As we roll into December, we are in a quiet period when it comes to event-driven investing. The losing stocks of 2025 keep setting new lows as tax-loss selling sets in, with some of those names entering deep-value territory. Even the bargain hunters have learned not to step in front of a bulldozer, and to hold off on buying tax-loss harvesting candidates until around Christmas.

One of the recurring points of feedback we have received in our recent survey is that some of the less obvious monitors require an explanation on how to use them. While some of our readers might have been trading event-driven strategies since they first read Greenblatt’s “You can be a stock market genius” at age 12, some others might need a little refresher on why exactly we track certain events.

We plan to roll out some of those tutorials over the next couple of months. In fact, we were surprised to find that some tutorials were already present on the KEDM website. To get this initiative started, let’s point you to our tutorials on trading CEO Changes and IPO Unlocks.

Given the large number of upcoming investor events, we want to dive deeper into this monitor. For anyone who does not need a tutorial on this monitor, feel free to skip to the Kliff Notes. We promise there will be actionable themes in the next couple of weeks. Or if you missed our write-up on Macau Casinos, Payments, or HK Real Estate, go back into the archive to get your copy.

Investor Days

December is a month when many investor days are organized. We have been diligently tracking those investor days in our Investor Day Monitor, and we believe such events can be a rich source of alpha, though they always require additional research.

From attending many of those events, we have learned over the years that there are roughly two reasons why a company organizes an investor day. On the one hand, you have companies that host such an event annually and invite their analysts to 1 or more days of presentations, followed by a factory tour and a fancy dinner. The fact that those events are organized annually makes them less exciting: no company has something completely new to share each year.

Multi-day events in fancy tourist destinations where they will serve you ample amounts of foie gras are not uncommon. Attending such an event makes it difficult for a sell-side analyst to assign anything other than a ‘strong buy’ rating to the stock, but at the same time, it tells the company’s shareholders how they spend their dollars. These are not the companies we are after

On the other hand, some companies organize an investor event only when they have something exciting to share. They might not have hosted such an event in 5 years, or, in some cases, it’s their first-ever investor event.

No company goes through the trouble of inviting 50+ shareholders to an in-person event to present bad news. Those events take months of planning. When they organize such an event, they have a message to tell. And when they do, we’d better listen. We love companies that seem stagnant for years, with their stock going nowhere. And then suddenly, change is happening, and they feel the need to tell us about it.

Case Studies

Let’s look at some investor days that worked well.

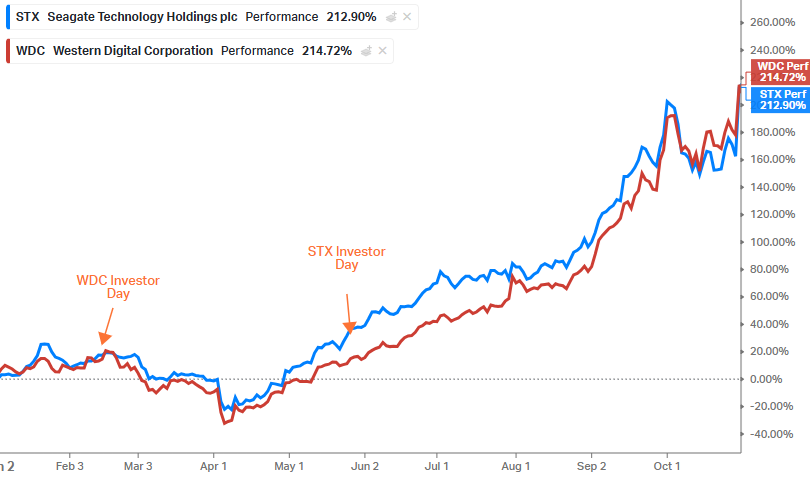

Western Digital Corp (WDC) hosted an investor day in February 2025, while its competitor, Seagate (STX), hosted one in May. The companies operate in a near-monopoly (Toshiba is a distant 3rd player) in Hard Disk Drives (HDD). Let’s focus on WDC, because the ED angle is more obvious.

