It’s said that markets don’t usually crash from equity bros doing really stupid things, but they usually crash from debt bros doing really stupid things.

With that in mind, we should probably talk a bit about PE, especially as the charts are starting to break. And the same can be said of large BDCs who lend to PE.

We first started noodling on this back in April 2025, and even had one of our favorite analysts, Erik Renander (also a Happy Hour guest), chime in with a guest post back in 2024 (we have already pinged Erik for an update, so stay tuned). We think this is still early innings but a very big deal, hence us coming back to topic. Credit and illiquidity has a funny way of creating spillover effects that few can predict.

Essentially, if your BDC marks are below par, it implies the equity is worthless—which would be existential for many of the larger PE shops who to date have taken very few losses during the four-decade everything bubble. Remember it’s not a loss until you sell, right??? Market to model is great… until you reach for liquidity!

Maybe, we should go back in time. When PE started about 5 decades ago, smart scrappy guys would buy underperforming assets from larger companies, put a few turns of debt on it at very high rates, then work hard to turn these assets around. It was risky, but the rewards were massive. There is a reason that the early vintages of these funds had such great IRRs, especially as there were so few buyers for these dysfunctional assets.

Now, fast forward to today. Apparently there are more PE funds than McDonalds in USA (19,000 vs 14,000). There are no unique and unloved assets that need fixing. Instead, there are public auctions where every firm kicks the tires, then pays top dollar. No longer is it about fixing a company, it’s about levering up and buying Beta in a bull market. As funds have gotten larger, the smaller quirky deals stopped even moving the needle. The big boys buy big assets, and usually well-run assets. As with everything in finance, you can improve returns by adding leverage—so they have. Then they marked them to model, raised additional funds and put this thing on cruise control for a decade—or until they’re supposed to give the capital back.

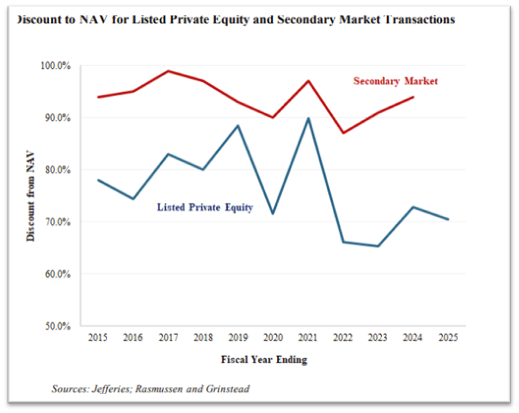

The issue is that the internal marks are above where they are in the actual market. Their PE peers no longer want to pay 15x EBITDA for an HVAC rollup with declining revenues, so they can’t sell it laterally to another PE fund. They can’t sell it into the market, as larger public players trade at lower multiples. They can’t sell it to a strategic, because the value is also too high. It’s stuck. They’ll extend & pretend via continuation funds, but eventually there is a liquidity event, and that’s what we’ve all been waiting for. Where are the real marks for this stuff??

Publicly listed PE tells a different story…Verdad PE piece: https://papers.ssrn.com/sol3/papers.cfm?abstract_id=5391741

We’ve been amazed at how many of the schlocky companies we invest in, openly claim that they want to do M&A, but can’t buy from PE because the valuations make no sense and cannot buy privately owned assets because PE will outbid them. Why would a larger and more diversified public business be worth 5 times EBITDA, when the smaller and more fragile PE name is 15 times?? We can think of one that just sold two separate divisions (both underperformers) for multiples that were almost three times the multiple of the mothership. Look, when one party is acting irrational, you do what you have to do—even if you genuinely want to grow and gain synergies…

In any case, funds are choking on product that they bought years ago, and they cannot recycle the capital. If these businesses are anything like the businesses that we track in the public markets, their fundamentals are likely fading fast. Hence, why we’re seeing credit deterioration.

It’s easy to laugh at a subprime auto lender who does something illegal and then blows up. That happens every cycle. But, it’s likely idiomatic of the whole universe of subprime that hasn’t had a cleansing moment in years. We think it’s coming.

Look at BIZD, which is an ETF of BDCs (no, really, they actually built this thing!!). As we all know, if you add another tier of fees, you improve returns (we joke) but you also give everyone a nice fat and liquid target. Look at this chart. It’s fuuuuuugly. Turns out, that it’s hard pay dividends with PIK. It’s also not accretive when you have to start marking down loans. It’s a bit beyond today’s rant, but go through some of the loans at the individual BDCs. These are all privates, so you probably don’t know the businesses, but a bit of fancy work with your favorite LLM will give you a view of the business and the recent trends of business activities (ouch!!).

