Year-End Review

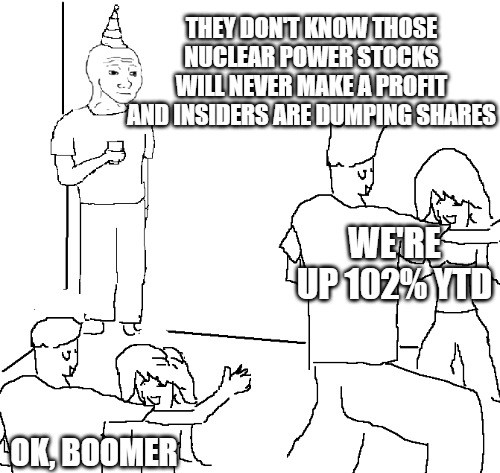

Last year’s New Year’s party proved that every relative was levered long Bitcoin and TSLA going into 2024. As the end of 2025 is coming near, we’re afraid that those same family members will claim to have been leveraged long unprofitable science projects and silver stocks in 2025, and that anything less than a triple-digit return means you’ve underperformed.

Retail traders have been on a rampage. 0DTE options, 3x ETFs, and old-fashioned margin loans stretched to the limit. Eventually, it will catch up with them, but do not expect anyone to admit it over holiday cocktails.

The BoA institutional investor survey last week showed that cash holdings of institutional investors are at an all-time low, near 3.3%. Many years of underperforming the Mag7 have taught the industry that stocks only go up, that every dip can be bought, and that cash positions make it hard to outperform. Regardless of the direction of the US economy, the amount of leverage in the system creates a giant air pocket under the market in case we do eventually get a correction.

Reflecting on our own year, it’s been a good year for the home team, and hopefully for our KEDM subscribers. We’ve covered a long list of new themes in 2025 (none of which were recommendations, so no victory laps if it worked and no walk of shame if it didn’t).

Some themes show early signs of working: Hong Kong real estate is rerating as rental prices stabilize, and Hibor is hitting new lows. Macau Casinos have seen growth re-accelerate since last summer. Refiners are benefitting from elevated crack spreads, as Russia finds out how drone-resistant its refining capacity really is.

The US Critical Mineral Security Act, together with higher gold and silver prices, is indicating a renaissance in US mining activity. And finally, US Automotive is slowly receiving recognition as a tariff winner, even though Ford saw its largest aluminium supplier burn down, impacting their production. Uggh, car manufacturing remains a terrible business…

Some themes hit early roadblocks, and we have since changed our thinking: iGaming is clearly noticing the competitive impact of prediction markets. DKNG and FLUT might launch their own prediction markets to compete, but that won’t stop hold rates from coming down. We are not sticking around to find out how this will end.

And then of course, there were some losers. We exited most of our offshore exposure early in 2025 as a temporary lull in industry activity proved to be more permanent. And even though lower utilization did indeed result in lower day rates in 2025 and oil actually traded down to below $60, offshore names defied gravity and actually moved up since our exit. Offshore is one industry where we feel we’ve overstayed our welcome, despite successfully flagging the sector when VAL and NE emerged from bankruptcy in 2021.

In addition, several older themes hit an inflection point. Most notably, the aerospace supply chain caught a bid as Boeing and Airbus finally got their act together and managed to ramp production, all without any of their planes losing parts mid-flight.

We discussed Elder Care in 2023, and next year will mark the first baby boomers’ 80th birthdays. Our preferred way to play this: the senior living facilities (WELL, VTR, BKD, SNDA) did very well in 2025, and we believe this sector is due for its own deep dive, which we’ve got planned for next year.

Rather than discuss every theme in detail here, we have included the transcript of our year-end Happy Hour with Kuppy (CIO Praetorian Capital) and Roderick (CIO Night Watch Investment Management) from last Friday. The full clip will be available on our website soon.

Regardless of how well we all did in our portfolios, we almost certainly did better than Main Street, which enjoyed a short 6-day winning streak in April before realizing again how much they’ve lost in spending power over the last few years. Whether it’s the sale of houses, sports boats, sneakers, or furniture, the US consumer seems tapped out, and every year, when we think it can’t get any worse, consumer spending continues to surprise to the downside.

Fortunately, the Ministry of Truth has declared an end to inflation. Drug prices are down by 1500%. Egg prices are down, beef prices can be hedonically adjusted using CPI, and there has been no bad private-sector employment data since the head of the BLS got fired. The US has clearly moved into a new paradigm, and we recently re-read the book 1984 to better prepare us for what is about to come. As every candidate for Federal Reserve President seems eager to show by how much they can cut interest rates, US Monetary policy will almost certainly switch more dovishly in 2026. Will Trump finally get to ‘run it hot’ in 2026?

