RRP + TGA

OK, let’s get into it. Sometimes someone says something that jars our memory and reminds us to check some charts. Our buddy Paulo Macro has done just that and as a result, we’re going to shamelessly steal from his recent piece. Please subscribe to see his other writings. We’re of the view that the global…

It’s All A Sideshow…

Just signed on, did anything happen this weekend???? Remember how the market was hyper focused on tarriffs 2 months ago as correlations hit 1. Did we solve that one yet? Asking for a friend. Now, fintwitters are all experts on Fordow and the Stait of Hormuz. Tarrifs are a sideshow. Funny how that works. But…

We Are Rather Dour…

We told ourselves that we’d come back from vacation when something happens. What’s going on in the Middle-East certainly qualifies as a “something happening.” We’ll leave it to Twitter experts to speculate on what exactly will happen. We watch the same videos that you do, with the proviso that “the first casualty of war is…

What Year Are We In????

Last week abroad before heading back to PR to get back into the saddle. Honestly, I check in each day and this market is making less and less sense. Seriously, between the DJT/Elon pissing match, the grift in SPACs, CRCL IPO, SBET secondary, and Trump & Co issuing a branded crypto wallet, what year are…

You are all going to panic…

Currently writing from Croatia and on my final leg before returning to PR late next week. Looking forward to getting back to the island, but hyper focused on not getting sucked back into the markets. Having been gone for a few weeks and clearing my head, the end result is that nothing has changed my…

Enjoying My Raki…

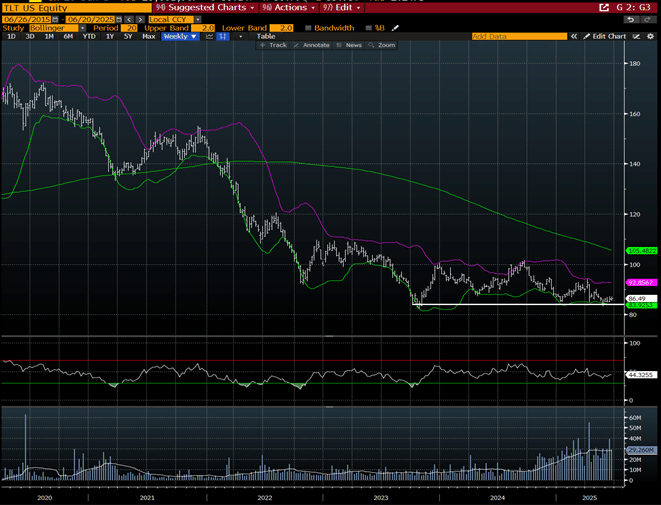

As mentioned last week, we shut off our screens and are writing to you from Crete. Not much to report on as bonds remain our focus. TLT continues to drip below 85 while global yields are breaking out. This is still one of the worst risk/reward setups we have seen for quite some time. It’s…

Another Dull Week…

The next few weeks may be a bit dull around here. We remain convinced that the best strategy is to step away and await the US equity market crash. KEDM is long overseas markets (they’re working), we’re long gold (it’s working), and not much else is working in US markets, besides Ponzi. We have a…

Nothing to do….

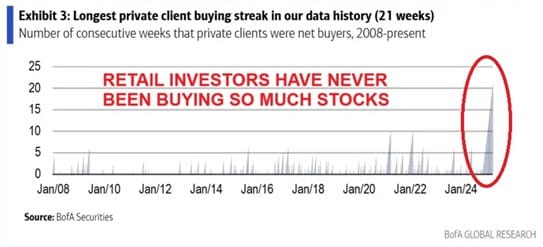

As we have warned a few times in past KEDM’s commentary is going to be light going forward as our bearish leanings are not going to change on a daily/weekly basis. We noted a couple weeks ago that the focus/headlines on tarrifs continue to mask the “real” solvency story that is coming to a head. …

Dead Cat Bounce

Once you see a chart, you sometimes struggle to un-see it… This is the Naz during the 2000 tech bubble. Now let’s look at the GFC. Note a pattern? A smash, then consolidate, then leak lower until the real selling starts. It’s almost a chart crime to then pull up 1929, but we can’t help…

A Bearish PSA, Part Duex

By now most KEDM readers get how bearish we are. We are not going to regurgitate it; we’ve beat that horse to its bloody death. But as we’ve talked to 50+ hediges over the past week, the common response is “sure I am bearish, but we are 1 tweet away from a tariff deal and…