Toll Roads

A low frequency but juicy strategy where the edge is government incompetence.

Let’s dig in…

Turning to the markets, this week we decided to invite our very good friend Roderick van Zuylen, aka RooJoo, to these KEDM pages to discuss a new theme. You may recognize the name as Roojoo is quite active in the Discord (@roojoo) and on Fintwit (@roojoo3). And similar to our KEDM style, he thinks in “themes” and “inflections.” He is currently the CIO over at Night Watch, a global value-focused fund built on deep, stock-specific research that he founded in 2023 after relocating to the US. Prior to that, he served as a portfolio manager at a multi-billion dollar value and dividend fund in the Netherlands. Roojoo has been a Day1 subscriber to KEDM and a lot of his idea gen and core themes have been found in KEDM.

I’ve known him for years and every time we speak, I learn something new, or get another great idea. When we chatted the theme below, it just “clicked” and I thought it would be valuable to share. I also asked him to join us for a KEDM Happy Hour in mid-August to discuss his current themes and how he uses KEDM. Should be a fun one, so stay tuned for the link…

Take it away Roderick…

__________________________________________________________________________________________

With the OBBBA passed, Trump’s attention has again shifted to picking simultaneous fights with as many countries as possible. Volatility will ebb and flow, but as long as Trump has a Truth Social account, we believe vol is in a structural bull market for at least this presidential cycle.

If you own the infrastructure to trade financial products (i.e., exchanges), or if you are a service provider that enables the trade (brokers), you probably stand to benefit. So, let’s look at what opportunities this provides.

You can broadly split this market into the enablers of trade in equities, futures and bonds.

In equities, stock brokers such as HOOD, IBKR, SCHW, FTK GY have clearly done well, and new entrants keep entering the market (see ETOR in the recent IPO list). Most brokers are disproportionately weighed towards trading the Mag7, so for us these are a pass at the moment.

Stock exchanges that trade cash equities such as NDAQ or ENX have historically been low growth. There are smaller stock markets, such as Brazil, Poland or Israel, which all have their own stock exchanges which could be interesting depending on your view on the underlying market. Did anyone notice EPOL and EWZ are on a tear? In June, The Warsaw stock exchange reported YoY growth in ADV of +90%…