All jokes aside, between lower gasoline prices and a falling Owner-Equivalent-Rent component in CPI, the index has several strong forces likely to push it lower in 2026. Tax refunds in February and March will also be higher than usual, which the low-end consumer has historically diverted toward discretionary purchases or debt repayment. We’ll be attending the consumer conference ICR in January to find out which companies have weathered the consumer recession best and when it’s time to go long this sector. Valuations are very attractive, but it still feels early.

Consumer stocks in 2026

Finally, we will be giving our team some time off over the holidays, so there will be no KEDM next week (December 28th). 2025 has been a transformative year for KEDM, and we hope you continue to notice the various improvements. Those changes were made possible by a team of 6 dedicated KEDM employees who often work throughout the weekend, making sure that, between Friday’s close and Sunday’s publication, we capture all relevant Event-Driven data for you.

We promise our subscribers 48 publications per year, and this is our 50th publication of 2025.

We will be back on January 4th. We’re expecting that week to be very light on the ED side, so we have a thematic deep dive ready to share with you.

Summary – Year End Review, Happy Hour with Kuppy and Roderick

2025 Recap

- Harris “Kuppy” Kupperman (CIO Praetorian Capital) finished 2025 with strong double-digit returns in a market dominated by momentum, leverage, and headline-driven moves. His macro and sector calls worked across gold, mining services, refiners, and aerospace, even if conservative sizing limited absolute upside.

- Markets rewarded acceleration and trend over valuation, and Kuppy navigated that tension with discipline. Early exits were opportunity cost, not mistakes.Roderick van Zuylen (CIO Night Watch Investment Management) also performed well by leaning heavier in volatility-driven and activity-linked businesses, demonstrating that positioning and sizing matter as much as direction.

Gold, Mining Services, and Sprott

- Gold dramatically outperformed, though Kuppy exited physical positions too early. He maintained exposure through mining services like Major Drilling (MDI), which benefited from surging junior miner equity raises, a 6–9 month leading indicator for drilling activity.

- Sprott (SII) remains Kuppy’s top high-conviction long: cash-flow positive, levered to precious metals and uranium, and positioned to capture retail FOMO.

- Despite high multiples, this is the cleanest and most structurally sound way to play ongoing global debasement.

Brazil and Emerging Markets

- Brazil underperformed politically, but fundamentals are compelling: low inflation, high real rates, and depressed equity valuations.

- B3 (BOLSY), the Brazilian stock exchange, is now actively trading and offers asymmetric upside if domestic capital rotates from fixed income into equities.

- Turkey remains structurally unattractive, reinforcing that EM exposure requires selectivity. This is a patience trade where optionality and convexity matter more than short-term returns.

Energy and Commodities

- Offshore drilling continues to produce minimal incremental cash flow. Valaris (VAL) and peers lock in modern rigs at barely break-even rates, making the sector unattractive.

- US refiners, including Marathon (MPC) and Valero (VLO), benefit from structural advantages due to high Nelson Complexity and a heavier global crude slate. Seasonal crack spread volatility masks long-term value.

- Marex (MRX) provides a volatility-driven, high-margin commodity brokerage that profits from market activity rather than price direction, making it a counter-cyclical cash-flow compounder.

Aerospace, Japan, Europe, Dubai, and Defensives

- Aerospace suppliers like ATI saw strong performance as production ramps at Boeing and Airbus finally materialized. Momentum in fundamentals overruled ROIC discipline, rewarding rate-of-change execution.

- Japan continues deliberately inflating to manage debt, weakening the yen and forcing asset holders to benefit at the expense of savers. Corporate governance remains weak, meaning policy risks remain high and execution is often inconsistent.

- Europe is cheap but slow, structurally weak, and culturally inert. Even credible corporate events like M&A move at a glacial pace, making the region a source of optionality rather than performance.

- Dubai is benefiting from a migration of wealth from high-tax regions. EMAAR Properties (EMAAR.AE), which owns the Dubai Mall and other iconic developments, represents a play on this “refugee crisis for the 1%,” where dominant local assets are trading at single-digit cash flow multiples.

- Dole (DOLE) was highlighted as a defensive trade at 7x free cash flow in 2025. It has rerated and is less compelling today, but still illustrates Kuppy’s approach to inflation-protected, cash-flow-positive businesses.

High-Conviction Trades for 2026

- Sprott (SII) remains the top long: cash-flow positive, structurally levered to precious metals and uranium, and positioned to capture both retail and institutional FOMO.

- Brazilian equities, particularly B3 (BOLSY), offer deep value and optionality if sentiment and flows eventually shift.

- US refiners continue to provide structurally advantaged, cash-flow-positive exposure hidden behind cyclical pessimism.

- Marex (MRX) is a high-conviction, counter-cyclical business that profits from market volatility and activity rather than direction.