We tend to think it gets worse from here, not better…

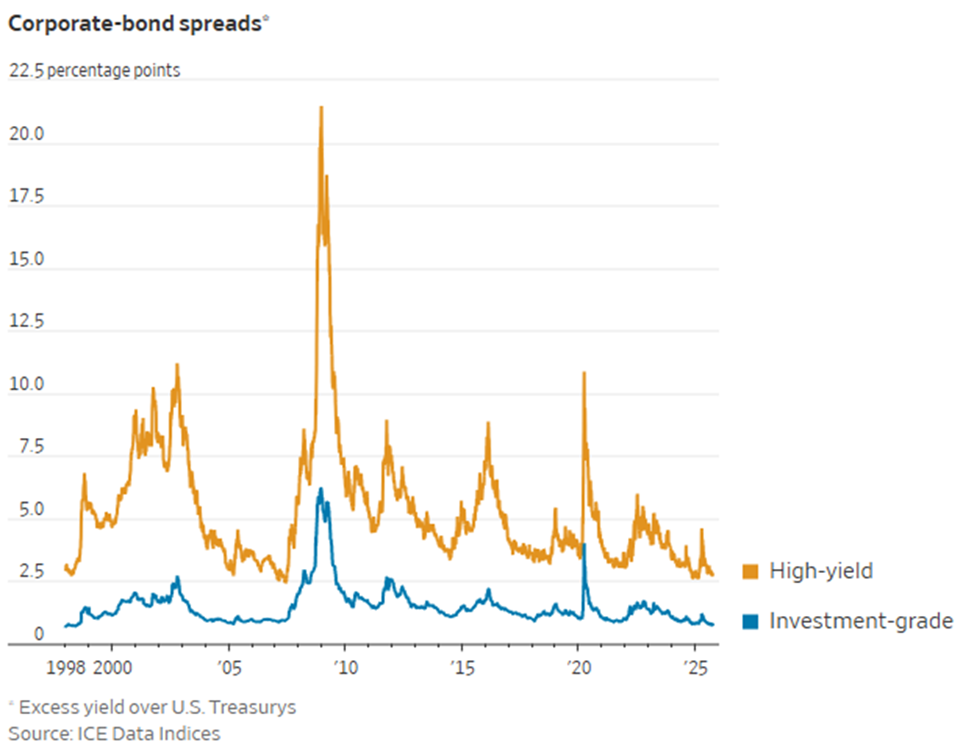

We have no position in BIZD, but wonder how this thing is blowing, while credit spreads are still at record tights. Could our good friend, and first KEDM Happy Hour guest, Kevin Muir, be right when he wonders if privates got all the dud credits, as they sought out cov-lite/PIK toggle options, while listed bonds are somewhat high-graded by that same process…

One of these two charts is wrong…

We have no great overriding theme here. We’re bears. We are observers. We see high-profile credit related assets taking the elevators down into the basement and we take notice. We remain of the view that things get really ugly at some point. Fortunately, we can sit on low exposure and wait it all out. The real fireworks are likely deferred until the Wealth Effect also comes undone, likely tied to AI blowing its brains out. We’re bearish there as well, and increasingly coming to believe that the tech is stalling out in terms of its functionality. While we aren’t tech nerds (we can barely even run our email accounts), we know plenty of tech nerds, and they assure us that the rate of change is slowing in AI. There is zero path to monetization. The tech is great for some things like glorified search (with minimal revenue), but it isn’t up to par for more advanced deep thinking. It can solve some problems, but fails hilariously at others. What if AI is a total flop?? Well, that remains our base case.

In any event, we are watching the opening signs that there’s trouble in credit land. That doesn’t mean we crash tomorrow. Remember that New Century, Bear Stearns Credit, Northern Rock, Bear Stearns itself and plenty of other names got zeroed, and only then did the market get to business months later. Rather, we keep wondering what else to sell and de-gross.

Everyone keeps telling us that ‘nothing stops this train’ except the train appears to have fallen off the tracks, and into a ditch… Besides, we find few new trends with good tailwinds, and at valuations that even sort of interest us.

This isn’t the first or last time in our career that this has happened. However, it’s the first time we’ve taken real caution and made it a purpose to have liquidity when the buying gets good at some point in the future.

Stay tuned…