out in this business when we realized that…

Trump 2.0

Turning to the markets, the secret to successful investing is the art of having strong views, loosely held. For the better part of our careers, we’ve been bearish bonds. “Project Zimbabwe” and all that jazz. However, we’re open to other views… Over the past month, we have been astounded by the progress made by Trump,…

Mean-reversion is imminent…

Last week, we showed the 1 chart to rule them all. It was the chart of Q4/Q1 of 2021/2022 overlayed with the current market tracking almost perfectly. Since then, this year has tracked reasonably well (shocking…). If the comparison holds, then the selling starts this week when everyone gets back from vacation. Though, we’re willing…

October 6, 2024, Vol. 195

The admin of this site has disabled this download item page.