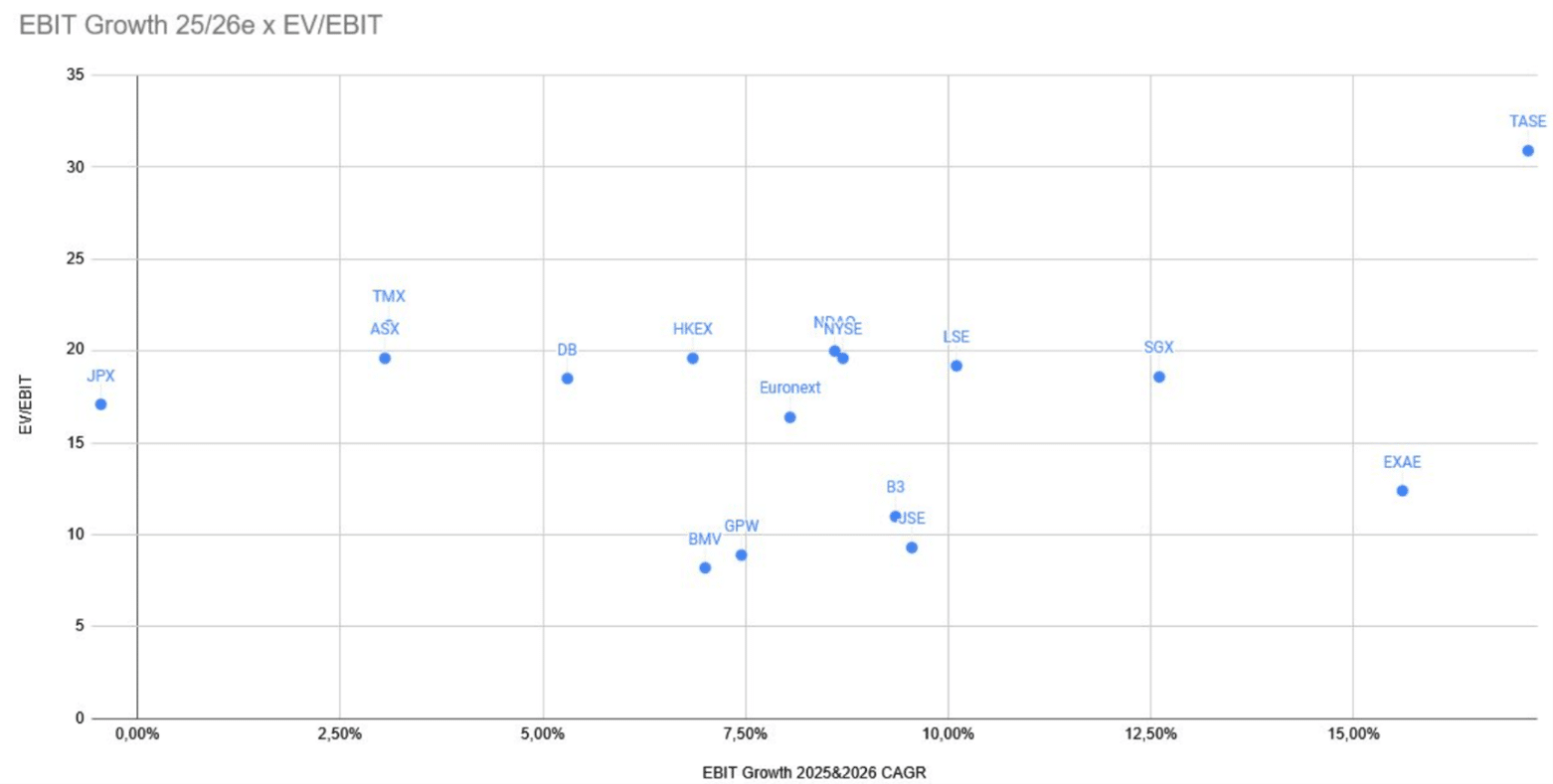

Source: Koyfin compiled consensus data

Our interest is in the futures market and OTC market for commodities, rates and FX. We want to benefit when a souring USD increases the demand for FX hedging. When a bunker bomb on Iran sends oil soaring, we want to sleep well knowing that we’ll be making money on the spike in ADV for Brent futures. Or if Trump threatens a 50% tariff on copper, and copper on the CME trades at a premium to the LME. We want to be long the broker or the exchange that enables hedgies to trade this arbitrage. Finally, we’re not 100% convinced we’ll see 6% on the US10YR any time soon, but if we do, the trading volume in interest rate swaps will probably pick up dramatically.

Futures Commission Merchants

A Futures Commission Merchant (FCM) like Marex (MRX) or StoneX (SNEX) acts as a critical intermediary in the global derivatives markets, facilitating the execution and clearing of futures, options, and other listed or over-the-counter (OTC) products for clients ranging from hedge funds and commodity producers to corporations and individual traders. FCMs handle customer margin, provide access to exchanges (such as CME or ICE), and offer risk management tools and market insights. They may also offer value-added services like prime brokerage, structured hedging solutions, and physical commodity logistics.

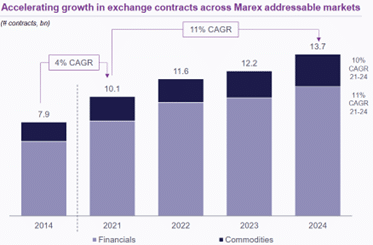

ADV of futures has been growing at an 11% CAGR since 2020. This is largely driven by the hedge funds trading more futures, while historically futures were mostly traded by industrial players.

Source: MRX Investor Presentation April 2025

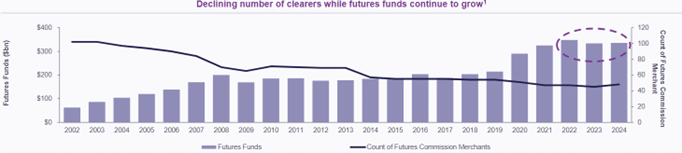

Meanwhile, the number of registered FCMs has been cut in half over the last 2 decades. Banks have exited either because they could not keep up with the required tech investments, or because stringent Basel III Capital requirements made this business unattractive. Meanwhile, smaller independents have exited due to soaring compliance costs.

Source: MRX Investor Presentation April 2025

This hasn’t just improved the supply-demand balance in the market, it also creates a very attractive roll-up opportunity for the larger non-bank FCMs. Acquisition multiples have often been in the mid-single digit range when accounting for the day 1 synergies: lower clearing costs at the exchanges. For both MRX and SNEX, M&A has been a significant driver of earnings growth. At their April investor day, MRX stated they target <3-year paybacks and >20% year 1 ROEs on all acquisitions. If they can find enough deals like that, M&A should allow them to continue to compound book value at high rates.

