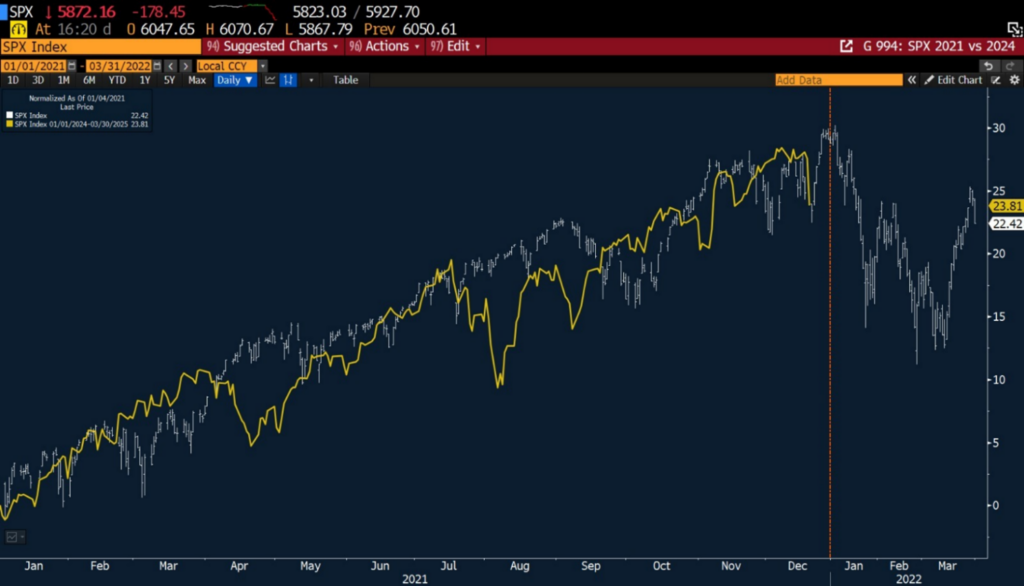

Mean-reversion is imminent…

Last week, we showed the 1 chart to rule them all. It was the chart of Q4/Q1 of 2021/2022 overlayed with the current market tracking almost perfectly. Since then, this year has tracked reasonably well (shocking…). If the comparison holds, then the selling starts this week when everyone gets back from vacation. Though, we’re willing…

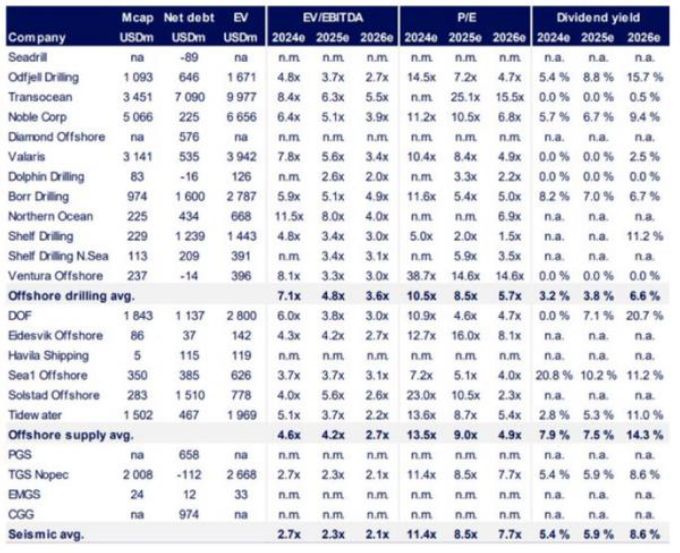

Quick Update on Offshore…

Let’s quickly turn over to offshore. We’ll have more to say in a future edition, as this has gotten long-winded already, but given the equity performance we’d be remiss to not mention it. Much like Naz is peaking in the final days of December, we think offshore is bottoming. We’ve basically tossed a lot of…

More Bear Porn…

Once you look at this chart, you simply cannot unsee it. Our good friend, Kevin “The Macro Tourist” Muir sent this to us during the Wednesday Fed smash. It accurately predicted the subsequent ripper on Friday. If it goes to analog, it likely continues for a few days, then death. Kevin has been harping on…

The Bell is Ringing…

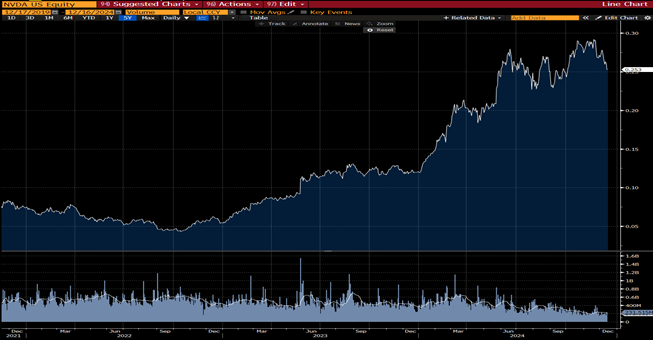

The commentary will be quite light this week (i.e. non-existent) as our entire team is nursing hangovers from our annual holiday party last night. Needless to say, our thinking hasn’t changed much since our piece last week. If anything we kept hearing even more bells ringing the top this week, as Mike Saylor and Palantir…

