Trump 2.0

A low frequency but juicy strategy where the edge is government incompetence.

Let’s dig in…

Turning to the markets, the secret to successful investing is the art of having strong views, loosely held. For the better part of our careers, we’ve been bearish bonds. “Project Zimbabwe” and all that jazz. However, we’re open to other views…

Over the past month, we have been astounded by the progress made by Trump, and in particular, DOGE. We sorta expected a repeat of Trump 1.0, where he’d tweet at various cable TV personalities and then go golfing. Trump 2.0 is a whole different animal. He’s empowered his people, and they’re doing stuff.

We all know that there isn’t a business that Trump hasn’t found a way to bankrupt. He likes to borrow money and run big losses. We’re a bit confused at this new-found discipline, but suddenly he’s the Expense-Cutter-In-Chief. Someone (we think Bessent) got into his ear, that they need to focus on the 10-year, and not the stock market. To us, this is a profound change.

We’ve always wondered how Trump would square his circle. He wants lower rates, lower Dollar, lower inflation, higher tariffs and higher equity markets. It almost reminds us of our dating lives…

…yet we expected Trump to choose them all. What if he actually has a plan…?? What if that plan is to cut spending, reduce deficits, have a proper recession, spook the 10-year into a rally, lower 10-year rates, reduce the rate differential, so lower the DXY, let Bessent term the debt out, then run it raging hot in 2026 into mid-terms?? We’ve always said that Trump doesn’t do subtle. Maybe some adult is in his ear on this stuff. Maybe he’s even willing to accept an equity bear market?? Have you seen him tweet once about stocks?? This is dramatic change. It’s unlike Trump.

For that matter, we sort of thought DOGE was a joke. Musk would cut a few crazy programs, then get bored of it. This feels different. He’s engaged with it, and so is the public. DOGE has the highest approval ratings of any government agency in decades. He’s loving the attention. So far, they’ve cut some left-learning money-laundering operations. The overall Dollar amounts are small, but it sets a good precedent. Of course, these are all rounding errors. They have far more work to do, especially as the big targets are Medicare/Medicaid and Military spending. All Americans know that there are hundreds of billions of fraud in these agencies. Musk couldn’t target them first, but they’ll be targeted. Those are where the real savings will be. Maybe not $2 trillion of savings, but could it be half a trillion??

In the economic view that governments spend money into existence, and the fact that everything happens on rates of change (2nd derivative for you nerds out there), we’re talking bigly here. Rates of change on fiscal are about to go negative. Meanwhile, employment disruption is a huge change-agent.

‘New Listings’ + ‘Coming Soon’ in DC (The nation is healing…)

We’ve read various studies, and we’re really not sure who to believe. Just roll with us because we want to be directionally correct here, if numerically incorrect. There are approximately 15 to 25 million government and government adjacent employees. To us, government adjacent means contrators, service providers and NGOs funded with laundered cash. In a proper house-cleaning by a professional CEO, you’d expect the bottom 10-20% of employees to be fired. Given the systemic rot at our government, we’d think that’s a low estimate if DOGE does its job correctly. Would that mean that 2 to 5 million people get fired over the next few months?? Then think about all the down-stream jobs as kids leave private school and illegal housekeepers get sent packing. It’s the sort of thing that would send the 10-year vertical, and maybe that’s the point.

Back to our books, we’re epic, raging, kodiak bears looking out a few years. We think that entitlements are untouchable in today’s environment, and they’ll ultimately crowd out the good work of DOGE. However, we’re open to the idea that we first have one hell of a recession.

Lots of traders hear the word ‘recession’ and seek out shorts. A younger version of ourselves did the same (hell, we did that in December cause we were also learning), but in a DOGE world, we know that you buy OTM 10-year futures calls out a few quarters. We’ve even grabbed some bond futures. Since we always focus on what the retail fukwits do, we’re going to speak about TLT here. We’re going to keep it real simple in terms of visualizing this trade setup. There’s a red line of death, and below it, starts “Project Zimbabwe” while above it, means they DOGE’d enough…

We accept that there are other options here, ones where 10s stay in the 4s and the curve simply steepens. However, we think that at the first whiff of panic (even if inflation is still elevated and rising), bond bros will wave in the bonds. This doesn’t mean we’re changing our whole book (WE’RE NOT!!), but we’re overlaying some cheapie duration calls and some bond futs just in case…

