EMs Curling Up…

Since mid-to-late 2024 we have been banging the table on EMs, specifically Turkey, Colombia, Brazil and China. See issues 197 and 209 for China; 210 and 200 for LatAm. YTD the latter 3 have been on a tear with China up 25%, Brazil up nearly 13%, and Colombia up 22%. While stretched in short term…

Colombia and Brazil are perking up…

Last week we left you on the topic of Brazil, so LatAm has been on our mind all week, especially with Trump laying out a heavy dose of FAFO during the week… Lets rehash…This week began with a bang in Latin America as Trump came out swinging on Colombia after they refused to accept a…

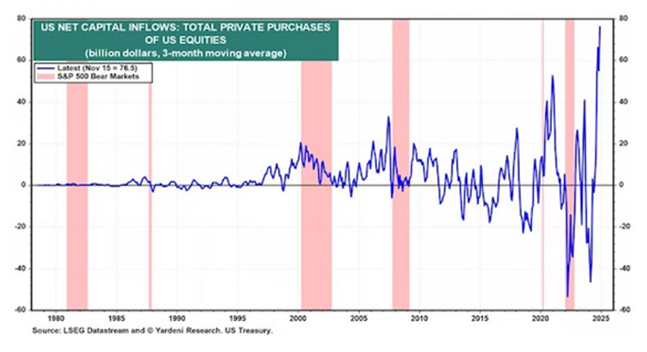

Fund Flows Flip

Things may be light over the next couple weeks as we are in South Florida taking meetings during the annual iConnections pilgrimage. In our typical fashion, we don’t pay the 20k entry price to roam the halls, but rather sit with a cold beer at a local bar and laugh as the sleeveless vests descend…

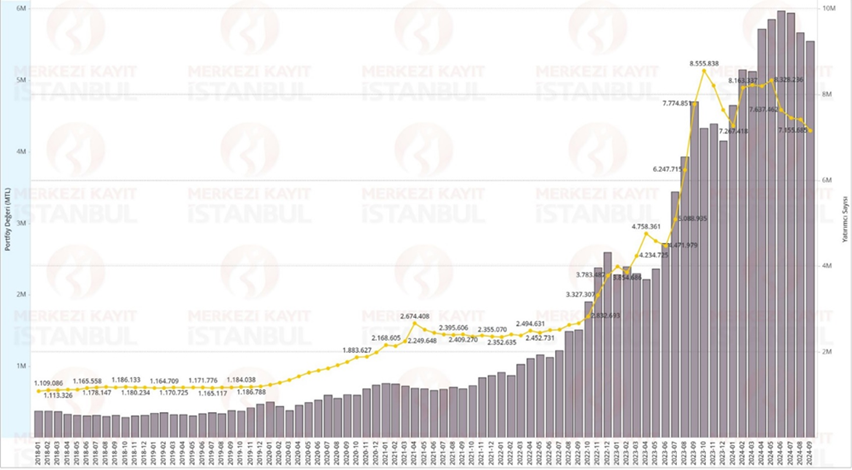

Let’s chat Turkey…

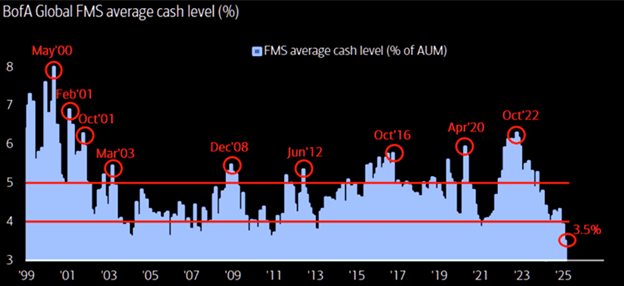

Regular KEDM readers have likely picked up on our growing bullishness for some specific EMs. We all know the chart by now but the US is stretched as NVDA and MSTR prop up the whole market. And as DMs become EMs, emerging markets should see a flip in fund flows with EMs finally “emerging.” Since…

LatAm will roar…

Trump won!! Naturally, we wonder if we’re positioned right for what comes next. What does Round 2 look like?? Is it like Round 1 where he spends most of the day golfing, and occasionally tweeting about how great the market is?? (Remember those 150bps rippers every afternoon??) Or does he actually try and Make America…

EMs Take the Spotlight

JPOW pulled the trigger on re-engaging Project Zimbabwe. We’ve been banging the table on the peasants getting carved up, hence our de-grossing, but we were a bit surprised on how trigger happy he was with equity markets clipping highs. Just goes to show how bad the FED is fuct. I tweeted this out earlier…

September 22, 2024, Vol. 194

The admin of this site has disabled this download item page.