What’s happening with Offshore?

Switching over to our offshore theme, after a volatile first few months of 2024 where the market was spooked by the Saudi jack-up announcement and the slower cadence of deepwater contract announcements, the offshore drillers pointed to the fundamentals they’re seeing being as strong as ever. Dayrates and term lengths continue their steady march higher…

Ongoing tailwind from people fleeing to

Ever since we started paying taxes, we’ve been aware that many jurisdictions that offer reduced tax rates, or even zero tax rates. We know of places that offer attractive citizenship programs—we’ve even had Basil Elziki of Henley Partners on for a KEDM Happy Hour to share some insight on these places. However, we wonder what…

We are just back from Kazakhstan with Uranium News

Moving into the Uranium theme, our analyst just returned back from Kazakhstan on a fact finding mission, so combined with a few earnings updates, we figured an update is in order. If you aren’t a U-a**hole like us and your eyes glaze over by the first mention of U, feel free to skip ahead and…

Our thoughts on Gold vs. Bitcoin

We picked a hell of a week to head to Cayman as MENA lit up…again. With headlines dominated by Israel we took a look at our themes dominated by long chaos and inflation and feel comfortable headed into what should be a contentious election year. Since gold was top of mind all week, we kept…

Happy Hour with Doug Casey on “Crisis Investing”

Shifting topics, I had a blast catching up with Doug on Friday. Given what is happening in the gold markets we couldn’t have timed this one any better. As we typically do for Happy Hours, we jotted down some notes for those that were unable to join live. The replay will be available next week,…

Our thinking on Gold

Since many of us are involved in the metals markets, we thought a quick “awww shucks” was needed. Yes, we like to make fun of charts, but sometimes they really do work, even if they only work when you’re drawing your lines after the fact. Here’s gold. We’ve posted this a few times now, but…

Market Update: MAG7 Divergences

Ok, with that out of the way, we want to talk about divergences. For those of you who’ve followed us for any length of time, you’ll know that we pay special attention to divergences, as they tend to happen at the end of a move—signaling an exhaustion of the move. For nearly a year, MAG7…

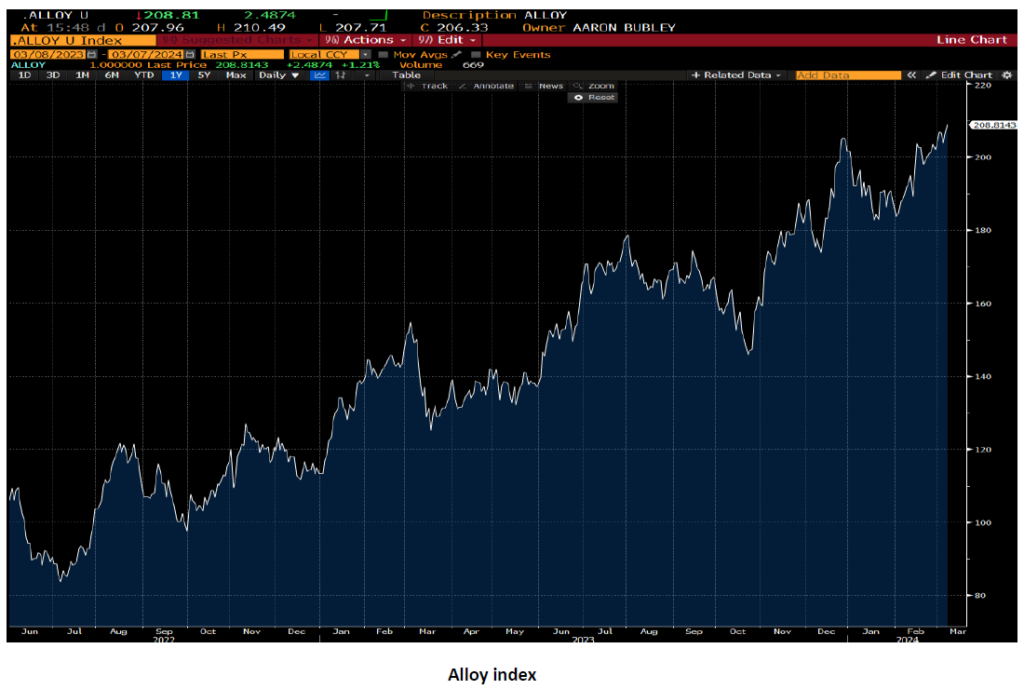

Theme Update: Aerospace Alloy

Jumping into some themes, last June we introduced the aerospace alloy theme as a play on the surging demand for new planes, thinking at the time that this bull could turn into a super-cycle given the supply issues on such robust demand. Well, our alloy index has been on a tear (see chart below) so…

Event-Driven trading: Index Additions / Deletions

Let’s start with some Event-Driven set-ups as we style ourselves as an E-D site first, with a side-helping energy/uranium commentary. We’ve talked a bit about index additions/deletions as there have been a few interesting deletions of deep value names, but we haven’t talked much about additions because, honestly, since Tesla back in Q4/2020, they’ve all…

Inflation is Back

Moving on, we don’t know exactly why it happened on Friday, but after weeks of data showing that inflation was accelerating, on Friday, the markets finally started to care… Check this chart of GLD (we’re using it instead of XAU as it doesn’t have that crazy overnight wick)… XAU – ‘Ain’t she a beauty…?? We’re…