You are all going to panic…

Currently writing from Croatia and on my final leg before returning to PR late next week. Looking forward to getting back to the island, but hyper focused on not getting sucked back into the markets. Having been gone for a few weeks and clearing my head, the end result is that nothing has changed my…

Enjoying My Raki…

As mentioned last week, we shut off our screens and are writing to you from Crete. Not much to report on as bonds remain our focus. TLT continues to drip below 85 while global yields are breaking out. This is still one of the worst risk/reward setups we have seen for quite some time. It’s…

Another Dull Week…

The next few weeks may be a bit dull around here. We remain convinced that the best strategy is to step away and await the US equity market crash. KEDM is long overseas markets (they’re working), we’re long gold (it’s working), and not much else is working in US markets, besides Ponzi. We have a…

Nothing to do….

As we have warned a few times in past KEDM’s commentary is going to be light going forward as our bearish leanings are not going to change on a daily/weekly basis. We noted a couple weeks ago that the focus/headlines on tarrifs continue to mask the “real” solvency story that is coming to a head. …

Dead Cat Bounce

Once you see a chart, you sometimes struggle to un-see it… This is the Naz during the 2000 tech bubble. Now let’s look at the GFC. Note a pattern? A smash, then consolidate, then leak lower until the real selling starts. It’s almost a chart crime to then pull up 1929, but we can’t help…

A Bearish PSA, Part Duex

By now most KEDM readers get how bearish we are. We are not going to regurgitate it; we’ve beat that horse to its bloody death. But as we’ve talked to 50+ hediges over the past week, the common response is “sure I am bearish, but we are 1 tweet away from a tariff deal and…

Correlations to 1

Short week, so it’ll be a short, data-only KEDM this week. Besides, nothing is going to change our view over the coming weeks. Sure, a TON of volatility but our thinking remains the same. This tariff story is an undercard to upcoming big govt credit/PE/private credit/refi/endowment unwind. We are headed into a trader and ED…

An Important Gloom and Doom PSA….

It’s said that there’s no such thing as a quadruple bottom in finance. That’s terrifying as TLT (yeah, we know only retail track it…) looks to be teasing a 4th bottom. We’re increasingly of the view that TLT fails. When that happens, we really don’t know WTF happens. Just think about all the things that…

Liberation Day

We were all looking forward to Liberation Day. We even had something of a celebration planned. Honestly, we thought Trump would do a flat tariff. Maybe something in the 10-20% range. Instead, he came out swinging. He literally carpet bombed every CUSIP. We don’t blame him. These tariffs are the right thing to do—though he…

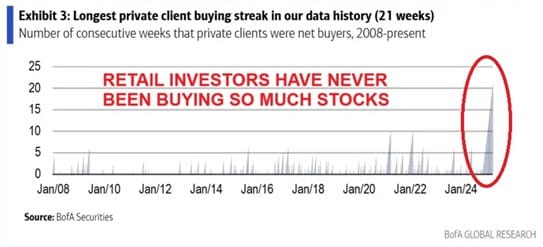

Tina died in 2025…

Speaking of tops, on January 12, we posted an eerie chart of CSCO against the last remaining generals left in the markets using SMH as the proxy (we urge you to re-read here). Let’s revisit: “In summary, we’re bears. Now raging Kodiak Bears… We were just starting out in this business when we realized that…