Offshore Is Getting Cheap…

We’re in Zurich and then Geneva, after a week in Oslo at the Pareto Energy Conference. It was crowded, but we haven’t seen this much emotional pain outside of a funeral. A look at the below chart will give you a sense of why everyone is so dour. Then again, if your book even sort…

September 15, 2024, Vol. 193

The admin of this site has disabled this download item page.

Offshore Earnings

We haven’t been exactly bullish in recent months. We aren’t doom and gloomers either, but regime changes tend to create markets where macro Trumps the micro. Are the past 10 days, just a precursor to the coming wackiness and onslaught of “100-year, one-in-a-lifetime moves” that will likely come weekly?? We are in the 4-6 month…

August 11, 2024, Vol. 188

The admin of this site has disabled this download item page.

What’s happening with Offshore?

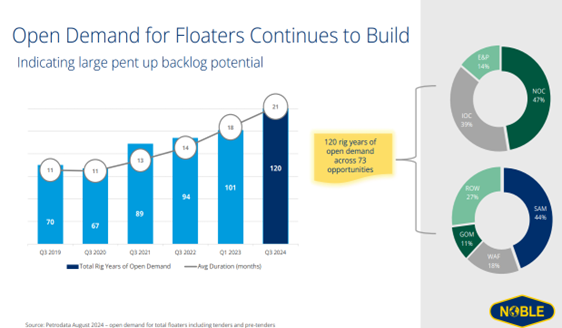

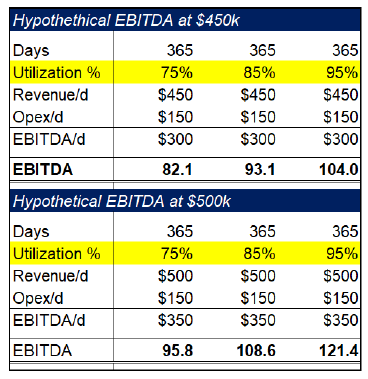

Switching over to our offshore theme, after a volatile first few months of 2024 where the market was spooked by the Saudi jack-up announcement and the slower cadence of deepwater contract announcements, the offshore drillers pointed to the fundamentals they’re seeing being as strong as ever. Dayrates and term lengths continue their steady march higher…

Update on Offshore drillers

Jumping into the markets, it was a long week of earnings throughout some of our themes, e.g. Florida migration and Oil Services, both of which seem to be trending in the right direction, albeit slowly. Offshore drillers in particular had a sleepy 2H23, where contract awards slowed and seemingly every operator had a handful of…