Bear Porn…

Let’s turn to the markets. Since early summer, KEDM went into full “harvest mode,” cleaving off the chaff and moved to center book. We weren’t outright bearish but envisioned volatility coming into play over summer and into the elections. While that didn’t serve us well in the short-term (looking at you offshore…) we’d rather err…

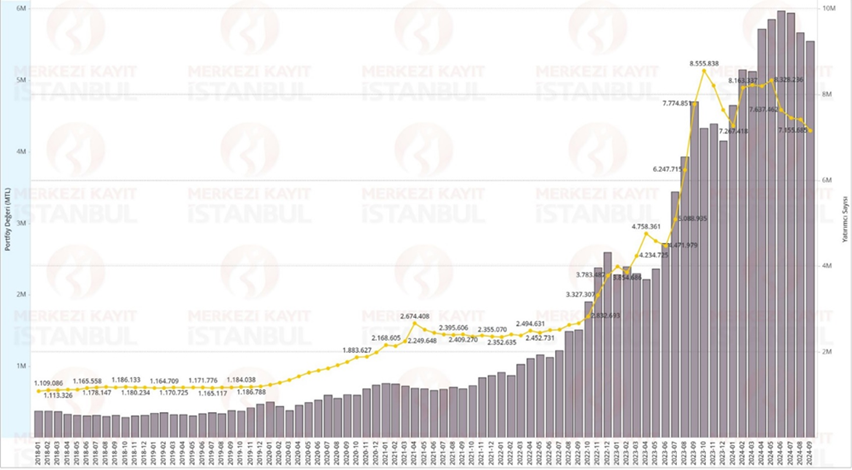

Let’s chat Turkey…

Regular KEDM readers have likely picked up on our growing bullishness for some specific EMs. We all know the chart by now but the US is stretched as NVDA and MSTR prop up the whole market. And as DMs become EMs, emerging markets should see a flip in fund flows with EMs finally “emerging.” Since…

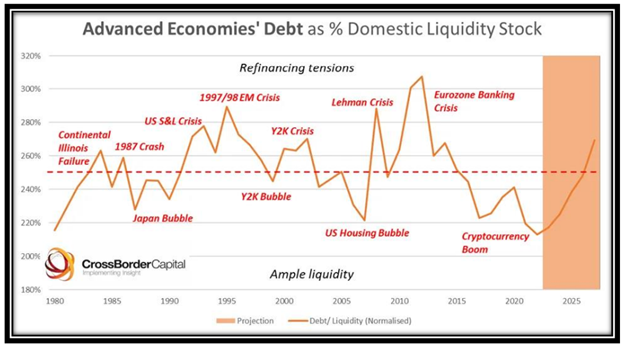

The World Is a Rollin…

Last week, we talked about why South America may finally have its bull market, after over a decade of persistent bear markets. This week, we want to break with past traditions and simply give you a bunch of charts—bearish charts. While we are bullish longer-term, we also recognize that timing is everything. Quite honestly, a…

LatAm will roar…

Trump won!! Naturally, we wonder if we’re positioned right for what comes next. What does Round 2 look like?? Is it like Round 1 where he spends most of the day golfing, and occasionally tweeting about how great the market is?? (Remember those 150bps rippers every afternoon??) Or does he actually try and Make America…

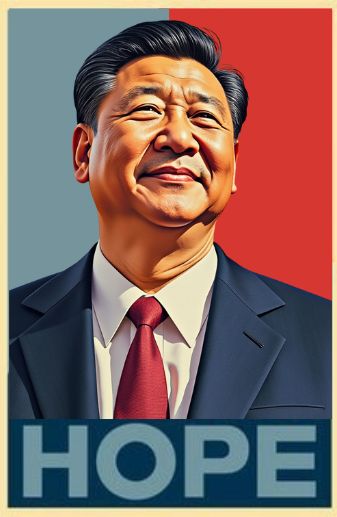

China’s “Whatever it takes” Moment – The Year of the Dragon

What the hell is going on over in China?? First, they detonated their real estate sector. Remember how homes are for living in, not speculating?? Then, they locked down for germs (you can’t be a superpower if you’re scared of the common cold). Finally, they crowned Xi as king, right after the party congress/purge.…

The Buyside Monitor aka The BSD

Hedge fund letter season is fast approaching and we are gearing up for pages of deep value sh*tcos pitches and fancy numbers that prove being down 20% is still a win because they did it with less volatility and risk. That said, we do get some value skimming the thoughts of the industry. There is…