Fartcoin Sharted

Two months back, we were at a family wedding, and ran into some uncles, cousins and other assorted relatives that we haven’t seen in a few years. As the resident ‘financial guru’ they came up to us to seek ‘advice.’ Except, this time, they didn’t ask any questions. Instead, they bragged about the 3x levered…

Boooring…

Turning to the markets, as traders, we recognize that sometimes there’s a whole lot to do, and sometimes the best thing to do is absolutely nothing. In this game, you get no points for fighting boredom. Sometimes, it’s best to just sit and wait it out. We’re in such a world. While we are outright…

When The Window Closes…

We just got off the plane from a VERY long couple of weeks of client meetings plus the Pareto Offshore Conference over in Oslo, so forgive us if make this week a bit shorter than usual. While in the air, we got caught up with a ton of Substack reading, and one that caught our…

Big Themes With RooJoo

We want to thank Roderick for joining us on Friday to chat thematics, ED and KEDM. We covered a TON of ground from nic pouches, to US automotive (Issue 237), to Long Vol names. As we typically do, we will get the recording up on the Video section of the website later this week. In…

Public Service Announcement…

As an FYI, we got the video recording from last week’s Happy Hour with Gator Capital’s Derek Pilecki up on the website. For those that missed the live session, it’s definitely worth watching as he knows his niche – click here. Moving over to thematics, a few week’s ago we introduced a good friend,…

Chomp, Chomp…

Reminder that next week, Friday at 4:15 EST, we will be hosting our “Financials Unplugged” Happy Hour with Gator Capital’s founder, Derek Pilecki. This guy knows all there is on financials and has turned out returns for decades. We are looking forward to getting some insight on some tradeable opportunities as the curve steepens in…

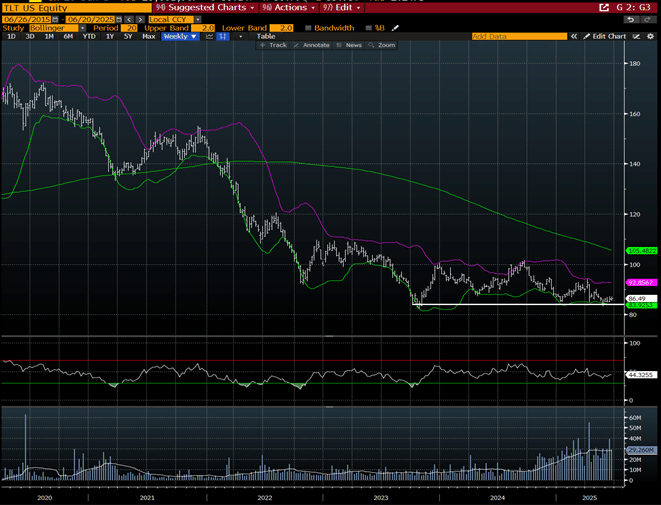

RRP + TGA

OK, let’s get into it. Sometimes someone says something that jars our memory and reminds us to check some charts. Our buddy Paulo Macro has done just that and as a result, we’re going to shamelessly steal from his recent piece. Please subscribe to see his other writings. We’re of the view that the global…

It’s All A Sideshow…

Just signed on, did anything happen this weekend???? Remember how the market was hyper focused on tarriffs 2 months ago as correlations hit 1. Did we solve that one yet? Asking for a friend. Now, fintwitters are all experts on Fordow and the Stait of Hormuz. Tarrifs are a sideshow. Funny how that works. But…

We Are Rather Dour…

We told ourselves that we’d come back from vacation when something happens. What’s going on in the Middle-East certainly qualifies as a “something happening.” We’ll leave it to Twitter experts to speculate on what exactly will happen. We watch the same videos that you do, with the proviso that “the first casualty of war is…

What Year Are We In????

Last week abroad before heading back to PR to get back into the saddle. Honestly, I check in each day and this market is making less and less sense. Seriously, between the DJT/Elon pissing match, the grift in SPACs, CRCL IPO, SBET secondary, and Trump & Co issuing a branded crypto wallet, what year are…