Tina died in 2025…

Speaking of tops, on January 12, we posted an eerie chart of CSCO against the last remaining generals left in the markets using SMH as the proxy (we urge you to re-read here). Let’s revisit: “In summary, we’re bears. Now raging Kodiak Bears… We were just starting out in this business when we realized that…

Bear Porn…

Let’s turn to the markets. Since early summer, KEDM went into full “harvest mode,” cleaving off the chaff and moved to center book. We weren’t outright bearish but envisioned volatility coming into play over summer and into the elections. While that didn’t serve us well in the short-term (looking at you offshore…) we’d rather err…

Our Fave Ponzi…

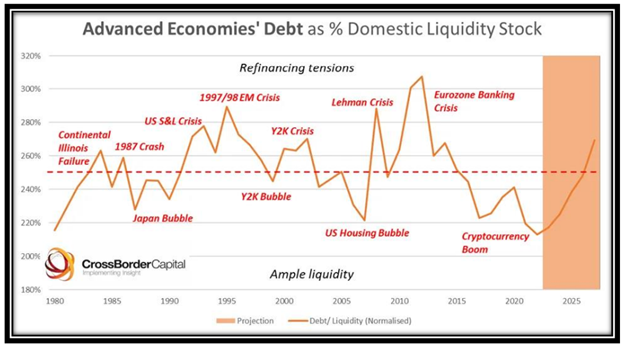

We want to quickly touch on our favorite Ponzi Scheme. When a Ponzi makes a new all time high, you want to buy it. However, you need to be careful as it may be a trap. Look at the red circle, that was a trap. It sucked in the last few baggies on the highs,…

June 9, 2024, Vol. 180

The admin of this site has disabled this download item page.

April 21, 2024, Vol. 173

The admin of this site has disabled this download item page.

Our thoughts on Gold vs. Bitcoin

We picked a hell of a week to head to Cayman as MENA lit up…again. With headlines dominated by Israel we took a look at our themes dominated by long chaos and inflation and feel comfortable headed into what should be a contentious election year. Since gold was top of mind all week, we kept…

April 14, 2024, Vol. 172

The admin of this site has disabled this download item page.

Happy Hour with Doug Casey on “Crisis Investing”

Shifting topics, I had a blast catching up with Doug on Friday. Given what is happening in the gold markets we couldn’t have timed this one any better. As we typically do for Happy Hours, we jotted down some notes for those that were unable to join live. The replay will be available next week,…

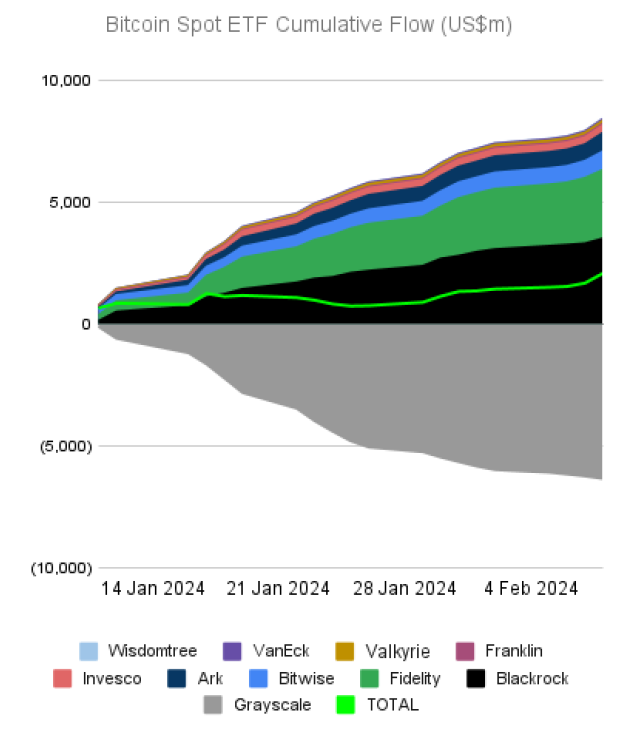

Bitcoin Flows

And since we are on the topic of passive flows and reflexivity, we figured we’d note the massive passive flows picking up in BTC-linked ETFs. Front-running ETF-like flows has been a recurring theme in KEDM back in 2020 with GBTC (BTC) and again in 2021 with SPUT (uranium). This time we come back to well…