Less restrictions…

This is the first week where KEDM gets published under new ownership. As mentioned before, from the community/user perspective it will be business as usual. Same Kuppy, same data, same product, same analysts (actually we are picking up 2 new ones!). However, under the new ownership, KEDM will be less restricted in talking about investment…

Boooring…

Turning to the markets, as traders, we recognize that sometimes there’s a whole lot to do, and sometimes the best thing to do is absolutely nothing. In this game, you get no points for fighting boredom. Sometimes, it’s best to just sit and wait it out. We’re in such a world. While we are outright…

Liberation Day

We were all looking forward to Liberation Day. We even had something of a celebration planned. Honestly, we thought Trump would do a flat tariff. Maybe something in the 10-20% range. Instead, he came out swinging. He literally carpet bombed every CUSIP. We don’t blame him. These tariffs are the right thing to do—though he…

EMs Curling Up…

Since mid-to-late 2024 we have been banging the table on EMs, specifically Turkey, Colombia, Brazil and China. See issues 197 and 209 for China; 210 and 200 for LatAm. YTD the latter 3 have been on a tear with China up 25%, Brazil up nearly 13%, and Colombia up 22%. While stretched in short term…

Trump 2.0

Turning to the markets, the secret to successful investing is the art of having strong views, loosely held. For the better part of our careers, we’ve been bearish bonds. “Project Zimbabwe” and all that jazz. However, we’re open to other views… Over the past month, we have been astounded by the progress made by Trump,…

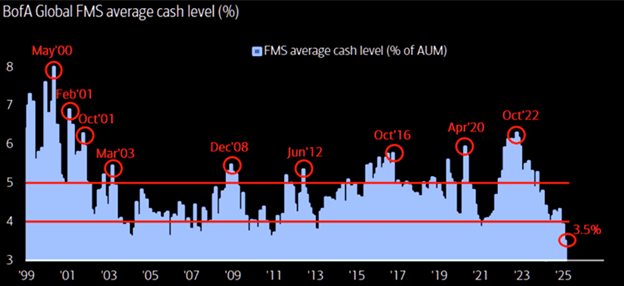

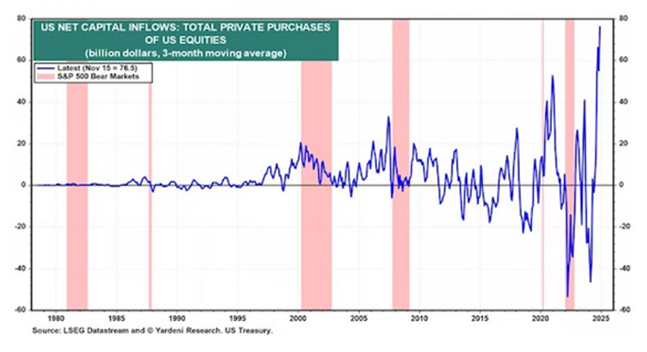

Fund Flows Flip

Things may be light over the next couple weeks as we are in South Florida taking meetings during the annual iConnections pilgrimage. In our typical fashion, we don’t pay the 20k entry price to roam the halls, but rather sit with a cold beer at a local bar and laugh as the sleeveless vests descend…

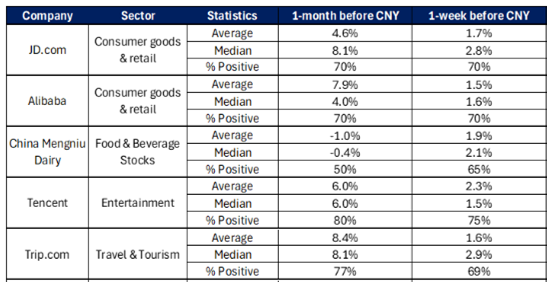

The Year of the Snake…

We are going to keep the commentary light this week as you have plenty of reading to do with the Happy Hour transcripts. However, last week we noted our increasing interest in the China theme when we wrote: “After stopping out on a lot of our China exposure in Q4, we’re back at it. We…

Where Did the Margin Go??

Our thinking hasn’t changed since last week, but this week’s price action is worth revisiting. In summary, we’re bears. Now raging Kodiak Bears… We were just starting out in this business when we realized that the wheels were coming off the tech bubble and spending on networking was about to fall off a cliff, to…

October 27, 2024, Vol. 198

The admin of this site has disabled this download item page.

China’s “Whatever it takes” Moment – The Year of the Dragon

What the hell is going on over in China?? First, they detonated their real estate sector. Remember how homes are for living in, not speculating?? Then, they locked down for germs (you can’t be a superpower if you’re scared of the common cold). Finally, they crowned Xi as king, right after the party congress/purge.…