Yoga pants and oil…

A low frequency but juicy strategy where the edge is government incompetence.

Let’s dig in…

As the market is focused on ORCL’s *not fake* RPO numbers, we continue to hunt for themes outside of the mainstream. Call us boomers all you want but we like value, with real assets and investing in things that hurt if we drop them on our foot (h/t Gartman). But every time we write about commodities, we feel like we’re repeating the same Econ 101 lecture- supply and demand. It’s really not that complicated. Yet it’s amazing how often investors trip over this most basic truth.

In equities, people obsess over product launches, management changes, or Fed policy pivots (and Reddit threads) but ultimately it comes back to supply and demand. Think of Lululemon – ten years ago if you wanted some athleisure there was only one place to get it. LULU, being the first on this trend, had a monopoly on supply and capitalized on it appropriately. They sold these products at huge mark ups with little advertising and ran zero sales or discounts, resulting in fat profit margins. If you were long during this stage you printed cash. But capitalism did its thing and the excess profits invited a flood of new entrants. Now, there are dozens of imitators all buying the same products from the same Bangladeshi sweatshops and dumping them into the US market, eroding LULU’s advantage and collapsing its stock. It’s no different than high oil prices lighting a beacon for every wildcatter to flock to the Permian and drill until their shareholders bleed out. Yoga pants and oil are pretty similar at the end of the day.

Commodities though, are a bit more straightforward without all the distractions. It always comes back to how much is being produced versus how much is being consumed. Demand is a moving target—good luck modeling it with any precision. Supply, on the other hand, is usually knowable, and it’s where the big money gets made.

But so what? We’re not making the case to trade LULU or to go short Labubus (9992 HK) as both go through their cycles. We are just plain, old grumpy value investors. And as such, we once again revisit our old friend- the O&G Sector- for a new supply and demand mismatch.

However, we are not revisiting the upstream players this time. Instead, we’re focusing on the neglected downstream – refineries. They’re a little thought of and often underappreciated sub-sector of the oil and gas industry. Refineries turn crude oil into the products that keep the world moving—diesel for trucks, jet fuel for planes, gasoline for cars, and yes, chemical feedstocks for LULU yoga pants. If crude is the raw ingredient, refineries are the factory floor. Though this sector is downstream of oil, it exists on its own unique supply and demand curve… and the supply side is shifting.

Let’s rewind to the pandemic. Remember the headlines? Gasoline prices spiked, people were screaming about shortages, and governments began sharpening their knives against the petroleum industry. In the U.S. and Europe, policymakers leaned hard into the idea of “peak demand.” Why invest in new refineries when EVs are supposedly going to make them obsolete? Add in ESG mandates, rising permitting costs, and NIMBY pitchforks, and the industry was practically forced to shrink capacity. Multiple facilities were shuttered, converted, or mothballed, and few serious projects were announced to replace them. Yet as we continue to sunset our petroleum industry, the developing world has been building theirs.

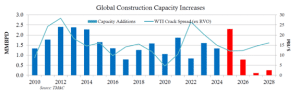

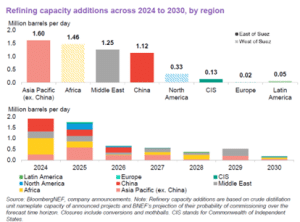

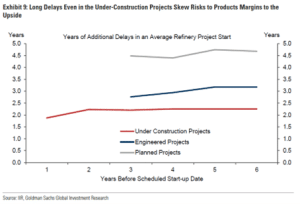

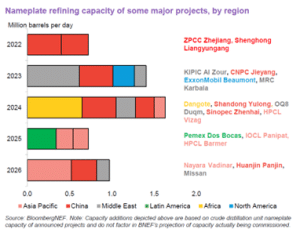

On the face of it, the consensus dynamic is stagnating supply in the DMs and growing supply in EMs, roughly aligned with expected demand trends. Crucially, however, the outlook for supply growth in the out years is extremely low. Refineries are not like drill rigs; they cannot be slapped down as demand necessitates. It takes nearly a decade to go from announcement to completion due to inevitable project delays, inflation, and increased permitting requirements. Therefore, if a project has not already been announced it is extremely unlikely that it will begin production before the end of this decade. Right now, on the supply side, “what you see is all that you get”… and you may not even get that.

