Update on Offshore drillers

A low frequency but juicy strategy where the edge is government incompetence.

Let’s dig in…

Jumping into the markets, it was a long week of earnings throughout some of our themes, e.g. Florida migration and Oil Services, both of which seem to be trending in the right direction, albeit slowly.

Offshore drillers in particular had a sleepy 2H23, where contract awards slowed and seemingly every operator had a handful of rigs undergoing upgrades or contract prep. Despite the slower cadence of contract announcements, the ones that were announced in 2H23 tended to be at solid rates and, importantly, for longer terms. While Transocean’s 1Q23 estimate of +$500k leading-edge rates by year-end was not technically true (although Diamond Offshore sorta bailed them out by hitting a 30-day contract at $513k), offshore operators took time this week to level-set investors’ expectations with leading-edge rates solidly in the mid-to-high $400k range.

Most importantly, offshore drillers explained that the change in contracting cadence is due to E&P’s beginning to favor longer-term contracts. E&Ps are starting to look for multi-year contracts covering larger groups of wells that previously would have been broken up into multiple tenders. While many investors seem to have grown tired of offshore after the contracting binge of FY22 and 1H23, these long-term/solid rate contracts seem to offer better economics to the drillers vs the short-term/high rate contracts that leave a bunch of whitespace in the contract book.

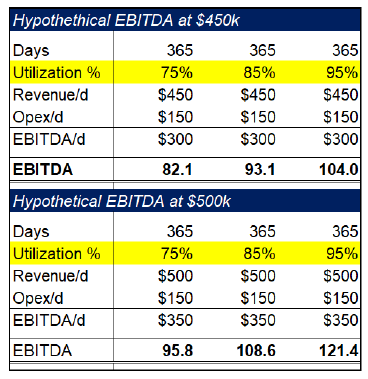

Utilization is such a potent lever for profitability that it can cause a $450k/day long-term contract to be more profitable than a $500k/day short-term contract.

In the example above, the only thing separating a $450k rate from a $500k rate is 10 percentage points of utilization. Now, of course we’d rather long-term contracts at $500k, but the point is that pushing for the mythical $500k rate contract at the expense of term becomes increasingly unprofitable if it costs you ~a month of working days.

Looking out over the rest of the year, we’ll be keeping our eye on how the offshore drillers fill in whatever whitespace remains in FY24 and build out their FY25 books. Brazil has ~7 tenders that are expected to be awarded over the next 18 months, with 5 coming as soon as 2Q24. Transocean expects this to require at least 1 rig from another region and Valaris believes it may pull in as many as 3 rigs. West Africa remains hot, both in new discoveries and new tenders – Transocean sees ~13 tenders in the market over the next 18 months with ~1/2 being over 2 years in term.

Bottomline, the offshore trend is in motion and seems robust; now it seems just a matter of time and execution. And with oil curling up, timespreads on the move, and services & offshore ticking up, we are locked and loaded all things energy…

Small cap oil services

Start your 28-day free trial

Kuppy’s Event Driven Monitor (“KEDM”) is not a financial or investment advisor and the information contained in this publication is not intended to constitute legal, accounting, or text advice or individually-tailored investment advice and is not designed to meet your personal financial situation. The investments discussed in this publication may not be suitable for you. You are required to conduct your own due diligence, analyses, draw your own conclusions, and make your own investment decisions. Any areas concerning legal, accounting, or tax advice or individually-tailored investment advice should be referred to your lawyers, accountants, tax advisors, investment advisers, or other professionals registered or otherwise authorized to provide such advice. KEDM makes no recommendations whatsoever regarding buying, selling, or holding a specified security, a class of securities, or the securities of a class of issuers, and all commentary is for educational purposes only. The investment examples noted are intended to provide and example of the events and data KEDM flags each week and is not representative of typical returns generated by each event or any future returns.