Mean-reversion is imminent…

Last week, we showed the 1 chart to rule them all. It was the chart of Q4/Q1 of 2021/2022 overlayed with the current market tracking almost perfectly. Since then, this year has tracked reasonably well (shocking…). If the comparison holds, then the selling starts this week when everyone gets back from vacation. Though, we’re willing…

Offshore Is Getting Cheap…

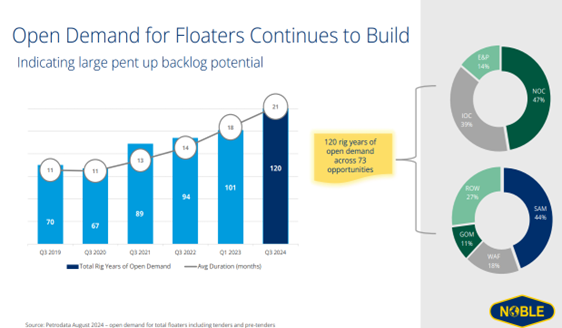

We’re in Zurich and then Geneva, after a week in Oslo at the Pareto Energy Conference. It was crowded, but we haven’t seen this much emotional pain outside of a funeral. A look at the below chart will give you a sense of why everyone is so dour. Then again, if your book even sort…

September 15, 2024, Vol. 193

The admin of this site has disabled this download item page.

Offshore Earnings

We haven’t been exactly bullish in recent months. We aren’t doom and gloomers either, but regime changes tend to create markets where macro Trumps the micro. Are the past 10 days, just a precursor to the coming wackiness and onslaught of “100-year, one-in-a-lifetime moves” that will likely come weekly?? We are in the 4-6 month…

August 11, 2024, Vol. 188

The admin of this site has disabled this download item page.

Market Update: MAG7 Divergences

Ok, with that out of the way, we want to talk about divergences. For those of you who’ve followed us for any length of time, you’ll know that we pay special attention to divergences, as they tend to happen at the end of a move—signaling an exhaustion of the move. For nearly a year, MAG7…

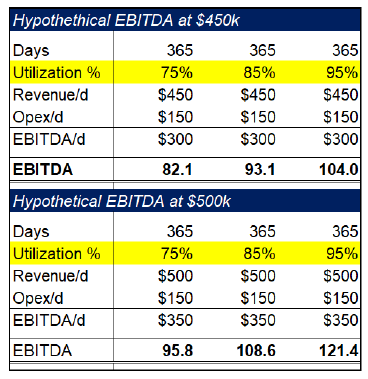

Update on Offshore drillers

Jumping into the markets, it was a long week of earnings throughout some of our themes, e.g. Florida migration and Oil Services, both of which seem to be trending in the right direction, albeit slowly. Offshore drillers in particular had a sleepy 2H23, where contract awards slowed and seemingly every operator had a handful of…