In the same month, the company held its investor event and spun off SanDisk, a NAND Flash maker, from its core HDD business. Their message to the capital markets was that they were now a pure-play HDD company that was significantly less capital-intensive, and that they would sell the remaining SanDisk shares to deleverage and soon begin buybacks.

In other words, execution risk was low: the transformation had already happened. In addition, both STX and WDC explained that the industry had consolidated, that AI was driving demand for HDD storage, and that neither was planning to add new supply. There was a macro tailwind. Both companies continued to perform strongly, and in hindsight, the investor day was indicative of an inflection.

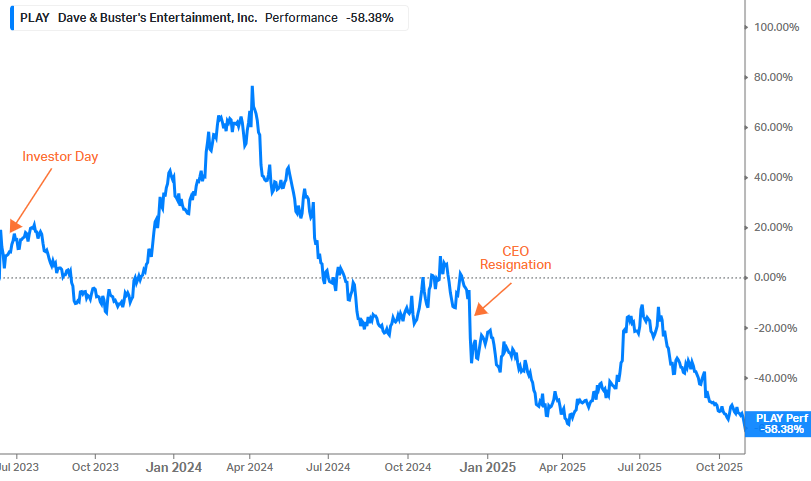

Now, let’s look at the investor days that didn’t work. In June 2023, Dave & Buster’s (PLAY) felt like it needed to present the market with their turnaround strategy.

Earlier, in 2022, PLAY acquired Main Event, and Main Event CEO Chris Morris took over as CEO of the combined company. At the investor day, he laid out a detailed plan to grow by becoming more efficient with advertising, accelerating store rollouts despite current high leverage, remodeling existing stores, introducing dynamic pricing, and introducing a new F&B menu, all while cutting costs. The Excel jockeys loved the details and bid up the share price.

Two years later, the chairman stepped in as CEO while Chris Morris got canned. They had overloaded their employees with too many changes without proper training, and they had underinvested in new games. The turnaround was a disaster.

So why did it fail? We think there are two reasons. First, macro trumps strategy. A weak consumer climate made an already struggling retail format very difficult to turn around. Second, the company presented what they were about to do, with no progress booked. Execution risk was high.

