Short Reports

While short sellers have been around since Jesse Livermore shorted the railroads in the early 1900s, short positions were only discussed publicly more recently. Some notable shorts this century include Chanos’ calling out Enron as a Fraud, or David Einhorn testifying before Congress against Allied Capital.

The practice of publishing in-depth research on a short position began around the time Muddy Waters published its short thesis on Sino Forest in 2011.

To come up with their short thesis, Carson Block would rent a house in China for a month, where they bunched up with a couple of analysts and private investigators. Only when the smell of beer and chips in their man cave became unbearable did they publish a 39-page research report that concluded that Sino Forest did not, in fact, own any forest.

All Sino Forest shareholders would have to admit that they had never actually verified the existence of forests in Northern China and that they were merely in the trade as a macro call on real assets and on China’s growth. Whoever read through the 39 pages the quickest before hitting the sell button had the highest recovery on their position. 2 months later, trading in Sino Forest was halted, and less than a year later, the company filed for bankruptcy. Everyone who still owned shares by that time vowed to take Muddy Waters more seriously in the future.

Over the next few years, many similar reports hit the market. PMs soon realized they had no interest in reading 50 pages on accounting shenanigans and started selling at the mere sight of another Muddy Waters report.

Because nobody likes a sudden drop in their share price, some companies started fighting back. Short sellers could expect to get sued for market manipulation. The French grocery chain Casino Guichard allegedly sent private investigators after Carson Block after a short report claimed it was using accounting tricks to hide its excessive leverage.

Some companies had great connections in local politics, which they used in their defense. The fraud at German payment provider Wirecard had been front-page news in the FT since 2015, but the German regulator BaFin decided to open an investigation into the FT, as well as the short seller Zatarra, rather than into Wirecard itself. Wirecard collapsed in 2020 after it turned out the short thesis was in fact accurate.

Between the costs of doing in-depth research and the legal costs when they got sued, the life of an activist short seller wasn’t easy.

Short sellers soon figured out that the best return on their time and capital was to be long only in the first hours after publication. Short reports were more frequently published early in the trading day, preferably on an illiquid day, to maximize impact. Open interest on the stock’s options would have ticked up in the days prior to publication, and most of the short position would be closed before anyone had time to fully digest the content of their short report.

To make it all a little more sketchy, short sellers would ‘provide balance sheet’ to each other, which effectively means that they let their buddies front-run the publication of their report, as long as they get the favor returned at some point in the future.

To be fair, there are still reports out there unveiling good, investigative work. But for every Hindenburg report that uncovers that Nikola rolled a truck downhill while claiming they had a working hydrogen-powered prototype, we had various less thorough hit pieces aimed at making a quick buck.

The Short Report Monitor

So why are we tracking all short reports in KEDM? First of all, because they tend to significantly impact share prices, regardless of whether the price move turns out to be correct. They also tend to provide new insights into a company. This creates opportunity.

In 2025, 2 names discussed in our KEDM thematics got hit by a short report. The Brazilian stockbroker XP was written up by Grizzly Research, who alleged that XP’s profits are largely derived from 2 internal funds, accounted for as Variable Interest Entities, with improbable Ponzi-like returns. XP’s defense is that, while its market-making business is structured as a fund for tax reasons, it is really an operating business, which explains the steady returns. So far, XP seems to be correct, and the day of the publication of the short thesis ended up being the bottom in XP’s share price. The short report presented a buying opportunity for those who could quickly verify the short seller’s claims.

Source: Koyfin

A few months later, the Futures Commission Merchant called Marex was the target of a report by Ningi Research, which made similar claims. The main allegation was that Marex’s profits were derived from the trading in derivatives with their own, unconsolidated entities in Luxembourg. Shares traded down roughly 10% on the report. A few weeks later, Marex gave a qualitative rebuttal during their earnings call, explaining that those entities are, in fact, consolidated, making it impossible to book fake mark-to-market profits, and they are in the process of shutting down both Luxembourg entities, given that they’re not actively used. Management followed up with large inside purchases to show support: everyone in senior management chipped in around $1m.

Source: Koyfin

In contrast, we just named several short reports (Sino Forest, Wirecard, Casino) in which the companies ended up in bankruptcy, and the short reports proved very accurate.

A company’s response to a short report is often as telling as the short report itself.

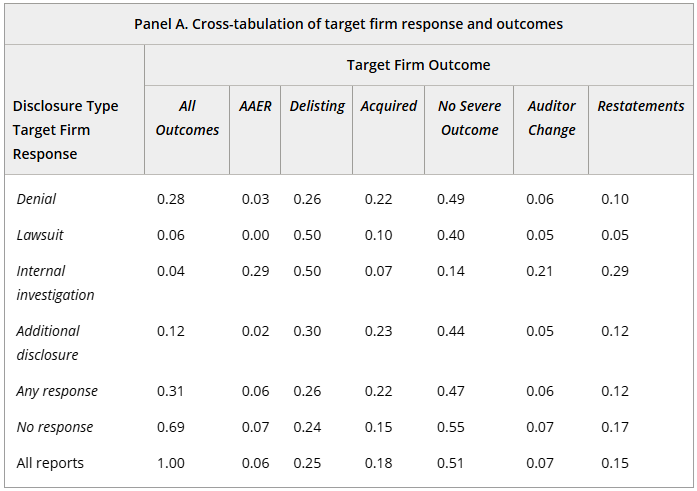

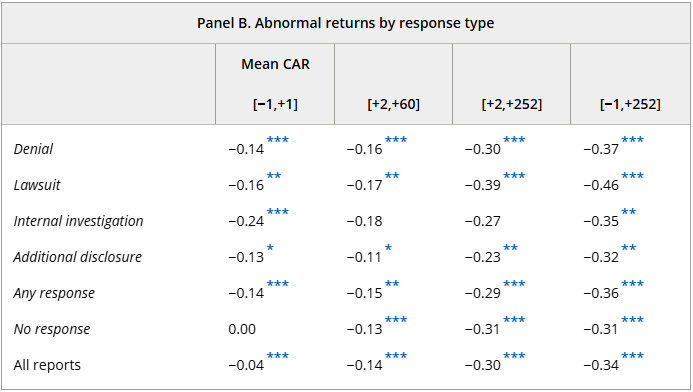

A 2021 study by Brendel & Ryans examined 351 short seller reports from 25 short sellers from 1996 to 2018. In their study, 31% of the targets responded to the allegations. 28% of targeted companies would deny the allegations, and 12% would provide additional disclosure. Those firms did relatively well, with 49% and 44% showing no severe outcomes, respectively.

6% of companies threatened with lawsuits, of which only 40% ended up with no severe outcome, but share price returns in the 1-year period following the short report were the worst (-46%). Companies that launched internal investigations had the worst prospects, with only 14% avoiding severe outcomes.

Source: Brendel & Ryans, 2021 (https://onlinelibrary.wiley.com/doi/10.1111/1475-679X.12356)

As with everything in investing, you will always have to put in the research to be able to form your own opinion. If one of your core positions gets targeted by a short seller, you should be able to quickly verify the claims in that report. While short reports used to mean there was something seriously wrong with the company, they now more often turn out to be baseless hit pieces that create buying opportunities. One thing is guaranteed: volatility around the publication of the report. That’s where the opportunity lies.