We Are Rather Dour…

We told ourselves that we’d come back from vacation when something happens. What’s going on in the Middle-East certainly qualifies as a “something happening.” We’ll leave it to Twitter experts to speculate on what exactly will happen. We watch the same videos that you do, with the proviso that “the first casualty of war is…

What Year Are We In????

Last week abroad before heading back to PR to get back into the saddle. Honestly, I check in each day and this market is making less and less sense. Seriously, between the DJT/Elon pissing match, the grift in SPACs, CRCL IPO, SBET secondary, and Trump & Co issuing a branded crypto wallet, what year are…

Enjoying My Raki…

As mentioned last week, we shut off our screens and are writing to you from Crete. Not much to report on as bonds remain our focus. TLT continues to drip below 85 while global yields are breaking out. This is still one of the worst risk/reward setups we have seen for quite some time. It’s…

Nothing to do….

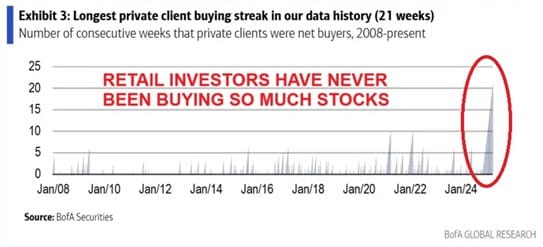

As we have warned a few times in past KEDM’s commentary is going to be light going forward as our bearish leanings are not going to change on a daily/weekly basis. We noted a couple weeks ago that the focus/headlines on tarrifs continue to mask the “real” solvency story that is coming to a head. …

Dead Cat Bounce

Once you see a chart, you sometimes struggle to un-see it… This is the Naz during the 2000 tech bubble. Now let’s look at the GFC. Note a pattern? A smash, then consolidate, then leak lower until the real selling starts. It’s almost a chart crime to then pull up 1929, but we can’t help…

A Bearish PSA, Part Duex

By now most KEDM readers get how bearish we are. We are not going to regurgitate it; we’ve beat that horse to its bloody death. But as we’ve talked to 50+ hediges over the past week, the common response is “sure I am bearish, but we are 1 tweet away from a tariff deal and…

Correlations to 1

Short week, so it’ll be a short, data-only KEDM this week. Besides, nothing is going to change our view over the coming weeks. Sure, a TON of volatility but our thinking remains the same. This tariff story is an undercard to upcoming big govt credit/PE/private credit/refi/endowment unwind. We are headed into a trader and ED…

An Important Gloom and Doom PSA….

It’s said that there’s no such thing as a quadruple bottom in finance. That’s terrifying as TLT (yeah, we know only retail track it…) looks to be teasing a 4th bottom. We’re increasingly of the view that TLT fails. When that happens, we really don’t know WTF happens. Just think about all the things that…

Mean-reversion is imminent…

Last week, we showed the 1 chart to rule them all. It was the chart of Q4/Q1 of 2021/2022 overlayed with the current market tracking almost perfectly. Since then, this year has tracked reasonably well (shocking…). If the comparison holds, then the selling starts this week when everyone gets back from vacation. Though, we’re willing…

Failing Rallies…

As you know, we’ve turned bearish. We’re not raging bears, because of “Project Zimbabwe” and all of that stuff. In fact, we think equity markets are dramatically higher, looking out a few years. That said, we think there’s a stumble first, and while everyone is getting excited about 25 or maybe even 50bps of Fed…