Theme Update: Aerospace Alloy

A low frequency but juicy strategy where the edge is government incompetence.

Let’s dig in…

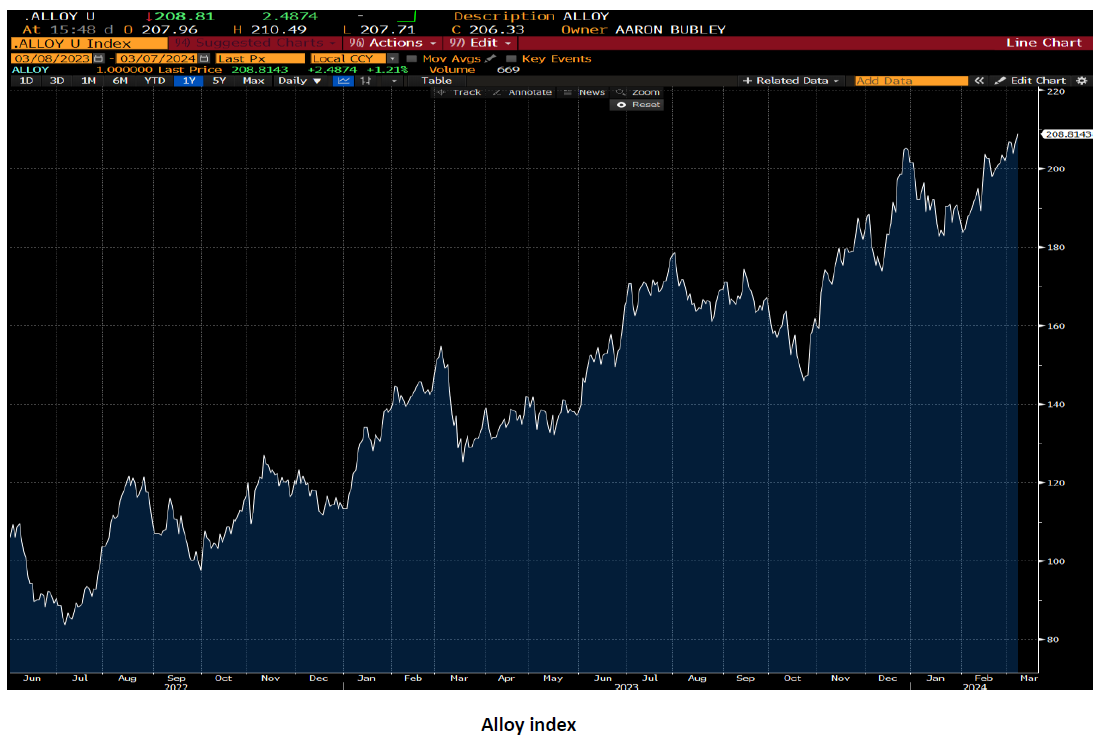

Jumping into some themes, last June we introduced the aerospace alloy theme as a play on the surging demand for new planes, thinking at the time that this bull could turn into a super-cycle given the supply issues on such robust demand. Well, our alloy index has been on a tear (see chart below) so we figured it was about time for an update and asked our analyst to give us the lay of the land in 2024…

