Uranium Earnings Are Flowing In…

A low frequency but juicy strategy where the edge is government incompetence.

Let’s dig in…

We thought we’d check in on a sector that seems to have the wind at its back. Our yellow friend had major earnings this week, i.e. Kazatomprom earnings, and if you are invested, then you also had a “Happy Friday” thanks to our buddies in Kazakhstan. While we are not going to bore you to death with repeating every detail of the Q2/H2 print and the earnings call, we do want to touch upon a couple points.

Let’s briefly look at numbers, previous guidance was 82m lbs for 2025 which they revised down to 65-68.9m lbs. That’s a 15m lbs shortfall, which not only means -17% miss by the largest producer, but also translates into almost 10% chunk of the global supply has vanished on a production base of roughly 150m lbs. To put into context, Saudi Arabia is the largest producer in OPEC at roughly 9.1m boe and that’s around 8.8% world production, so effectively world uranium supply lost 1.15x Saudi Arabia on Friday.

You’ve probably been thru the numbers a dozen times so not going to waste your time here, but we do want to highlight a couple things that no one seems to be talking about. Firstly, we thought this was one of the weirder earnings calls even for Kazatomprom, as the CEO didn’t attend the call (apparently was in a trip with President Tokayev but this wasn’t communicated) and the CFO abruptly left the company.

Secondly, there is a curious corp. restructuring going on. First, they began consolidating some of their JVs in to subsidiaries, while their ownership stake remains the same. This will affect the financial results in what’s reported as “the Group” vs “the holding” but not much else, so we’re wondering why they would bother:

Adding to this corp restructuring, there was a chunky transfer of KAP shares post-quarter from National Bank and Samruk-Kazyna JSC, which is sort of a wealth fund founded by ex-president Nazarbayev, to the Ministry of Finance, another move that we’re not clear why they would bother:

The more interesting part of the day was the earnings call. While the company have been saying that production shortfall is mainly due to sulfuric acid shortages, and that they are working to get a new acid plant online (initially online in 2026, now planned for 2027), it seems some of the new mines, mainly Budenovskoye 6 & 7 and Appak are tougher to mine geologically:

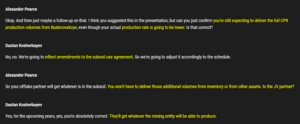

KAP historically aimed to keep 6-10 months of production in inventory, and they’re far below their target at the current level of 10m lbs. Without saying it out loud, they just said they are expecting more production problems and to preserve inventory, they are amending their contracts with the partners in their JVs (Rosatom, Cameco, etc.) so that they get whatever their share of production is, and not the CPR or subsoil use agreement. This likely pisses off the Russians at Rosatom who have been expecting their pounds from Budenovskeye:

Here’s a very brief, TLDR, state of events. World’s largest producer is missing targets by a wide margin. Apart from a couple US producers, almost every other junior is behind schedule and overbudget. Every major is low on inventories, and most of their inventories is likely not even enough to cover their commitments unless meaningful ramp up occurs in the next 24 months. As you probably know, Orano is particularly f*ked with the situation in Niger, and they still owe Cameco 2.4m lbs from the original 5m lbs loan, in additional to 1,148,200 kgU of conversion supply due 2035, and 1,200,000 of concentrate due 2027. Bottomline, the supply side is getting a bit spicy…

We are heading to WNA London in two weeks, and it feels like the Kazatomprom news just made our trip exponentially more interesting…we’ll circle back after WNA…

Start your 28-day free trial

Kuppy’s Event Driven Monitor (“KEDM”) is not a financial or investment advisor and the information contained in this publication is not intended to constitute legal, accounting, or text advice or individually-tailored investment advice and is not designed to meet your personal financial situation. The investments discussed in this publication may not be suitable for you. You are required to conduct your own due diligence, analyses, draw your own conclusions, and make your own investment decisions. Any areas concerning legal, accounting, or tax advice or individually-tailored investment advice should be referred to your lawyers, accountants, tax advisors, investment advisers, or other professionals registered or otherwise authorized to provide such advice. KEDM makes no recommendations whatsoever regarding buying, selling, or holding a specified security, a class of securities, or the securities of a class of issuers, and all commentary is for educational purposes only. The investment examples noted are intended to provide and example of the events and data KEDM flags each week and is not representative of typical returns generated by each event or any future returns.