Correlations to 1

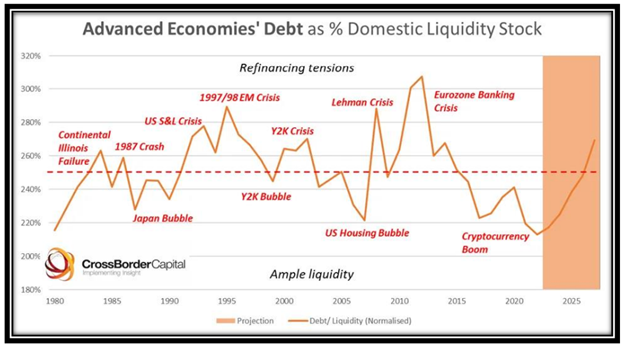

Short week, so it’ll be a short, data-only KEDM this week. Besides, nothing is going to change our view over the coming weeks. Sure, a TON of volatility but our thinking remains the same. This tariff story is an undercard to upcoming big govt credit/PE/private credit/refi/endowment unwind. We are headed into a trader and ED…

An Important Gloom and Doom PSA….

It’s said that there’s no such thing as a quadruple bottom in finance. That’s terrifying as TLT (yeah, we know only retail track it…) looks to be teasing a 4th bottom. We’re increasingly of the view that TLT fails. When that happens, we really don’t know WTF happens. Just think about all the things that…

Liberation Day

We were all looking forward to Liberation Day. We even had something of a celebration planned. Honestly, we thought Trump would do a flat tariff. Maybe something in the 10-20% range. Instead, he came out swinging. He literally carpet bombed every CUSIP. We don’t blame him. These tariffs are the right thing to do—though he…

Tina died in 2025…

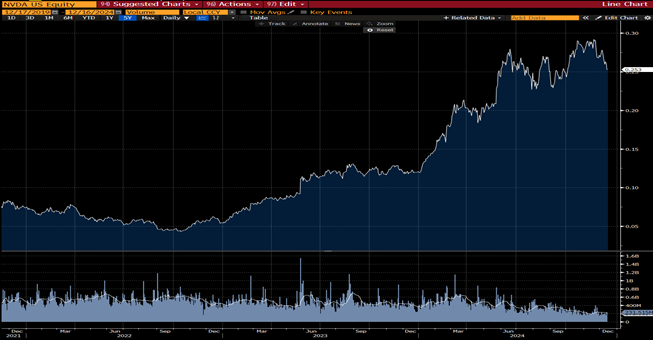

Speaking of tops, on January 12, we posted an eerie chart of CSCO against the last remaining generals left in the markets using SMH as the proxy (we urge you to re-read here). Let’s revisit: “In summary, we’re bears. Now raging Kodiak Bears… We were just starting out in this business when we realized that…

Where Did the Margin Go??

Our thinking hasn’t changed since last week, but this week’s price action is worth revisiting. In summary, we’re bears. Now raging Kodiak Bears… We were just starting out in this business when we realized that the wheels were coming off the tech bubble and spending on networking was about to fall off a cliff, to…

Mean-reversion is imminent…

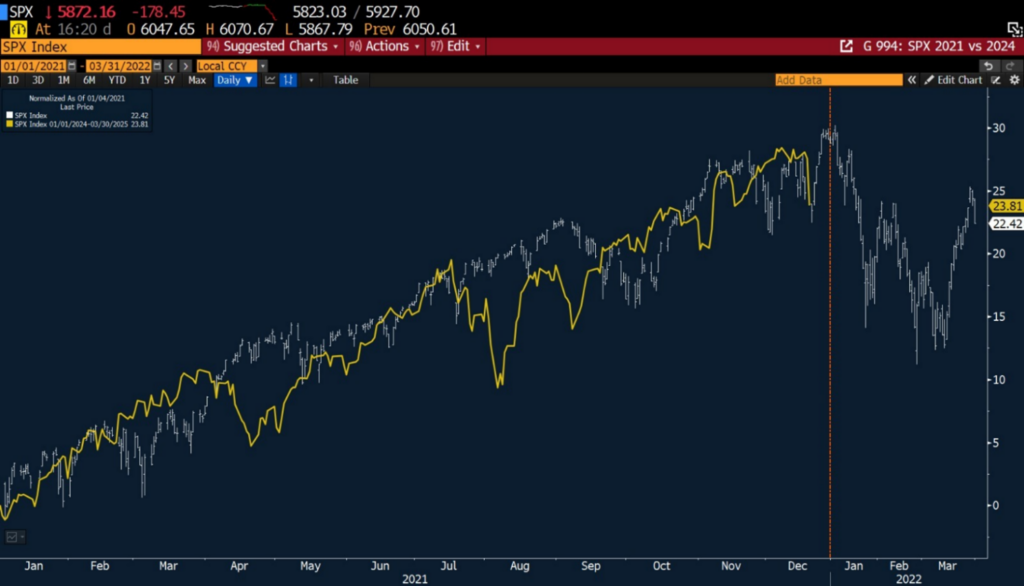

Last week, we showed the 1 chart to rule them all. It was the chart of Q4/Q1 of 2021/2022 overlayed with the current market tracking almost perfectly. Since then, this year has tracked reasonably well (shocking…). If the comparison holds, then the selling starts this week when everyone gets back from vacation. Though, we’re willing…

More Bear Porn…

Once you look at this chart, you simply cannot unsee it. Our good friend, Kevin “The Macro Tourist” Muir sent this to us during the Wednesday Fed smash. It accurately predicted the subsequent ripper on Friday. If it goes to analog, it likely continues for a few days, then death. Kevin has been harping on…

The Bell is Ringing…

The commentary will be quite light this week (i.e. non-existent) as our entire team is nursing hangovers from our annual holiday party last night. Needless to say, our thinking hasn’t changed much since our piece last week. If anything we kept hearing even more bells ringing the top this week, as Mike Saylor and Palantir…

December 8, 2024, Vol. 203

The admin of this site has disabled this download item page.

Bear Porn…

Let’s turn to the markets. Since early summer, KEDM went into full “harvest mode,” cleaving off the chaff and moved to center book. We weren’t outright bearish but envisioned volatility coming into play over summer and into the elections. While that didn’t serve us well in the short-term (looking at you offshore…) we’d rather err…