Where are we with Uranium hitting triple digits?

A low frequency but juicy strategy where the edge is government incompetence.

Let’s dig in…

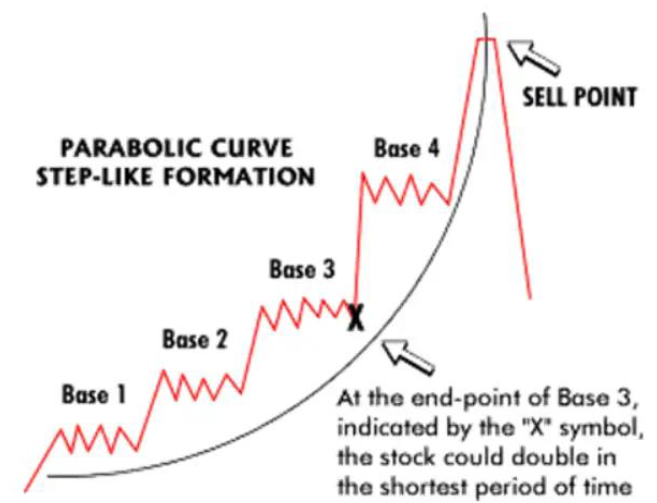

Shifting topics a bit, with Uranium hitting triple digits, we would of course, be remiss if we didn’t mention it (yet again). Let’s talk about parabolas…

Which base are we in?? The one where utilities finally say “fukit!! git sum!!” and machine gun the offer…

Look, there are a number of public RFPs out there where not a single producer has even responded. There’s hardly any lbs in the next few years from CCJ or KAP that aren’t spoken for. If you need lbs, you need to do venture capital and back a junior and hope the damn thing produces. The spot market has been cleansed of lbs and now the producers are missing their targets too. Imagine how scary that must be for a utility when your inventory is drawing down and no one will even pick up the phone. There’s an old saying, “If you’re going to panic, make sure you panic first.” We think that someday soon, a utility will sweep the book for a few million lbs, then every other utility is going to be forced to follow…

Let’s explain what we think really happened with Kazatomprom, as they’ve basically been lying to you. If the issue was a few barrels of acid, they could just fly them in from a place with plenty of acid. The issue is that they’ve been forced to over-inject acid into their older assets in order to keep production from collapsing. However, there’s a parabola here as well. In order to keep production going, you need more and more and more acid. At some point, you need more acid than exists on this earth. We’re at that point. The are blaming some supply chain issues, when they should be blaming the fact that they over-produced the assets. They’re fully depleted. Terminal decline. Done.

How big is the miss? We’re hearing it’s 10m+ lbs in 2024, but could be 20m or more in 2025. This is a function of not seeding assets with acid in 2023, along with free-falling production from legacy assets. It’s baaaaaad.

It’s worse because they pre-sold those lbs and we’ve heard they’re in the spot market, desperately buying physical. Which is the logical thing to do, but that pushes up the price and makes the loss cost even more. At least KAP is being proactive, as opposed to most utilities who are still oblivious…

Then there’s CCJ. We are hearing that there are production issues at Cigar Lake (still) and that Q1 will miss. We have to assume that they’re also in the spot market to cover their production shortfall??

For that matter, how insane is it that the world’s two largest producers (half of global production) are buying in the spot market? This isn’t how commodity production is supposed to work (lol). Imagine if OPEC got into an “Offer Wanted” situation for oil?? Yet OPEC is only a third of global production. This is worse…

Anyway, we think that moving past $100 per pound puts us firmly into the parabola?? How crazy will it get??

We think it becomes an insanity bubble, especially now that SPUT is once again ATMing.

The trick with insanity bubbles, is not selling too soon—or too late…

Anyway, if you’re been reading KEDM for any length of time, you know that uranium is our favorite idea since we launched this publication. After two years, it sure feels good to get some price validation.

Start your 28-day free trial

Kuppy’s Event Driven Monitor (“KEDM”) is not a financial or investment advisor and the information contained in this publication is not intended to constitute legal, accounting, or text advice or individually-tailored investment advice and is not designed to meet your personal financial situation. The investments discussed in this publication may not be suitable for you. You are required to conduct your own due diligence, analyses, draw your own conclusions, and make your own investment decisions. Any areas concerning legal, accounting, or tax advice or individually-tailored investment advice should be referred to your lawyers, accountants, tax advisors, investment advisers, or other professionals registered or otherwise authorized to provide such advice. KEDM makes no recommendations whatsoever regarding buying, selling, or holding a specified security, a class of securities, or the securities of a class of issuers, and all commentary is for educational purposes only. The investment examples noted are intended to provide and example of the events and data KEDM flags each week and is not representative of typical returns generated by each event or any future returns.