Costco Marks the Bottom – Is Platinum About to Shine?

You all know we remain commodity bulls and have beaten a dead horse on gold since we got interested in it again in Q3 of 2023. As the world enters chaos with DMs becoming EMs, gold should remain relatively bid. And with silver finally waking up, its worth moving through the family tree over to…

Bond Quickie

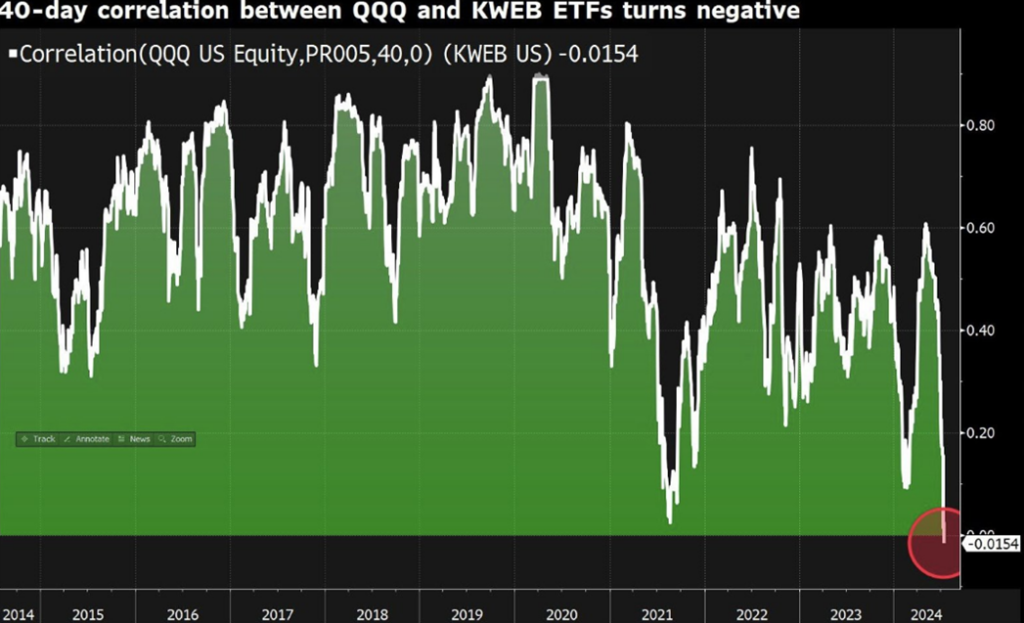

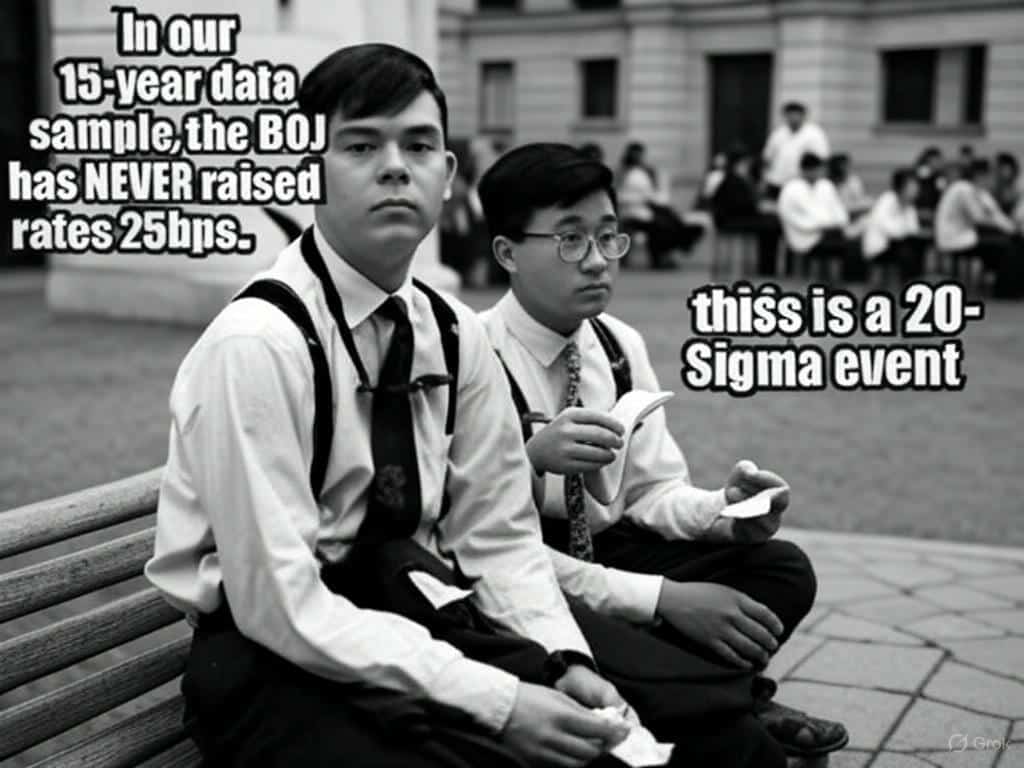

Last we left you, we were talking about how the FED and bonds were fuct and EMs were likely the recipients of a flip in fund flows. Two weeks don’t make a trend but that sure seemed timely as TLT continues to roll on the back of made-up NFP numbers, while EMs (i.e. China) went…

EMs Take the Spotlight

JPOW pulled the trigger on re-engaging Project Zimbabwe. We’ve been banging the table on the peasants getting carved up, hence our de-grossing, but we were a bit surprised on how trigger happy he was with equity markets clipping highs. Just goes to show how bad the FED is fuct. I tweeted this out earlier…

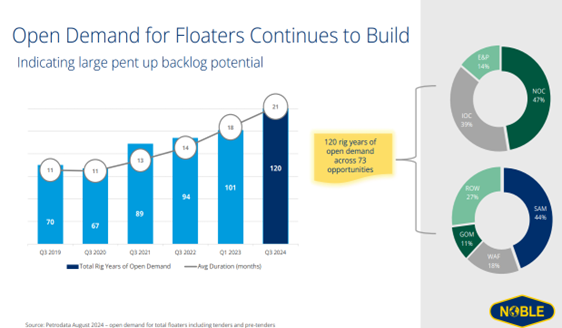

Offshore Is Getting Cheap…

We’re in Zurich and then Geneva, after a week in Oslo at the Pareto Energy Conference. It was crowded, but we haven’t seen this much emotional pain outside of a funeral. A look at the below chart will give you a sense of why everyone is so dour. Then again, if your book even sort…

Uranium Update from WNA…

We had a busy week at the annual Uranium conference – WNA London – tons of meetings with traders, miners, fuel suppliers, technical specialists, rector suppliers, IAEA executives. We met practically every part of the supply chain. Overall, the mood was upbeat as the fundamentals of the thesis are playing out even better than most…

