We had a busy week at the annual Uranium conference – WNA London – tons of meetings with traders, miners, fuel suppliers, technical specialists, rector suppliers, IAEA executives. We met practically every part of the supply chain. Overall, the mood was upbeat as the fundamentals of the thesis are playing out even better than most imagined, combined with confusion around the price and fundamentals divergence, finished off with investor fatigue from bleeding lower the last 7 months…

While we don’t have anything earth shattering to add, we went into the conference two main questions in mind:

- Why has the term contracting and spot volumes been so low YTD?

- Is conversion bottleneck real and is it impairing U308 demand?

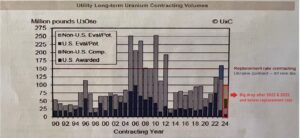

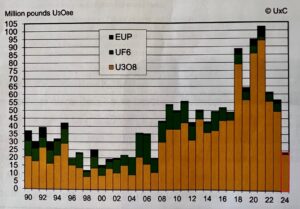

(sorry for the impressive picture quality, snapped it of Sprott’s presentation during our meetings)

After the strong momentum in volumes in 2022 but especially H2 2023, everyone expected a strong year in 2024. While that did not materialize, we have been wondering what the reason for such a drop in volumes was. See above the long term volumes which is almost down 50% from 2023.

Story is the same with the spot volumes, with the caveat that spot is not where utilities procure pounds so it is not a good proxy for utility demand.

How do we explain this? Look, we mentioned after WNA in Almati that lots of utilities were front running demand and picking up cheap Russian EUP repackaged in China. This is also evident in Centrus (LEU) Q2 results SWU import numbers, up 200%.

Another explanation that made sense to us is a simple one, there has been no contracting volume because there is no volume to sell. Cameco is sold out for 5 years. KAP is failing badly in ramping up, and any incremental pounds are always out of Rosatom JVs and going to Russia. Orano is out of pounds. Actually, sh*t you not, heard that they are trying to get their main client, EDF to swap or loan them some pounds (only in uranium does the market get so tight that producers are begging customers for material). We just went over 85% of the primary suppliers. If you look at secondary, at least half of these miners are not signing offtakes right now. We got drunk with enough mining guys and heard “I’m not selling sh*t until 2027” to know that most miners are putting in extra effort not to be the next Cameco, ie: selling pounds at $48 just to miss on production and buy them back at $90.

The final point that came up in our Vodka infused conversations with mining Execs is that 60% of RFP or RFIs that come to their desk is now exclusive and invitation-only, which also means they do not get disclosed. Our unnamed executive was confident that the utility interest is out there, but no one wants to be the looser that scared the market and overpaid, so instead of telegraphing their demand to the market, they discreetly sit with a supplier trying to make a deal.

That said, we’ve heard of a number of large RFPs that are supposedly coming to market, some of which have already come to market and been ignored. Is contracting slowing because utilities are not liking the price? Or are RFPs simply being ignored as there’s none to sell?? We think it may just be the latter—though there appears to be a time-lag between when this becomes obvious, and utilities do something about it…

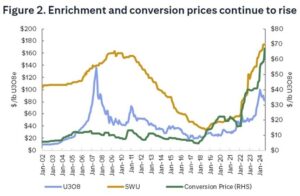

Moving on to conversion bottleneck, which was a main conversation topic in London. Look, all we know is the conversion price has skyrocketed, and all the suppliers seem to be out of capacity, which is the case with Cameco and Orano and no one wants to (publicly) deal with the Russian’s at Uranium One (Rosatom).

For us, we cue off term pricing, and that keeps creeping higher. We suspect that eventually, term will drag spot with it…