…besides, we think the better trade is short DXY h/t Porter Collins

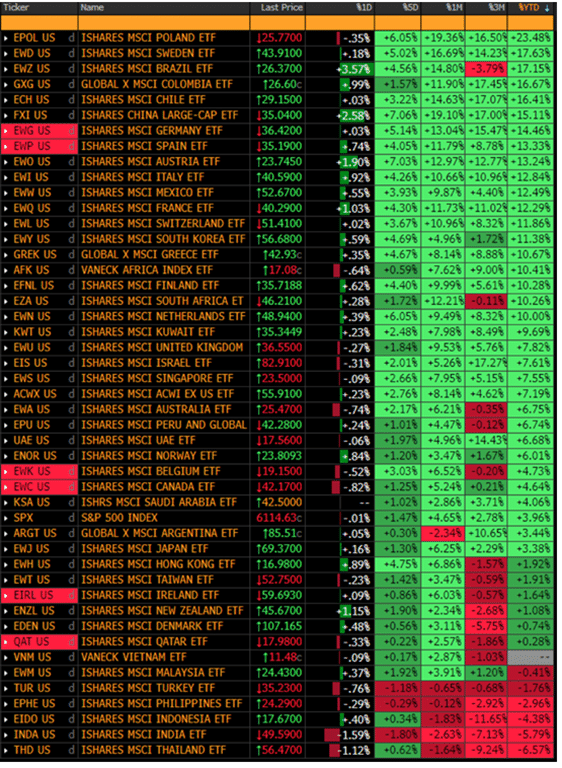

As you can imagine, we’re not short Dollars outright. Instead, we’re long Brazil, we’re long Turkey, we’re long Colombia, we’re long China (who couldn’t do stimmies until they knew that we’d also stimmy, or at least lower rates). It started a bit slow, but overseas markets are suddenly en fuego!! It’s been something of a drought here at KEDM in terms of big actionable calls. Not gonna lie though, we nailed this one!! Check those YTD returns, when compared to the S&P 500 up a lousy 3.96%. We think it’s just starting…

All this pin action has come about with only a 3% decline in the DXY. Markets are forward looking, they’re clearly looking at a much larger decline.

Think of NVDA as a capacitor that is storing the world’s liquid capital. We think it’s about to release, and spew liquidity at every other international market. It appears to be starting…

Back to markets, we’ve been bearish US equities. We still have shorts and put spreads. Now we’re overlaying it with duration. However, our big bets remain international. As capital returns to their home markets, and their currencies stabilize, interest rates will also decline, leading to accelerating economic growth. NVDA literally enslaved 6 billion people in the EM. Now those people will be set free!! They’ll consume!!

We tend to think of the 3-2-1 crack spread as a useful benchmark for short-term changes in consumption as refining capacity is somewhat fixed, but small changes in energy demand can lead to large movements in the crack spread, while oil pricing is far more politically manipulated. Anyway, you can see the global recession of 2024 and the new-found demand in 2025. Are the EMs with 6 billion consumers on the S-Curve, finally waking up?? Was our thesis only postponed three years as the world suffered through Woke, Climate Communism?? Is the world awakening with Trump back in charge??

We tend to think that 2025 will be a great year for the macro crowd. We’re having fun…

Start your 28-day free trial

Kuppy’s Event Driven Monitor (“KEDM”) is not a financial or investment advisor and the information contained in this publication is not intended to constitute legal, accounting, or text advice or individually-tailored investment advice and is not designed to meet your personal financial situation. The investments discussed in this publication may not be suitable for you. You are required to conduct your own due diligence, analyses, draw your own conclusions, and make your own investment decisions. Any areas concerning legal, accounting, or tax advice or individually-tailored investment advice should be referred to your lawyers, accountants, tax advisors, investment advisers, or other professionals registered or otherwise authorized to provide such advice. KEDM makes no recommendations whatsoever regarding buying, selling, or holding a specified security, a class of securities, or the securities of a class of issuers, and all commentary is for educational purposes only. The investment examples noted are intended to provide and example of the events and data KEDM flags each week and is not representative of typical returns generated by each event or any future returns.