Because the FCM guarantees the trade towards the clearinghouse, credit risk is significant and the clients will have to post margin with the FCM as a guarantee. If volatility goes up, the FCM can call on the customer intraday to increase their posted margin. Interest income on those margin balances is split with the customer, and this has become a considerably contributor to revenues. Given that FCMs earn a spread, a slight decline in short term rates is only marginally negative. But if Powell’s successor brings rates back to 0, the cut in NII will likely be much larger.

The risks are clear: lower volatility and lower interest rates would hurt revenue. A lapse of judgement on the credit risk management could blow up the business overnight. Remember the nickel squeeze of 2022? Nickel prices tripled overnight while Tsingshan was caught short. The LME paused trading and later cancelled all trades, because otherwise FCMs and potentially clearing houses would have blown up. That’s the tail risk you take.

This left tail risk likely probably means both companies will always trade at a depressed multiple. Based on consensus figures, MRX trades at 10.7x 2025 P/E vs 15.7x P/E at SNEX. You can speculate as to why this valuation gap exists, but it probably has to do with the final tranches of MRX that the original PE owners Amphitryon and Ocean Ring Jersey still own. They have sold down since the IPO in 2 different private placements. They gave up their BoD seats in May and likely still have 1 or 2 tranches to sell before the overhang is completely removed.

Inter-dealer brokers (BGC / TP ICAP)

Inter-dealer brokers such as BGC and TP ICAP act as intermediaries facilitating trades between dealers, typically large banks or market makers like Citi and JPMorgan. Those banks might use BGC or TCAP to preserve their anonymity. This leads to some differences versus an FCM. First of all, most trades are OTC. Trades are often made by phone and are less tech enabled. FX and rates are a much larger % of total business. During ZIRP there was less need to hedge rates, and therefore growth has been less impressive. Finally, BGC has been quite aggressive in hiring the brokers away from their competitors, despite mandatory periods of garden leave making this very inefficient. Consequently, past performance of the inter-dealer brokers trails that of the FCMs.

TCAP will probably show up in KEDM this autumn due to their plans to IPO their data business (called ‘Parameta’) on the US market. Will this unlock the value of their higher quality data business, or will the market worry that a data business is not truly independent if TCAP is the only supplier of data and will retain an 80% ownership? If you ask TCAP, they’ll tell you they are in conversations with Marex, who is willing to monetize their data through Parameta following its separation from TCAP.

BGC was previously managed by Lutnick, who has recently sold his stake following his appointment to the Trump administration. They’ve been investing more heavily in their hybrid and electronic platform called Fenics. Be mindful when looking at just the consensus multiple: BGC has diluted shareholders by an average of 4% per year through excessive SBC for which you still need to account.

One notable thing to keep in mind: Q2 earnings season will be all about FX. Sell-side models have not been properly adjusted to reflect a 10%+ decline in the USD. Brokerage is traditionally a business with a strong UK footprint and USD revenues could outweigh USD costs.

Exchanges (ICE / CME)

This one is included for the compounder bros out there. Exchanges generally have monopolies on certain contracts such as Brent (ICE) or WTI (CME). Earnings are more predictable which leads to higher valuations in the mid-20s P/E:

Source: Koyfin compiled consensus data

With the first post quarter trading updates in the rearview mirrors, this promises to be a tough earnings season. We’ve seen various companies do -10% on in-line earnings. Any company that mentions FX headwinds, or tariff related business uncertainty can expect far worse. There are few places to hide, but being long vol might be one of them.

Start your 28-day free trial

Kuppy’s Event Driven Monitor (“KEDM”) is not a financial or investment advisor and the information contained in this publication is not intended to constitute legal, accounting, or text advice or individually-tailored investment advice and is not designed to meet your personal financial situation. The investments discussed in this publication may not be suitable for you. You are required to conduct your own due diligence, analyses, draw your own conclusions, and make your own investment decisions. Any areas concerning legal, accounting, or tax advice or individually-tailored investment advice should be referred to your lawyers, accountants, tax advisors, investment advisers, or other professionals registered or otherwise authorized to provide such advice. KEDM makes no recommendations whatsoever regarding buying, selling, or holding a specified security, a class of securities, or the securities of a class of issuers, and all commentary is for educational purposes only. The investment examples noted are intended to provide and example of the events and data KEDM flags each week and is not representative of typical returns generated by each event or any future returns.