Let’s jump in…

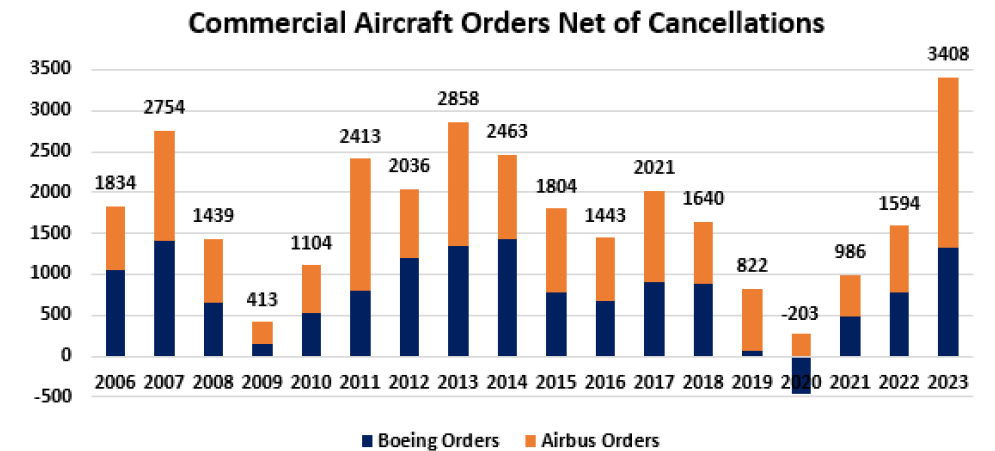

2023: A Year of Record Orders

Boeing and Airbus saw a surge in ordering in 2023, with Airbus leading the charge as Boeing continues to deal with challenges on the Max aircraft. The biennial Paris Air Show, which typically features the largest deals in Aviation, was very robust in 2023 and boasted the largest commercial aircraft deal ever with India’s IndiGo ordering 500 A320’s from Airbus during the show. This record-breaking year was fueled by a global travel upswing, airlines’ strategic focus on fleet modernization for enhanced fuel efficiency, and optimistic forecasts for medium to long-term growth in air travel. Both Boeing’s and Airbus’ backlogs are sitting at record levels, but both companies are struggling to ramp their productions as supply chain, labor, and quality control problems persist.

2024: Off to a Mixed Start

Aircraft orders started off the year pretty soft, as evidenced by Boeing’s challenging January, during which it recorded net zero aircraft orders, a setback attributed to the Alaska Airlines door-plug blowout scandal. Airbus fared somewhat better by securing 31 orders in January. As of this KEDM, February order data has not been published by Boeing or Airbus.

Orders did receive significant boost from American Airlines’ announcement of a massive deal for 260 aircraft, encompassing orders from Airbus, Boeing, and Embraer, with the airline also holding options to purchase an additional 193 aircraft. This order by American further demonstrates airline’s long-term growth outlook despite some of the issues around the Boeing’s Max. Theres speculation that an even larger order from United should be announced in the coming weeks.

Boeing Under Pressure

Boeing is currently in negotiations to reacquire Spirit Aerosystems, its fuselage supplier for the 737 after the supplier was previously spun off in what now looks like a case of financial engineering gone bad. This move comes amid the Company’s constant battles with regulators, with the FAA imposing a production cap on Boeing’s 737 Max at 31 aircraft per month. Despite these hurdles, Boeing has still communicated it wants to increase production to 50 of the 737 aircraft per month by 2025 or 2026.

Additionally, in a bid to overhaul its corporate ethos, Boeing is altering the formula that determines bonuses non-union employees, more heavily weighting safety metrics over financial metrics (ahem DEI metrics). However, the company’s commitment to safety has been recently criticized by the NTSB, which condemned Boeing for its “absurd” lack of cooperation in the investigation of the Alaska Airlines blowout incident, highlighting ongoing challenges in Boeing’s efforts to rebuild trust and ensure safety. The constant drip coming out of Boeing is a bit disconcerting for investors in the space but there are only 2 companies that make these aircraft and the recent deal by American Airlines highlights how dependent airlines around the world are on Boeing.

Aerospace Alloy Theme Remains in Play

Demand for specialty alloys used in aerospace and defense applications remains strong. We’re hearing through our channel-checks that lead times on certain aerospace bar products exceed 95 weeks from some of the mills. The pubcos are continuing to guide for massive earnings growth as they continue to push significant price increases and volume increases. Even in the current demand environment, it remains cost prohibitive to build a new mill so supply in the U.S. will remain relatively fixed and any new capacity brought online will be done via brownfield expansion or optimizing existing facilities.

Bottomline, its all systems “go” and the theme continues to play out. Regardless of BA’s issues, the world is forced to gobble up Boeing and Airbus planes while the supply side is still pretty well capped for a lot of the alloy and components. The imbalance should continue to put a tailwind behind these stocks (no pun intended…)

Start your 28-day free trial

Kuppy’s Event Driven Monitor (“KEDM”) is not a financial or investment advisor and the information contained in this publication is not intended to constitute legal, accounting, or text advice or individually-tailored investment advice and is not designed to meet your personal financial situation. The investments discussed in this publication may not be suitable for you. You are required to conduct your own due diligence, analyses, draw your own conclusions, and make your own investment decisions. Any areas concerning legal, accounting, or tax advice or individually-tailored investment advice should be referred to your lawyers, accountants, tax advisors, investment advisers, or other professionals registered or otherwise authorized to provide such advice. KEDM makes no recommendations whatsoever regarding buying, selling, or holding a specified security, a class of securities, or the securities of a class of issuers, and all commentary is for educational purposes only. The investment examples noted are intended to provide and example of the events and data KEDM flags each week and is not representative of typical returns generated by each event or any future returns.