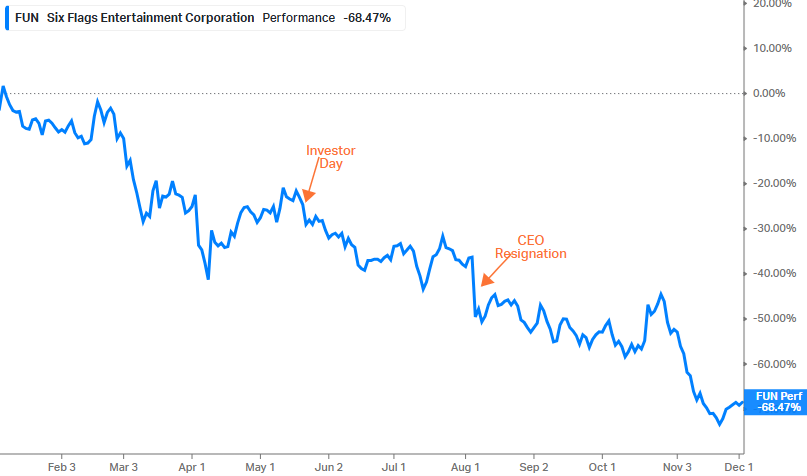

In April of 2025, Six Flags (FUN) repeated the PLAY book. After acquiring Cedar Fairs and a change in CEO, they presented the market with a plan to reinvest in F&B, turn visits around, and use that to save the company from an overleveraged balance sheet. Only 2 months later, FUN blamed the weather for falling short of those targets. Season pass sales disappointed, and they had to cut their capex budget, which was needed to reinvest in the parks. Debt metrics ballooned, and the CEO could look for another job.

Our lesson learned:

We are looking for companies that are making tangible progress on change that is already underway. We don’t want execution risk.

Macro trumps strategy. Which is why we also have an inflection monitor to identify industries with macro tailwinds.

This brings us to today and the investor days that we will be following in detail. At the top of our list are Brookdale (BKD) and Allfunds (ALLFG NA), both of which announced they will hold an investor day in early 2026.

BKD is an operator of senior living facilities. We are bullish on this theme as we have detailed in KEDM Vol. 150 (wide note: we have an update on Senior Living Facilities on the shelves waiting for you). Macro trumps strategy, and for BKD, there is a macro tailwind.

Second of all, BKD has had a recent CEO change, and occupancy has increased since this summer. In other words, we can see the first signs of a turnaround, and the investor day will be a moment where they make the market aware of those changes. They won’t just be making promises about the future; the progress is already tangible. And did we already say how many baby boomers will turn 80 next year?

Then there is ALLFG, a European fund distribution platform. They enable European asset allocators to choose from a broad array of funds to buy for their wealth management clients, and they are paid a couple of basis points by the fund manager. With inflows into Europe picking up earlier this year, and both bond and equity indices making new highs, Assets under Administration are growing rapidly (macro tailwind).

They recently split with their founder-CEO, who placed too much emphasis on cross-selling software to fund managers. Under new leadership, we expect the emphasis to shift to distributing private equity funds. This is an initiative they’ve been working on for multiple years, with >100% growth in recent quarters (no promises about the future, just focusing the market on what’s already happening). As discussed last week, Deutsche Boerse made a non-binding offer for ALLFG, and there is a chance the investor day will never happen.

Data

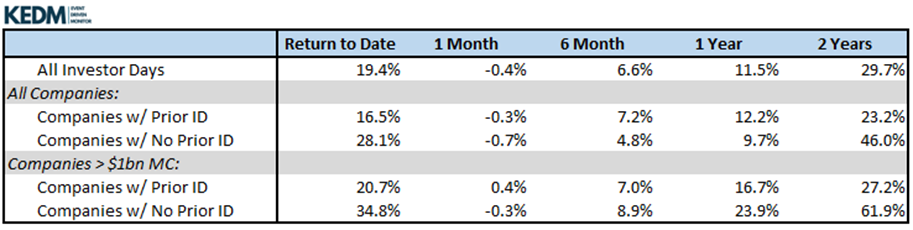

KEDM has tracked 7,213 investor days since 2018. Of course, we’d like to see our theories backed up by hard data. For our analysis, we focused on thte last 3 years. Since December 2022, we have tracked 1,021 investor events. We looked at absolute returns following investor days and split them between companies that held their first event and those that regularly organize investor days. The data is spurious. We think the data is affected by a number of small-cap shitcos who use investor days to pump their stock.

If we exclude small caps with a market cap of <$1b from our sample, there is a considerable performance difference between companies with a first-ever investor day and the regular presenters.

Are we data mining? Perhaps. This is our first attempt to apply statistical methods to our very large data set, and we hope to draw more useful conclusions over time.

Sources: KEDM investor day database

In summary, investor days can be a very important sign that change is happening at a company. We want to own companies that are in the process of transforming. We want to own companies where earnings are inflecting. It always requires extra work to verify whether a company’s new strategy is viable, but no company organizes an investor day to share bad news.