Correlations to 1

Short week, so it’ll be a short, data-only KEDM this week. Besides, nothing is going to change our view over the coming weeks. Sure, a TON of volatility but our thinking remains the same. This tariff story is an undercard to upcoming big govt credit/PE/private credit/refi/endowment unwind. We are headed into a trader and ED…

Erdy does it again…

Turning to the markets, by now you are well aware of our EM leanings as we have been beating a dead horse for well over 6 months on the theme. One of those EMs has been making some global news lately, so we figured we’d do a quick update. Let’s dig in… You’ve probably seen…

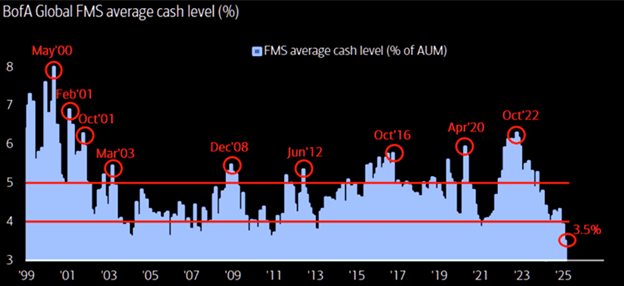

Tina died in 2025…

Speaking of tops, on January 12, we posted an eerie chart of CSCO against the last remaining generals left in the markets using SMH as the proxy (we urge you to re-read here). Let’s revisit: “In summary, we’re bears. Now raging Kodiak Bears… We were just starting out in this business when we realized that…

EMs Curling Up…

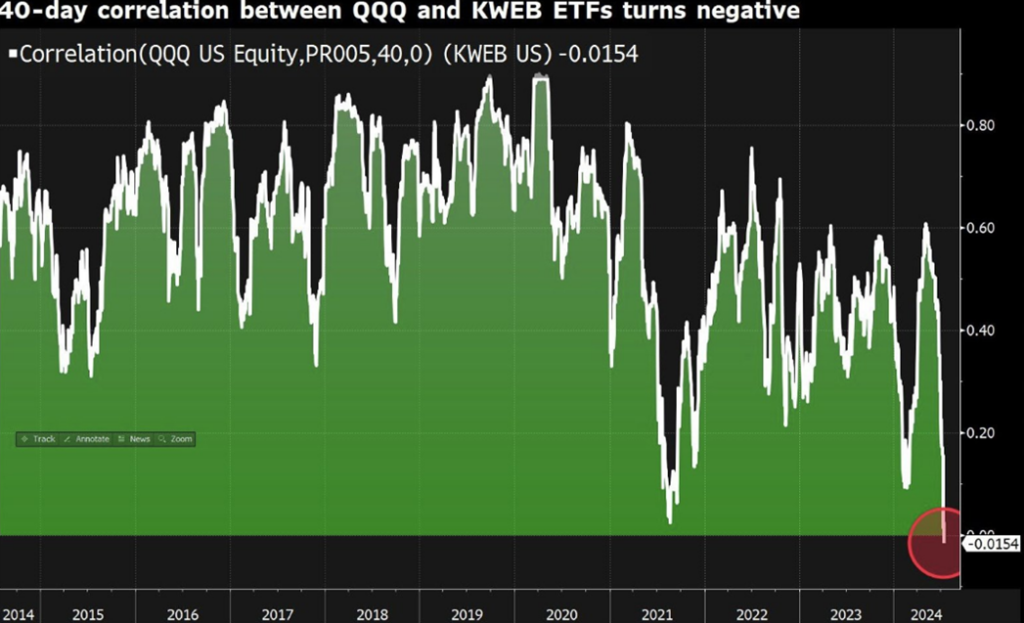

Since mid-to-late 2024 we have been banging the table on EMs, specifically Turkey, Colombia, Brazil and China. See issues 197 and 209 for China; 210 and 200 for LatAm. YTD the latter 3 have been on a tear with China up 25%, Brazil up nearly 13%, and Colombia up 22%. While stretched in short term…

Colombia and Brazil are perking up…

Last week we left you on the topic of Brazil, so LatAm has been on our mind all week, especially with Trump laying out a heavy dose of FAFO during the week… Lets rehash…This week began with a bang in Latin America as Trump came out swinging on Colombia after they refused to accept a…

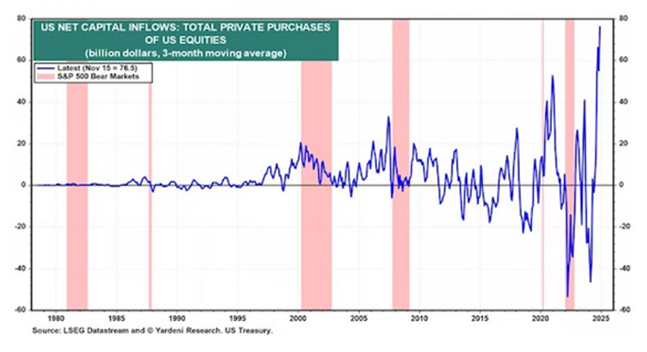

Fund Flows Flip

Things may be light over the next couple weeks as we are in South Florida taking meetings during the annual iConnections pilgrimage. In our typical fashion, we don’t pay the 20k entry price to roam the halls, but rather sit with a cold beer at a local bar and laugh as the sleeveless vests descend…

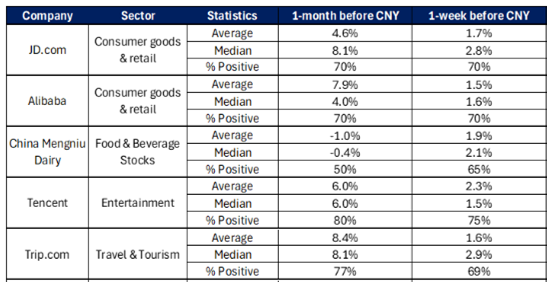

The Year of the Snake…

We are going to keep the commentary light this week as you have plenty of reading to do with the Happy Hour transcripts. However, last week we noted our increasing interest in the China theme when we wrote: “After stopping out on a lot of our China exposure in Q4, we’re back at it. We…

EMs Take the Spotlight

JPOW pulled the trigger on re-engaging Project Zimbabwe. We’ve been banging the table on the peasants getting carved up, hence our de-grossing, but we were a bit surprised on how trigger happy he was with equity markets clipping highs. Just goes to show how bad the FED is fuct. I tweeted this out earlier…

September 22, 2024, Vol. 194

The admin of this site has disabled this download item page.

China Is Looking Up…

This quarter’s 13Fs was non-eventful. As we’ve noted ad-nauseum, we went “full harvest” in recent months and cleaved off the chaff. Things get wacky at the tops and unless its related to gold, new CUSIPs just aren’t interesting. The only small nugget that caught our eye was the ongoing bull campaign by Tepper (Appaloosa) and…