As refinery capacity slows in DMs and grows in Ems, they come along with the usual EM issues. This is no clearer than in the troubles surrounding the Dangote refinery in Nigeria and the Dos Bocas refinery in Mexico. Dangote refinery was billed as Africa’s energy salvation, a 650,000 barrel-per-day behemoth that would eliminate the country’s dependence on imports. Dos Bocas was touted as a centerpiece of López Obrador’s nationalist energy policy. Both projects have become cautionary tales. Dangote has battled power outages, financing disputes, and design flaws that make it look less like a global game-changer and more like an expensive headache. Dos Bocas has blown through budgets, missed deadlines, and continues to limp toward functionality. Betting these plants will operate at anything near full utilization this decade is a stretch. And these two projects represent a huge portion of the planned supply growth.

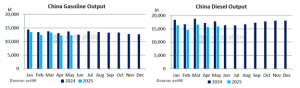

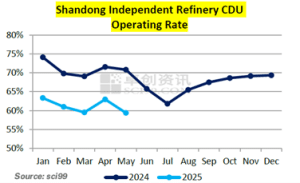

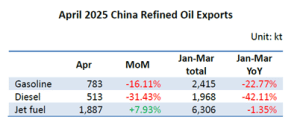

Even China, long the specter of negative gross margins for any industry they touch, hasn’t delivered the knockout punch people feared. Yes, they’ve added capacity, but much of it is tied up feeding their domestic chemical industry and to decouple themselves as much as possible from the West. Even the Teapots, which have long been the bane of the refinery sector, are seeing their utilization plunge. These results are a function of both falling demand (gasoline due to the onslaught of EVs and diesel due to slowing GDP growth) and the fact that exports are closely controlled by the CCP via the annual issuance of export licenses. Bottomline, the supposed wave of new capacity is more like a ripple.

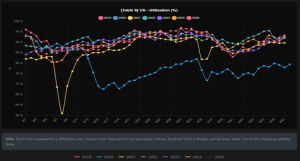

Meanwhile, the West keeps cutting. In the U.S., we’re running existing refineries hotter than ever, with utilization rates near the redline, and yet more closures are still planned. Europe has been even more aggressive in shutting down capacity – committing energy seppuku under the banner of decarbonization. The net result is that growth in developed-market capacity outlook is looking slim.

Like I’ve said, the money in commodities is made on moves in the supply curve as demand is typically anybody’s guess. But Trump wants to shoot Powell out of a cannon, take rates to zero, and is flirting with sending out “freedom checks”. He clearly wants to run the economy as hot as possible. Maybe this offsets our rapidly deteriorating job market or maybe it doesn’t. But even as is, we are facing a tight supply picture. Should demand pickup just a bit crack spreads will take off.

321 Gulf Crack

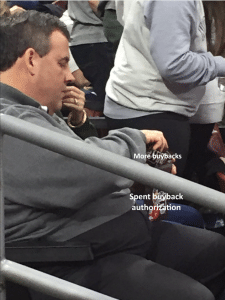

Refineries are pure operating leverage. A dollar pickup in cracks flows straight to the bottom line and with capacity not expanding these dollars would go directly to buybacks. This means that they’re awful businesses in a down cycle but they print in the up cycle. And they’ve been printing it since Covid – using the excess cash to gorge themselves on their own shares with a gluttony that would make Chris Christie blush.

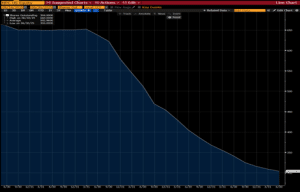

MPC, for example, has repurchased half of its shares since the end of 2021 and over 12% in the TTM (and #25 in our Buyback Leaderboard)

MPC Shares outstanding

Investors seem anchoring on the “peak demand” narrative, focusing on EV penetration and long-term energy transition goals. Meanwhile, the near- to medium-term reality is a shrinking refinery base, underwhelming capacity growth in emerging markets, and political incentives in the U.S. to run the economy hotter rather than colder.

This doesn’t mean refineries are a forever trade. Eventually, the supply side will respond and the cycle will turn… but for now there’s only one place to buy yoga pants…

Start your 28-day free trial

Kuppy’s Event Driven Monitor (“KEDM”) is not a financial or investment advisor and the information contained in this publication is not intended to constitute legal, accounting, or text advice or individually-tailored investment advice and is not designed to meet your personal financial situation. The investments discussed in this publication may not be suitable for you. You are required to conduct your own due diligence, analyses, draw your own conclusions, and make your own investment decisions. Any areas concerning legal, accounting, or tax advice or individually-tailored investment advice should be referred to your lawyers, accountants, tax advisors, investment advisers, or other professionals registered or otherwise authorized to provide such advice. KEDM makes no recommendations whatsoever regarding buying, selling, or holding a specified security, a class of securities, or the securities of a class of issuers, and all commentary is for educational purposes only. The investment examples noted are intended to provide and example of the events and data KEDM flags each week and is not representative of typical returns generated by each event or any future returns.