Trump Goes Mining…

We’ve always wondered why they let Trump win, after blocking him in 2020. And don’t think it’s about him getting more votes, it’s ALWAYS about who counts the votes. Call it a pet theory, but the oligarchs and Deep State types watched as the Russians steamroll a few NATO armies in Ukraine, watched the Russians…

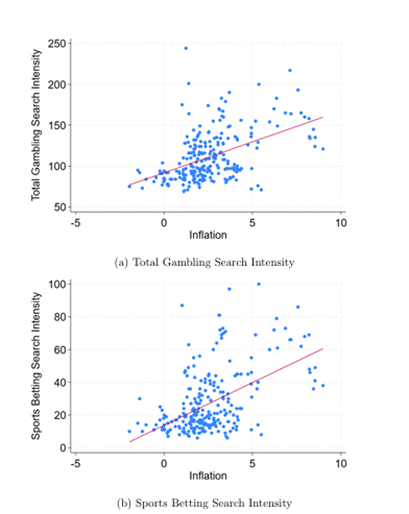

Betting on the degens…

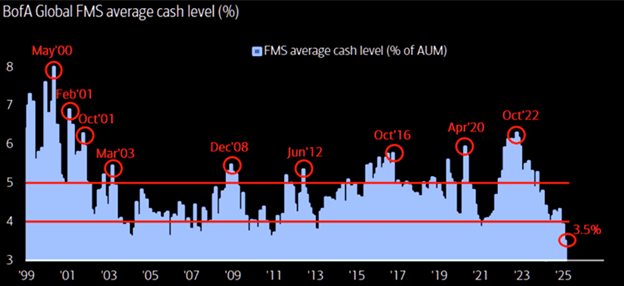

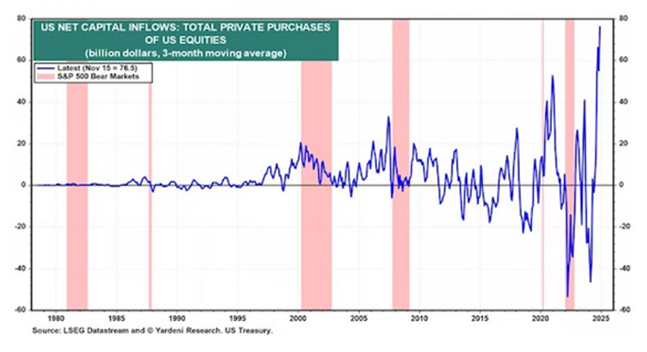

Turning to the markets, our themes seem to be kicking into high gear as EMs continue to suck flows out of the US. We expect some rips out of the US, but there is more pain ahead in ’25 as TINA (for US growth) doesn’t just take a month to die, this will take some…

Tina died in 2025…

Speaking of tops, on January 12, we posted an eerie chart of CSCO against the last remaining generals left in the markets using SMH as the proxy (we urge you to re-read here). Let’s revisit: “In summary, we’re bears. Now raging Kodiak Bears… We were just starting out in this business when we realized that…

EMs Curling Up…

Since mid-to-late 2024 we have been banging the table on EMs, specifically Turkey, Colombia, Brazil and China. See issues 197 and 209 for China; 210 and 200 for LatAm. YTD the latter 3 have been on a tear with China up 25%, Brazil up nearly 13%, and Colombia up 22%. While stretched in short term…

Colombia and Brazil are perking up…

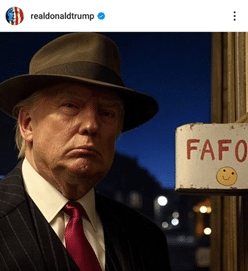

Last week we left you on the topic of Brazil, so LatAm has been on our mind all week, especially with Trump laying out a heavy dose of FAFO during the week… Lets rehash…This week began with a bang in Latin America as Trump came out swinging on Colombia after they refused to accept a…

Trump 2.0

Turning to the markets, the secret to successful investing is the art of having strong views, loosely held. For the better part of our careers, we’ve been bearish bonds. “Project Zimbabwe” and all that jazz. However, we’re open to other views… Over the past month, we have been astounded by the progress made by Trump,…

Ferts Back on the Radar…

Nothing worthy of note this week but we did want to introduce our February Happy Hour guest at the very least… We finally roped in our good friend Le Shrub to join us to chat macro and dive into an interactive Q&A with KEDM community. Shrub is an O.G. KEDM’er having been one of the…

Fund Flows Flip

Things may be light over the next couple weeks as we are in South Florida taking meetings during the annual iConnections pilgrimage. In our typical fashion, we don’t pay the 20k entry price to roam the halls, but rather sit with a cold beer at a local bar and laugh as the sleeveless vests descend…

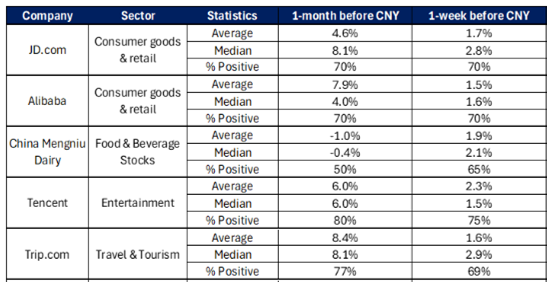

The Year of the Snake…

We are going to keep the commentary light this week as you have plenty of reading to do with the Happy Hour transcripts. However, last week we noted our increasing interest in the China theme when we wrote: “After stopping out on a lot of our China exposure in Q4, we’re back at it. We…

Where Did the Margin Go??

Our thinking hasn’t changed since last week, but this week’s price action is worth revisiting. In summary, we’re bears. Now raging Kodiak Bears… We were just starting out in this business when we realized that the wheels were coming off the tech bubble and spending on networking was about to fall off a cliff, to…