Uranium Earnings Are Flowing In…

We thought we’d check in on a sector that seems to have the wind at its back. Our yellow friend had major earnings this week, i.e. Kazatomprom earnings, and if you are invested, then you also had a “Happy Friday” thanks to our buddies in Kazakhstan. While we are not going to bore you to…

Failing Rallies…

As you know, we’ve turned bearish. We’re not raging bears, because of “Project Zimbabwe” and all of that stuff. In fact, we think equity markets are dramatically higher, looking out a few years. That said, we think there’s a stumble first, and while everyone is getting excited about 25 or maybe even 50bps of Fed…

China Is Looking Up…

This quarter’s 13Fs was non-eventful. As we’ve noted ad-nauseum, we went “full harvest” in recent months and cleaved off the chaff. Things get wacky at the tops and unless its related to gold, new CUSIPs just aren’t interesting. The only small nugget that caught our eye was the ongoing bull campaign by Tepper (Appaloosa) and…

Offshore Earnings

We haven’t been exactly bullish in recent months. We aren’t doom and gloomers either, but regime changes tend to create markets where macro Trumps the micro. Are the past 10 days, just a precursor to the coming wackiness and onslaught of “100-year, one-in-a-lifetime moves” that will likely come weekly?? We are in the 4-6 month…

De-gross, De-gross, De-gross…

Almost three months ago, we noted KEDM was in full harvest mode, as we culled the herd and moved to center-book. We even pruned some center-book names—though, our focus was on purging anything illiquid, stuff we’d be hard-pressed to sell in a real correlation-1 scenario. We wanted to de-gross in a major way. Admittedly,…